Next gen platforms surge while adviser FUA doubles

Specialist platform providers such as Netwealth and Hub24 are expected to maintain their growth momentum in coming years, taking on an increasing share of the direct investor market along with independent advisers, according to analysts.

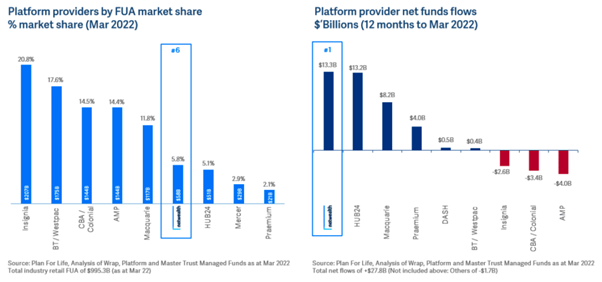

UBS has released a research report that reveals that over the past five years, specialist platform providers have taken in over $80 billion in net flows in aggregate, whilst incumbent platform providers have seen net outflows in excess of $20 billion. Inflows have been increasing as a result of increasing penetration into adviser headcount and directly winning clients, sources UBS expects to be ongoing flow drivers for both platforms.

In particular, Netwealth and Hub24 are expected to be the strongest performing and attract an increasing share of client wallets. Both platforms have grown their funds under management much faster than legacy providers, as the charts below show. Those legacy providers include BT/Westpac and AMP.

The success of these two platforms in winning funds under management has been attributed by independent analyst Investment Trends to their superior technology. In its annual platform report for 2022, Netwealth claimed the top spot with 91.5 per cent for its overall platform functionality. Hub24 followed at 91.1 per cent functionality followed by Praemium (89.3 per cent), BT Panorama (85.1 per cent) and Mason Stevens (82.6 per cent).

Netwealth also notes it is increasing its market share of directly managed client funds. It notes in its recent annual report that it is winning clients across all market segments, including high net wealth clients and a “large number of endowment funds trusts and trusts transition,” though it doesn’t give any numbers.

UBS favours Netwealth and Hub24 over traditional fund managers and advisory groups, with Buy recommendations for both stocks.

Morgans too sees both platforms in a positive light. “We view Netwealth as an attractive business, benefitting from a strong industry position, high cash generation and industry tailwinds. The clarity on pooled cash earnings is a positive, with leverage to increasing rates,” says analyst Scott Murdoch (pictured).

Risks include aggressive competitor pricing, loss of a major client relationship, greater-than-expected revenue margin pressure and slower medium-term net inflow profile versus market expectations.

In terms of Hub24, Murdoch says it is likely to entrench a market leading position along with Netwealth in the platform sector, and he has an Add recommendation on the stock. “We have a slightly more cautious view on HUB’s ability to deliver scale benefits without accelerated investment but continue to be attracted to HUB’s market position and long-term opportunity in the Platform segment,” Murdoch says.

Advisers FUA soars

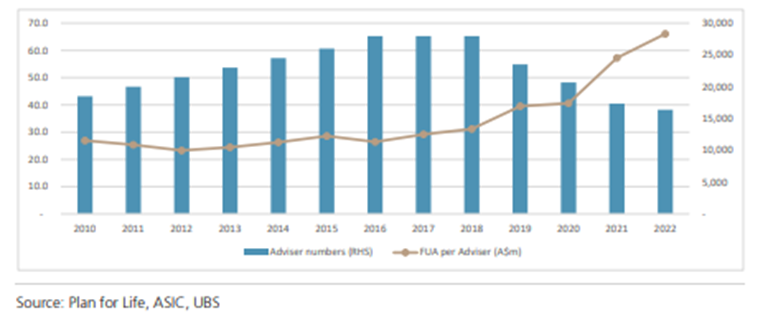

While pressure on margins will remain, there is good news favouring independent financial advisers. Since the Hayne Royal Commission has pushed some providers out of the market, and increasing regulatory has pushed up costs per client, UBS research points to increasing funds under management through each individual client.

“The consolidation of the advice industry has skewed funds flows away from the incumbents and concentrated existing funds into the hands of fewer, more productive advisers. Funds under administration (FUA) per average adviser has roughly doubled since the Royal Commission in 2017-18,” UBS says. The chart below highlights this strong growth, with average FUA of close to $30 million, compared to $15 million in 2018 when twice as many advisers were in the market.

Over the past 10 years, the big banks offloaded their financial advice divisions, leaving more business for independent financial advisers. The Commonwealth Bank has sold its wealth management business which included funds management, financial planning and platforms while ANZ and National Australia Bank have also sold their wealth management arms.