‘The golden age of retirement income’: All engines firing for fixed interest

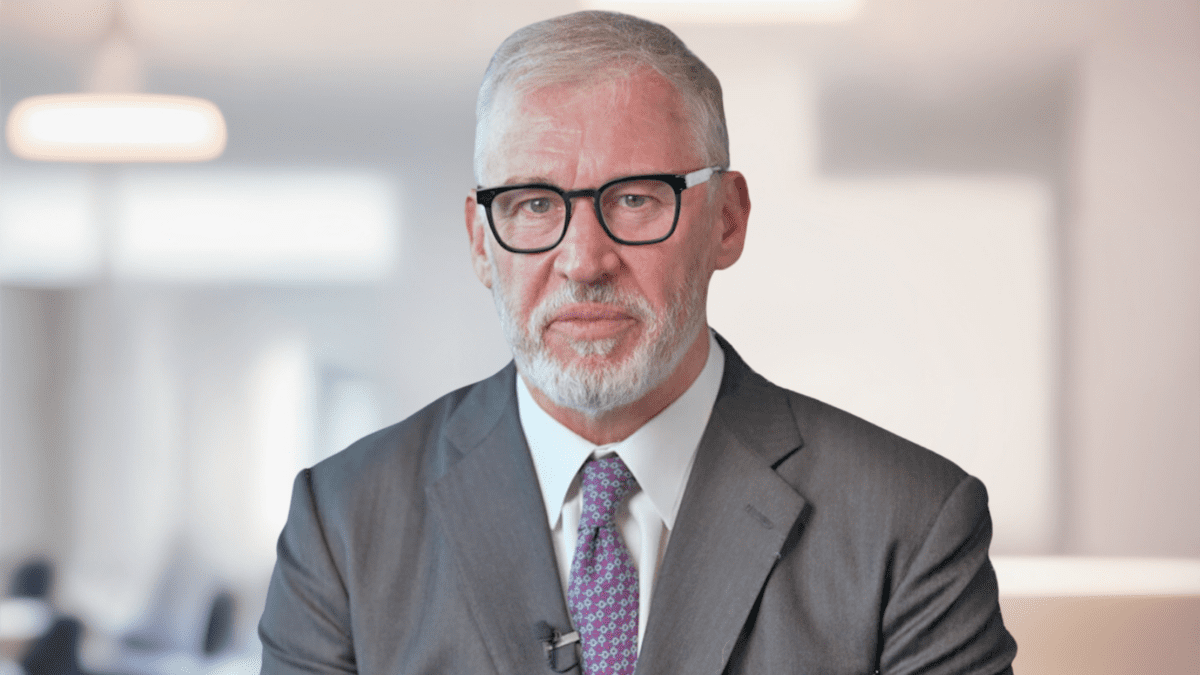

Boosted by higher interest rates and reasonable credit spreads, fixed income is poised for positive returns and set to outperform in a declining-equities scenario, according to Bentham Asset Management’s Richard Quin (pictured). As an ideal income source for retirees, it’s also likely to benefit from an incoming demographic tailwind.

The economic tumult of the past few years has been challenging for markets, but it’s also reset the playing field for fixed income, leading to the now-ubiquitous ‘bonds are back’ narrative. Quin, Bentham’s principal and chief investment officer, says there’s good reason for the optimism.

“Fixed income is something that, as a trade, should have been a lower allocation when interest rates were close to zero but now should be a lot higher,” he says. “We think we’ll see quite positive returns in the marketplace going forward.”

Dual engines driving fixed-income returns

The case for fixed income begins after a period of ultra-low interest rates that “wasn’t fantastic” for an asset class principally driven by interest-rate risk and credit risk. But with those “two engines” now driving returns, “there’s a lot of yield in the market right now”, Quin says.

“Today, we’re in an environment where base rates are higher and credit spreads are reasonable, and where fixed income looks attractive not only on a total-return basis but relative to other asset classes, including equities.”

Moreover, the idea that the inflation fight still has a long way to go is a “false narrative”. On the contrary, he says, central banks may have hiked rates too far, calling this a “Thelma and Louise moment – they’ve all sort of joined hands, and they’re driving the economy off the cliff together”.

These higher rates are causing lower valuations and creating real returns, making fixed income more attractive. It reprices very quickly, Quin notes, and when equities and bond returns are negatively correlated, that increases the value of fixed income.

“We think we’re close to that,” he says. “Bonds usually start to rally when central banks are on pause, i.e., when they’ve done enough damage to demand that will mitigate inflation.”

‘A middle-class, white-collar issue’

More concerning than inflation to Quin is that we have not waited to see the repricing effects from increased interest rates fully play out.

“It’s going to be large, and it’s the one thing that makes me a bit more pessimistic,” he says.

“I think we got quite used to very low interest rates – people adjusted their lifestyle, and we’re seeing a nuanced effect where people who borrowed in their 20s to mid-40s and have a lot of debt and financial obligations, they’re really suffering now,” he says. “It’s a middle-class, white-collar issue and conversation, that is not impacting the average retiree who has already paid down their home loans.”

He notes that fixed income is a particularly attractive asset class for retirees, who generally can’t afford the risk of losing their capital that generates income. Retirees really don’t want to risk income if equity markets go down, especially if they can lock in the current higher cash rates in fixed income.

Fixed income primed for a bigger role

If sharemarkets do struggle as the interest rate environment shifts, that’s ideal for bond markets, and for those relying on them for income.

“We are paid good income for fixed income assets that don’t take as much risk as equities,” Quin says. “And it’s a good environment for the divergence that comes through when a lot of assets are made to reprice.”

Another tailwind emerging for the fixed-income return profile over the medium term is demographic change, with the surge in retiree numbers expected in Australia.

“We think credit and fixed income will play a bigger role in client portfolios for the next five to 10 years, as people look to build regular income but don’t want to take the capital risk typically associated with sharemarkets,” Quin says. “We’re kind of in the golden age of retirement income; retirees just don’t know it yet.”