Zinc in focus as the world goes green

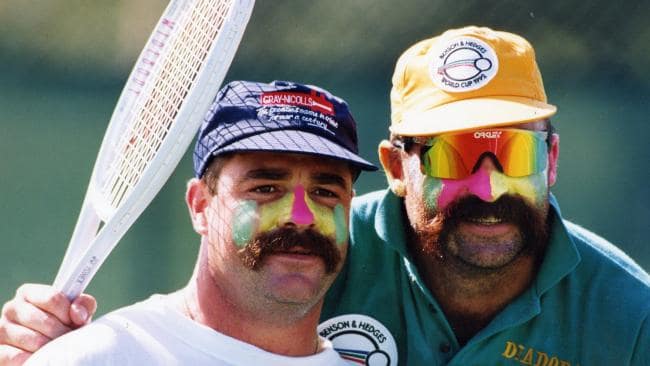

What is that white cream cricketers put on their faces and lips? You’ll be surprised to know, it’s zinc. Well zinc oxide to be exact. It’s the main and the strongest ingredient in any physical sunscreen used by cricketers. The Zinc Oxide cream is often referred to as a ‘reflector’ and isn’t absorbed by the skin. Instead, it reflects the sun’s harmful UV rays. It’s widely used in paints, rubber, cosmetics, pharmaceuticals, plastics, inks and soaps.

As you can see zinc has many uses. But when zinc oxide is heated with carbon, reducing to metallic zinc, it takes on a whole new life. Zinc can be used to galvanise iron to prevent corrosion, and can be mixed with other metals to create zinc alloys. More importantly, zinc is the secret base metal that is critical to reaching net-zero carbon emission targets. The essential metal is used to make more efficient solar panels and smaller and lighter batteries.

Like the men’s mullet hairstyle of the 70s, zinc might be a little less fashionable than other metals, but it too plays a pivot role in the worlds path to decarbonisation. Just like nickel, a big part of zinc’s attractiveness lies in its ability to be recycled. Being able to recycle at a product’s end of life can reduce energy use and emissions. Both nickel and zinc are now deemed critical minerals by the United States with demand for zinc expected to triple by 2030 as net-zero targets come into effect.

Analysts are seeing zinc premiums at record highs as physical zinc becomes harder to come by – causing a perfect storm for a bull market. Aussie-listed Variscan Mines (ASX:VAR), operates two advanced zinc projects and Managing Director and CEO Stewart Dickson is seeing these supply issues first-hand. He says, “Inventories have reached extremely low levels as demand rises and output of refined zinc has fallen dramatically mainly due to high energy costs in Europe which has led to refineries mothballing production.” The war in Ukraine isn’t helping either with trade sanctions preventing Russia from exporting zinc. Last year Russia’s zinc production last year grew 2% year on year to 211,800 mt, contributing 1.6% to the world’s total. Demand for zinc is expected to triple by 2030 as net-zero targets come into effect.

Dickson says, “Zinc prices have risen substantially over the recent period. Having touched on multi-decade highs, some of its gains have been lost more recently due to concerns over a global slowdown. Our view is that this is a temporary pause as structural demand remains strong. Perhaps worth pointing out that Zinc outperformed Copper in 2021 and over the last 12 months period.”

“As zinc is 100% recyclable it is the ultimate ‘green metal’ and works well in a circular economy. Zinc is an integral metal to energy transition. It is now formally recognised a critical metal by countries such as the US and Canada. Zinc usage for solar energy is expected to double by 2040. Zinc also has a role to play in batteries and energy storage.” And with the world pushing for decarbonisation, “zinc is 100% recyclable it is the ultimate ‘green metal’ and works well in a circular economy.

A carbon-constrained future needs more zinc and that means more mines. And that’s good news for investors. Australia is the second largest producer of zinc which gives many of the local miners an opportunity to gain any upside potential. Renewed interest in a number of small zinc miners include AuKing Mining (ASX: AKN), Zenith Minerals (ASX: ZNC), Rumble Resources (ASX: RTR) and Variscan Mines (ASX: VAR).

“There is a coming zinc boom. #thinkzinc” commented Dickson.