ASX powers ahead, materials sector jumps on iron ore, EML Payments surges

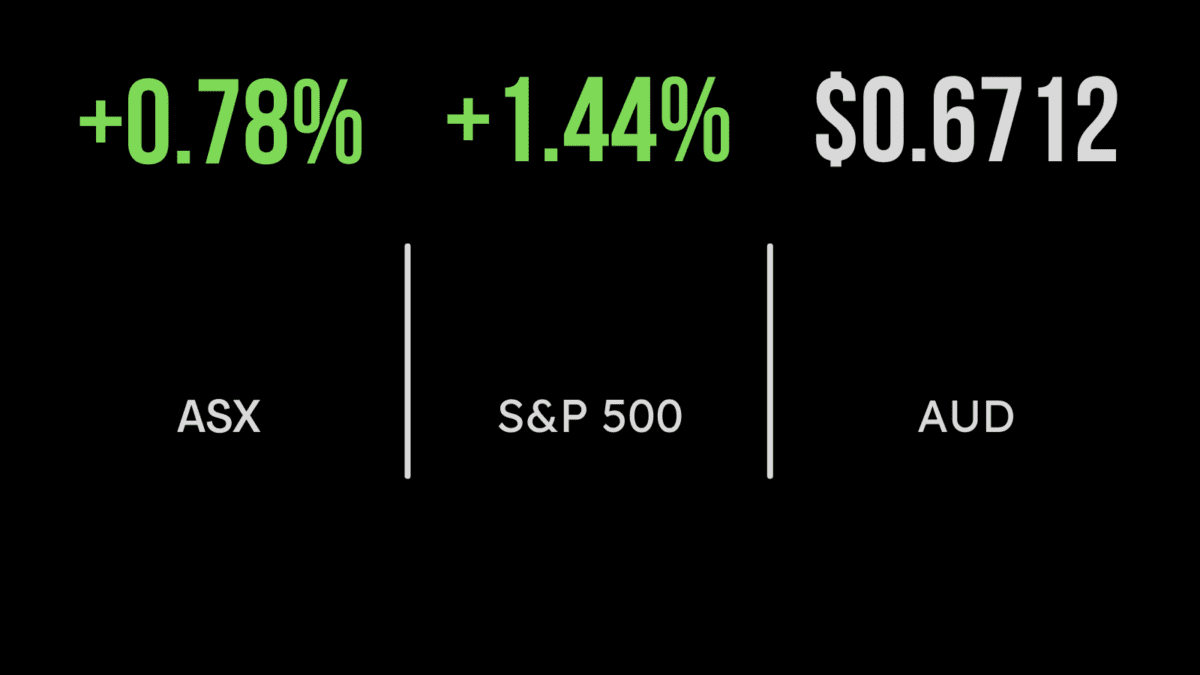

The local market finished the week strongly, gaining 0.8 per cent on Friday, and 3.2 per cent for the week. Once again, the cyclical financial and materials sectors drove the gains, adding 1.9 and 0.5 per cent with both Rio Tinto (ASX:RIO) and BHP Group (ASX:BHP) adding 2.5 per cent. The former benefited from an agreement with First Quantum Minerals to unlock a new copper project in Peru, the latter from a jump in the iron ore price. Shares in embattled payments group EML Payments (ASX:EML) jumped more than 30 per cent in a ‘no news is good news’ result as the Central Bank of Ireland confirmed they would not allow any further growth in the local business. Management confirmed guidance, with no such growth having been included, buoying traders. Shares in insurer NobleOak (ASX:NOL) entered a trading halt after APRA notified the business it was in breach of its reporting standards. Across the week the market was driven by the materials sector, which gained 7 per cent, on the back of the significant takeover bid for Liontown (ASX:LTR) which finished 73 per cent higher, while every other sector finished in the black.

Nasdaq powers higher, inflation slows, consumer remains resilient, quarter highlights

US benchmarks were buoyed by a continued rally in the consumer discretionary and communications sectors, with the FANG+ index finishing 2.7 per cent higher on Friday. The likes of Amazon (NYSE:AMZN) and Tesla (NYSE:TSLA) dragged the Nasdaq 1.7 per cent higher, with the S&P500 and Dow Jones adding 1.4 and 1.3 per cent respectively. The key driver was a further slowing of inflation, with core spending up just 0.3 per cent, and year on year inflation slowing to just 4.6 per cent. The seemingly unexpected result will give the central bank more room to hold off on further rate hikes. On the positive side was another 2 per cent improvement in consumer spending in January, much stronger than expected, but primarily driven by higher prices rather than volumes. In company specific news the Metropolitan Bank (NYSE:MCB) was the latest to stave off liquidity concerns, rallying y 33 per cent after noting it remained well capitalised, while Virgin Orbit (NYSE:VORB) fell by more than 40 per cent after management indicated it would be ceasing operations. Over the week all three benchmarks finished more than 3 per cent higher, led by the S&P500 which gained 3.5 per cent.

Inflation continues to trend lower, shares bounce back in quarter

Economic data continues to point to a weakening of the global economy and more importantly, end to the historical run of interest rate increases. Counter to the seemingly aggressive tone of central banks around the world, both the US and European inflation results this week are reflecting what it seems many had not expected, a slowing of inflation, to 6.9 per cent from 8.5 in the EU and down to 4.6 per cent in the US, as the 12-month impact of energy and housing prices continue to feed through the economy. The risk now is that the banking crisis slows growth in credit, and when combined with already implemented increases results in a deep recession. Despite this negative tone, sharemarkets around the world remained positive in the first quarter of the year, with the ASX200 lagging, by increasing just 2 per cent, compared to the S&P500, which gained 7 per cent. Among the biggest highlights thus far have been the massive comeback from semiconductor maker NVIDIA (NYSE:NVDA), which is up 90 per cent in 2023, and Tesla (NYSE:TSLA) which is 68 per cent higher.