History rhymes: GMO defends gloomy views

GMO has hit back at critics of its bearish seven-year forecasts, saying “great companies with great narratives can still experience price movements that are too great.”

GMO compared asset class forecasts from the seven-year period leading up to March 2000 with forecasts from 2014 onwards, noting that asset prices have both grown around 70 per cent faster than earnings per share (EPS) in the respective periods; and that markets could once again be heading for a tech-wreck-style massacre.

“Back then, the excitement of new technologies combined with growing confidence in the Fed had expectations running high. Wall Street EPS forecasts were rising healthily. Prices, unfortunately, moved even faster – 69 per cent faster. This, as you know, did not end well,” GMO’s asset allocation team wrote in its research, titled “There are no bad assets…just bad asset prices,” GMO said in a note to clients last week (June 7).

GMO has faced criticism that its forecasts don’t give enough credit to high-growth companies that are future “disruptors” but warned that “great companies with great narratives can still experience price movements that are too great.”

GMO used earnings forecasts “from the street” (as in, analysts’ consensus) to prove its point while noting that McKinsey believes those same forecasts are “100 per cent too high”.

“Today, history is rhyming. The new business model narratives are compelling – high-growth, asset-light, network effects, high switching costs, etc. Wall Street EPS forecasts are rising healthily. The problem is that prices are again growing 70 per cent faster. This, as you suspect, cannot end well,” the client note said.

“Many of you have been frustrated by the bearishness of GMO’s seven-year asset class forecasts and suggest that we are missing the bigger picture – that the S&P 500 is chock-full of great companies with great prospects,” the team wrote. “It is. We don’t dispute that. But that is missing the point. Our worry is the prices you are paying for that growth. Remember, there are no such things as bad assets, just bad prices.”

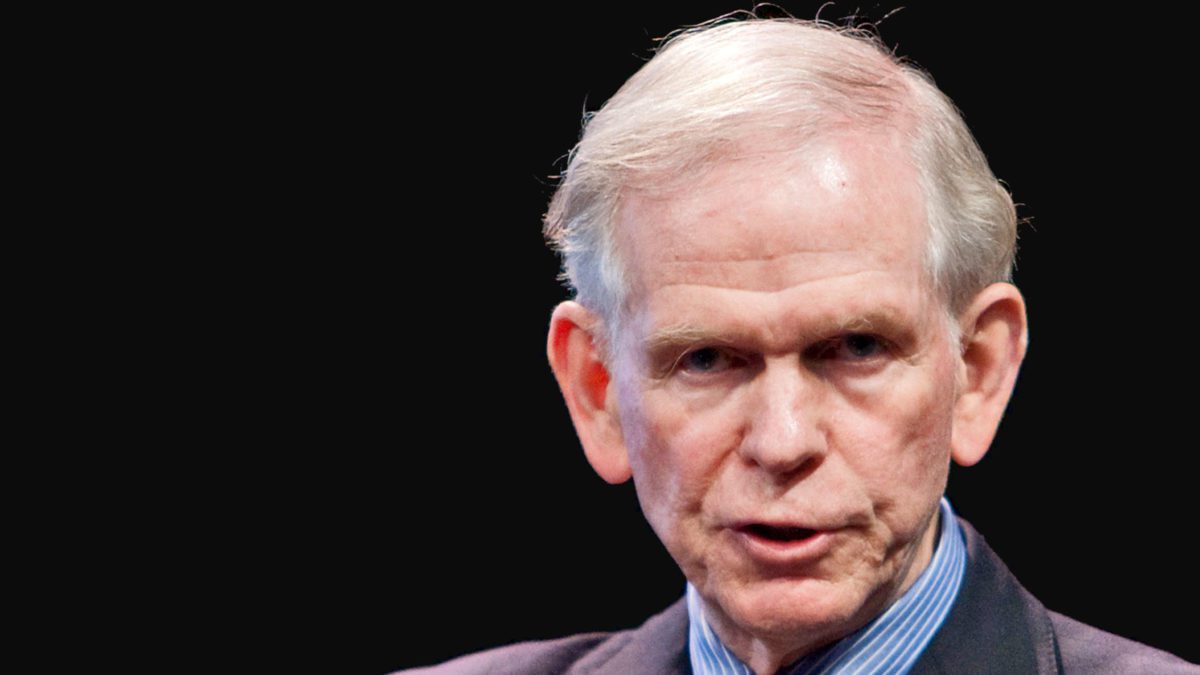

Jeremy Grantham, GMO founder, recently spoke at the Morningstar Australia ‘Individual Investor’ conference to share more doom-and-gloom predictions, saying that “super crazies” like Tesla and special purpose acquisition companies (SPACs) were signs that markets were in “the greatest bubble in history” while warning that there was “no traditional pin” to pop it.

“They’re still arguing about what caused the 1929 crash. It may be because there’s no traditional pin to pop the bubble,” Grantham said.

“But the market hits its all-time high when optimism is at its absolute peak. And the following day is the second most optimistic day in history, but it’s a shade less optimistic than it was yesterday. And the price begins to fall a little bit.

“It won’t take bad news and it won’t take a thoroughly bad economy to start bringing this market down. It will take a perfectly good economy and a perfectly optimistic outlook – but a little less than it used to be a week ago, a month ago,” he said.