As household wealth falls, Australians urged to focus on superannuation

Australian household wealth slipped back in the June 2022 quarter to $14.4 trillion from a record $14.9 trillion in the March quarter, with asset values falling on higher interest rates, according to the Australian Bureau of Statistics. The situation likely will have deteriorated markedly since June 30 on the back of the Reserve Bank of Australia’s continued rate hikes.

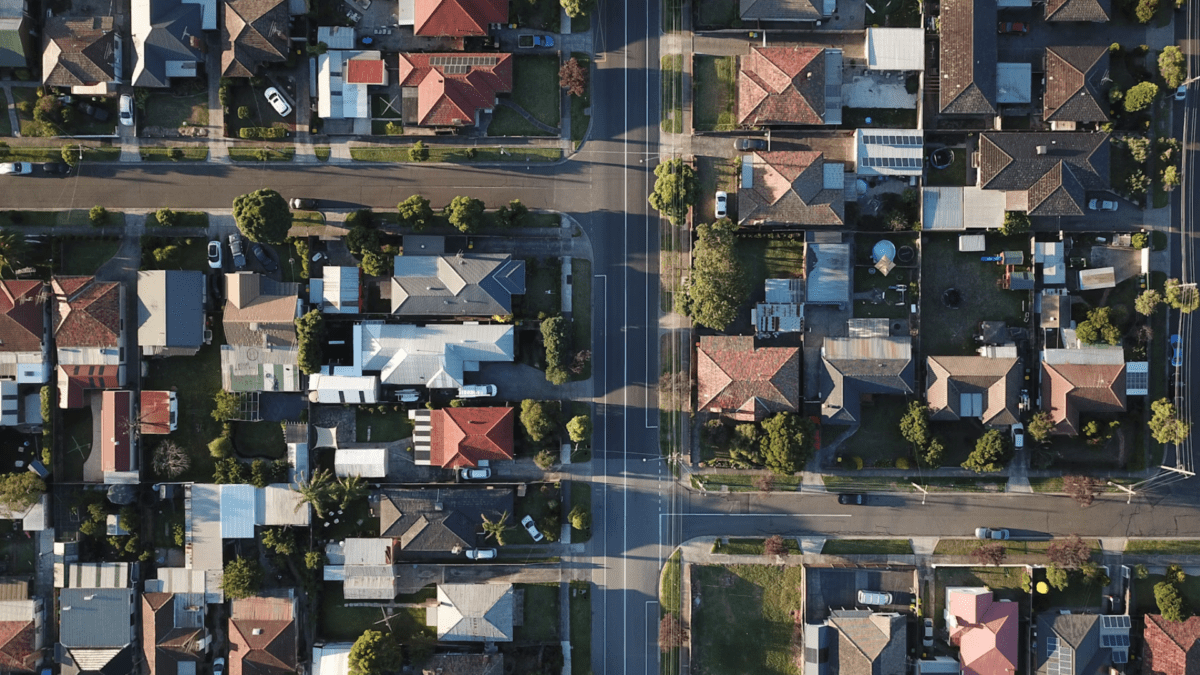

Financial planners are advising Australians to put more money into superannuation and diversify out of property, which still accounts for around 70 per cent of household wealth. The fall in household wealth in the June quarter coincides with increased cost-of-living pressures and rising interest rates, according to the ABS.

The overall drop in household wealth of $484.1 billion was the biggest decline since ABS records began in September 1999 and reflects the RBA’s commencement of its most aggressive monetary policy tightening since 1994. Wealth per capita fell 3.5 per cent to $553,954 as residential property prices fell for the first time in two years, which contributed 1.1 percentage points to the overall decline in household wealth, the ABS said.

However, the June quarter losses in wealth only partially reverse very strong gains in recent years, largely on the back of rising property prices. While total household wealth fell by 3.3 per cent in the June quarter, it still up 7.8 per cent on a year ago, and wealth per capita is up 6.1 per cent over the year.

Household portfolios lack diversification

The wealth numbers reveal that residential property still dominates household wealth. Around 70 per cent of household wealth is now held in property, totalling $10 trillion in the June quarter, compared with $3.4 trillion held in superannuation reserves, $1.2 trillion in shares and $1.5 trillion in cash deposits.

This highlights that many Australians are overexposed to property and underinvested in superannuation, according to Jonathan Philpot (pictured, left), wealth management partner at HLB Mann Judd. To overcome this imbalance, he said, once a mortgage is under about 50 per cent of a home’s value, Australians should consider strategies to start building wealth outside of the family home.

“Even if it’s just a further $5,000 per annum, for someone earning $200,000 per year, utilising some of the remaining concessional contribution limit would provide a personal tax benefit of 47 per cent,” Philpot said. “This far exceeds the interest cost of the home loan. And building more wealth into superannuation is also better diversifying your overall financial position.”

He added: “If the home debt is under 50 per cent of their home’s value and a person’s taxable income is $120,000 or above, they should consider salary sacrificing up to their concessional contribution limit. The sooner this can be achieved, the greater time [they] will then have to ‘build investment wealth’ independent of the family home.”

Super savings drop as contributions rise

Falling superannuation balances contributed 1.7 percentage points to the 3.3 percent decline in household wealth, thanks to large falls in domestic and overseas share markets as central banks around the world tightened monetary policy. In the June quarter of 2022, the S&P/ASX 200 index fell 12.4 per cent and the value of shares and other equity fell by $19.3 billion.

Total superannuation reserves dropped by $252.3 billion. But in some good news, superannuation losses were partially offset by strong contributions of $38 billion, reflecting a strong labour market and a rise in voluntary contributions at the end of the fiscal year.

Superannuation reserves accounted for 52.2 per cent of all financial assets in the June quarter, above the 52.5 per cent average since the global financial crisis (GFC) and the long-run average of 45.1 per cent, said Ryan Felsman (pictured), senior economist with CommSec. Households also held a record $1.5 trillion in cash and deposits at the end of June 2022, up by $7.4 billion from the March quarter.

“Cash and deposit holdings represent 23.2 per cent of financial assets above the average since the global financial crisis and the long-run average of 21.6 per cent,” Felsman said. In contrast, as share markets fell and investors sold out, listed shareholdings accounted for 18.9 per cent of all financial assets in the June quarter, below the 19.6 per cent average since the GFC and the long-run average of 22.1 per cent, he said.