Origin bid reduced, but recommended, Domino’s shares smashed, ASX sinks

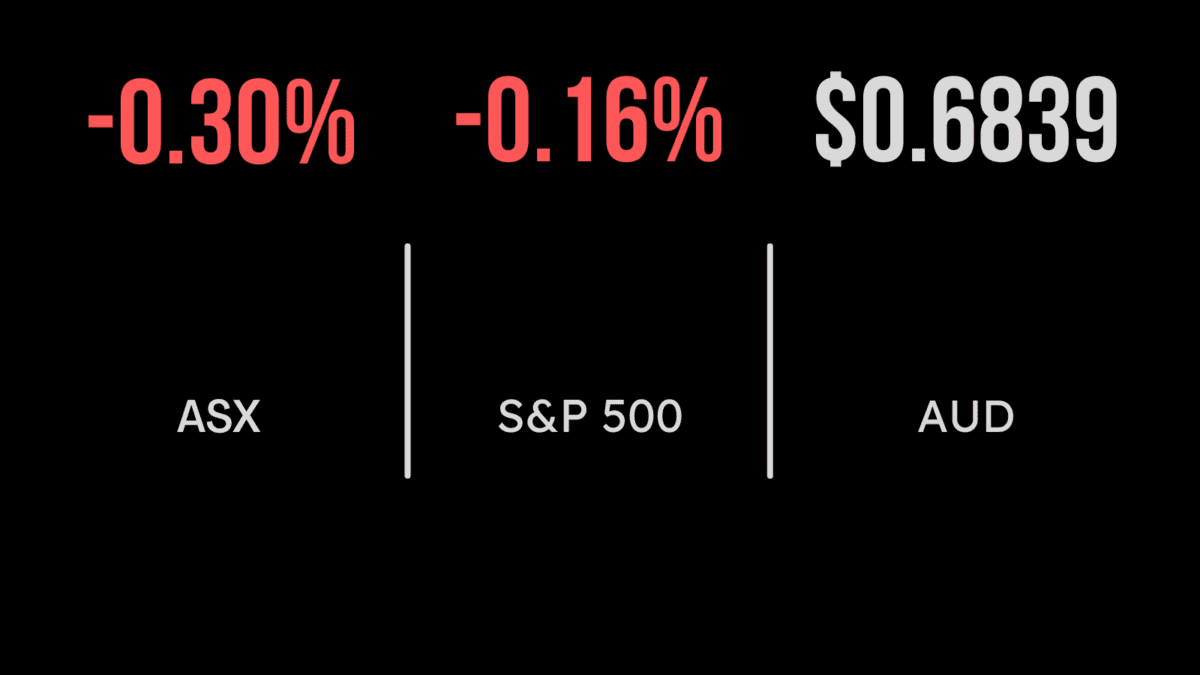

A significant rally in the utilities sector, which gained 4.8 per cent on Wednesday on the back of a renewed bid for Origin Energy (ASX:ORG) wasn’t enough to offset the selling pressure. The S&P/ASX200 fell by 0.3 per cent with the consumer discretionary sector among the largest detractors. News the Origin suitors Brookfield and EIG had reduced their bid by only 10 cents per share to $7.90 sent the stock up more than 12 per cent as the likelihood of a transaction continues to grow. But it was all about Domino’s Pizza (ASX:DMP) today, with the company shedding close to a quarter of its value, ultimately finishing down 23.8 per cent. The selloff came after the company reported an 18 per cent fall in profit to just $64 million but more importantly, guided to same store sales growth being below the forecast 3 to 6 per cent in future years. For the half itself, sales growth contracted by 2.2 per cent on the back of higher prices and labour challenges.

Woolworths sales boost, Santos free cash flow, but wage growth disappoints

A weaker than expected wage growth result, which saw growth of just 3.3 per cent for the 2022 calendar year wasn’t enough to buoy the market. The RBA had been predicting higher levels of wage growth when considering interest rate policy, which now offers hope that the end of hiking may be near. Shares in Santos (ASX:STO) buoyed the energy sector, gaining 3.1 per cent after reporting a 65 per cent increase in revenue and 142 per cent increase in free cash flow as the combination of higher gas prices and surging global demand benefitted the company. Most importantly, profit increased by more than 200 per cent to $2.1 billion, however there are clear signs of a weakening of prices. Shares in Woolworths (ASX:WOW) gained 2 per cent and strengthened the consumer staples sector as a strong recovery at BIG W and continued growth in food sales supported a 12 per cent increase in earnings. Profits jumped by a quarter, which supported an 18 per cent increase in the dividend.

US market selling slows, bond yields increase, Intel’s dividend cut, Coinbase slumps

All three benchmarks finished lower overnight, hit by higher bond yields despite growing consensus on the Federal Reserve board, which suggested each member supported a 25 basis point hike. The Dow Jones fell 0.3, the S&P500, 0.2 and the Nasdaq recovering slightly from the worst one day slide of the year. Interestingly, St Louis Fed President James Bullard believes the risk of a recession in the second half of the year is being overpriced by the market. Leading chip maker Intel (NYSE:INTC) fell by more than 1 per cent after announcing a 66 per cent cut to its dividend as the company seeks to hold onto cash flow during a difficult period for profitability. Once considered ‘unthinkable’ it highlights a return to cash flow focus and a deliberate approach to capital allocation. Shares in crypto platform Coinbase (NYSE:COIN) fell by more than 4 per cent after the company swung to a US$557 million loss from an $840 million gain in the prior quarter as revenue dropped by close to 75 per cent.