ASX edges to fourth straight record high

ASX records continue despite mining sell off, energy stronger, lithium deals continue

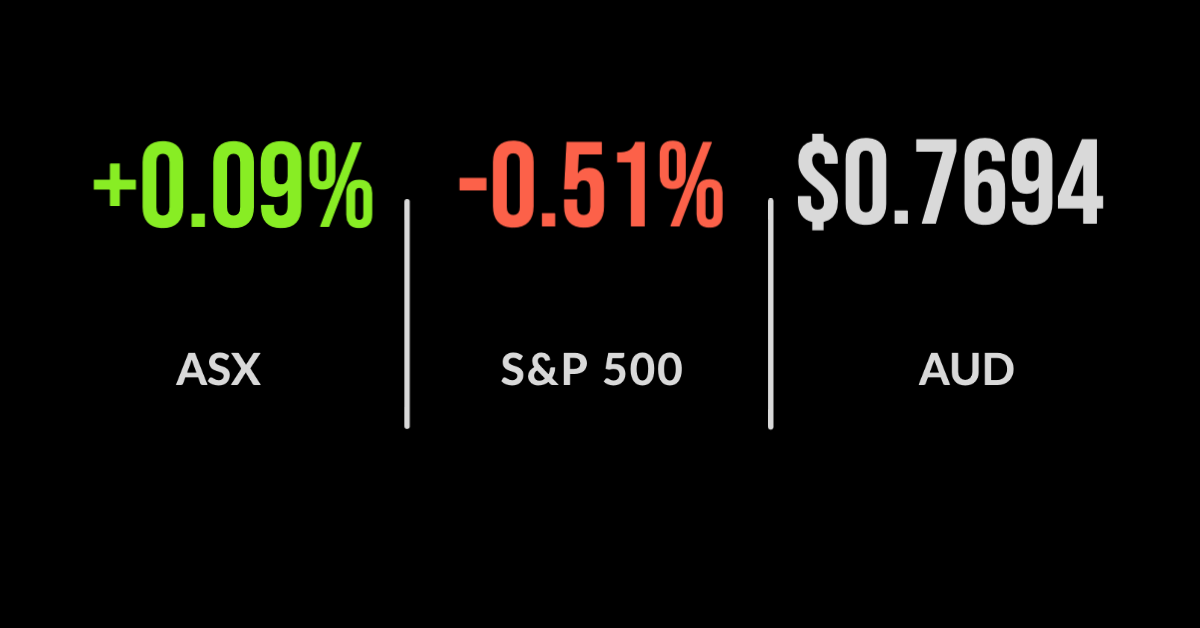

The ASX 200 (ASX: XJO) finished at another record, adding 0.1% on Wednesday despite weakening throughout the day.

Most sectors finished higher, led by the energy sector, up 1.5%, with the materials and IT down 1.6% and 0.4%, respectively.

It was bad news for those predicting another commodity supercycle, with the Chinese Government announcing they would release some additional natural reserves of copper aluminum and zinc to domestic businesses in an effort to stabilise record commodity prices.

The news sent OZ Minerals Limited (ASX: OZL) down 6.7% and BHP Group Ltd (ASX: BHP) down 1.7%.

Lithium miner Pilbara Minerals Ltd (ASX: PLS) jumped 2.2% after ASX counterpart Firefinch Ltd (ASX: FFX) confirmed a deal with Chinese battery metals giant Jiangxi Ganfeng to sell 50% of its Mali-based project for $250 million.

IAG flags claims hit, Avita revenue improves, Shaver Shop profit up 60%

Shares in insurer Insurance Australia Group (ASX: IAG) jumped 1.2% despite flagging potential payouts of between $720 and $743 million for the financial year. This comes after a terrible season of cyclones and recent storms in Victoria.

The update compares to the $658 million the company set aside and an increase on the $660 to $700 million predicted recently, once again highlighting the difficult business model faced by insurers.

That said, the company has natural peril protection, with reinsurance kicking in to cover a portion of the cost.

Struggling skin treatment group Avita Medical Inc (ASX: AVH) added 12.4% after upgrading its revenue forecast for the financial year.

Management noted that the company has returned to “normal activity” following lockdowns as burn accidents increase once again.

Quarterly revenue is expected to exceed guidance of between $8.2 million and $8.6 million, now expecting $9.5 to $9.7 million.

COVID beneficiary Shaver Shop Group Ltd (ASX: SSG) fell 8.3% the latest in the e-commerce related sell offs.

This came after releasing a trading update, announcing a 9% increase in revenue to $213 million and a 60% increase in profit to between $16.75 million and $17.5 million for the financial year.

Inflation expectations increase, rate hikes in 2023, QE set to continue, markets fall

Global markets fell after Federal Reserve Chair Jerome Powell announced an evolving view on the threat of inflation.

At the long-awaited Fed meeting, Powell confirmed that the board now expects at least two rate rises in 2023 and that inflation in 2021 may be higher than expected, but still transitory.

He highlighted signs that inflation expectations within the economy were increasing, but that the economic recovery was not yet strong enough to support a ‘tapering’ of the US$120 billion in bond purchases.

The result was an increase in the ten-year bond rate which hit 1.57%, the most in months, and a 260-point fall in the Dow Jones, down 0.8%. The Nasdaq and S&P500 fared better, falling 0.5% and 0.2% respectively.

This was much less volatile than expected given the context of the announcement, suggesting markets were prepared for a speeding up of rate hikes.

Economically exposed companies were more resilient, with energy and travel groups including Occidental Petroleum (NYSE: OXY) and Norwegian Cruise Line (NYSE: NCL) adding over 2% each.

On the other hand, the tech sector suffered smaller falls but was more widespread, with Facebook (NASDAQ: FB) down close to 2% and Amazon (NYSE: AMZN) gaining on the hopes of strong consumer spending.