ASX shares yet to fully reflect interest rate hikes

In a recent note titled I’m not buying this bounce, Thesan Asset Management director Steven Everett argued equity markets are failing to appropriately account for tightening monetary policy, particularly in Australia.

“The recent rally in equities is justified on relief,” he said. “But nothing more than that.”

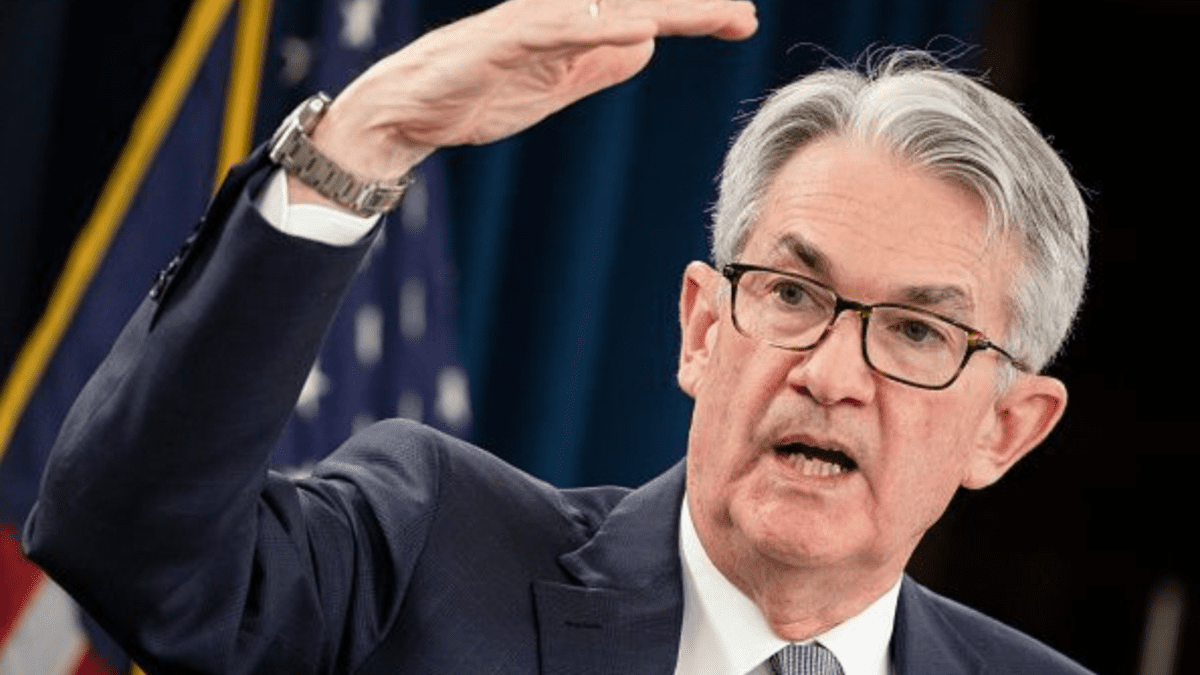

Almost on cue, US Federal Reserve chairman Jerome Powell warned in no uncertain terms that the central bank would take “forceful and rapid steps” – via increasing interest rates – to tame inflation.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time,” Powell added. “The historical record cautions strongly against prematurely loosening policy.”

Powell’s address at the Jackson Hole Economic Symposium noted there would be “some softening of labour market conditions” – central bank lingo for higher unemployment. There would also be some pain for households and businesses via a sustained period of below-trend growth.

It was his clear and concise resolve – which had been absent in prior speeches – that cut through. Powell had a 30-minute speaking allocation, yet only used eight minutes to deliver his message.

The speech, delivered Friday night Australian time, did not reverberate through local markets until Monday. The benchmark S&P/ASX 200 closed 1.95 per cent lower, with just eight companies finishing in the green. Over in the US, the S&P/500 dropped 3.36 per cent.

In a rare public admission, Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, said he was “happy” to see how Powell’s speech was received – alluding to the sharp fall in equity markets.

“People now understand the seriousness of our commitment to getting inflation back down to 2 per cent,” Kashkari said.

RBA to bifurcate from Fed

The Reserve Bank of Australia (RBA) has been less steadfast in its commentary so far. The Central bank is placing a high priority on returning inflation back to 2 to 3 per cent while also keeping the economy on an “even keel”.

Speaking to The Inside Investor, Everett says the RBA will be forced to bifurcate from the Fed due to the higher than normal number of fixed-rate mortgages. He cites research by Westpac that estimates 64 per cent of fixed-rate mortgages will mature before the end of 2023.

“If the RBA moves too heavy before the fixed roll-off, they risk a massive policy mistake in 23/24 when those people are forced to re-price and it may shock the market into a crash,” Everett says.

US borrowers are typically less sensitive to movements in interest rates. The US housing market lends on longer fixed terms of 10 to 30 years whereas, in Australia, fixed loans range from 1 to 5 years.

Everett forecasts the RBA will announce a 25 basis point increase when it convenes on Tuesday, with another 25-point hike at its October meeting before pausing to assess the impact on borrowers.

“I think that the RBA will want to see what aggregate demand looks like once the higher rates filter properly through to the majority of homeowners before getting too aggressive.”

The big banks are more hawkish, with each expecting the RBA to hike by 50 basis points on Tuesday. ANZ is the most bearish, expecting three straight 50-point moves resulting in a cash rate of 3.35 per cent by November.

ANZ head of Australian economics David Plank said “We don’t think the RBA will be comfortable with policy merely getting to neutral by year-end given this backdrop.”

When to turn bullish

Asked what would need to happen for him to turn more bullish on equity markets, Everett points to a weakening US dollar, as it indicates a more risk-on environment.

He also notes the US Fed halting hiking would help equities find their feet, as investors would be able to price in a “terminal rate with some surety”.

China’s property problem remains the elephant in the room. Everett wants to see some sort of consensus by analysts that the problem is being resolved.

Over the medium-term, he thinks this is a stock pickers market. The best approach is to have “35 per cent defensive equities, 35 per cent bonds and 20 per cent cash”.

“The other 10 per cent used to try and pick up stocks that have strong fundamentals and management but have been hammered by the mob.”

“Once you’ve found your 10 per cent, hopefully, the market looks brighter and you can use another 10 per cent of your cash”.