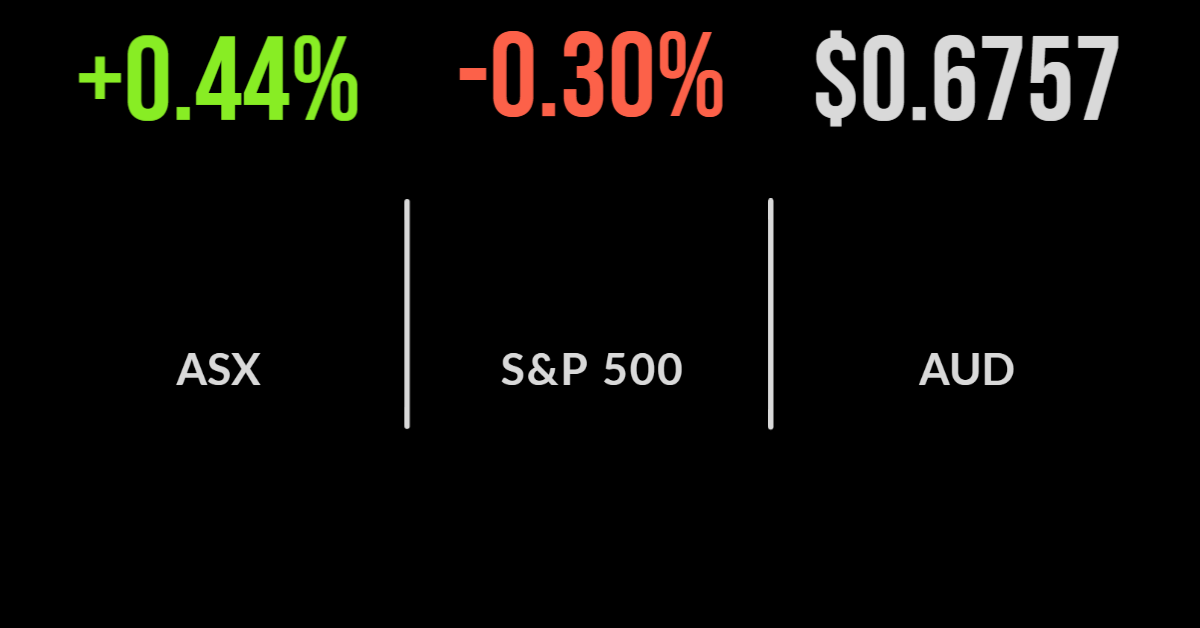

The local market managed another positive finish, gaining 0.4 per cent backed by an unexpected rally in the technology sector. Nine of the 11 sectors gained, with technology 2.1 per cent higher, with only real estate and financials detracting, down 1.1 and 0.8 per cent each. Shares in Netwealth (ASX: NWL) bucked the trend gaining…

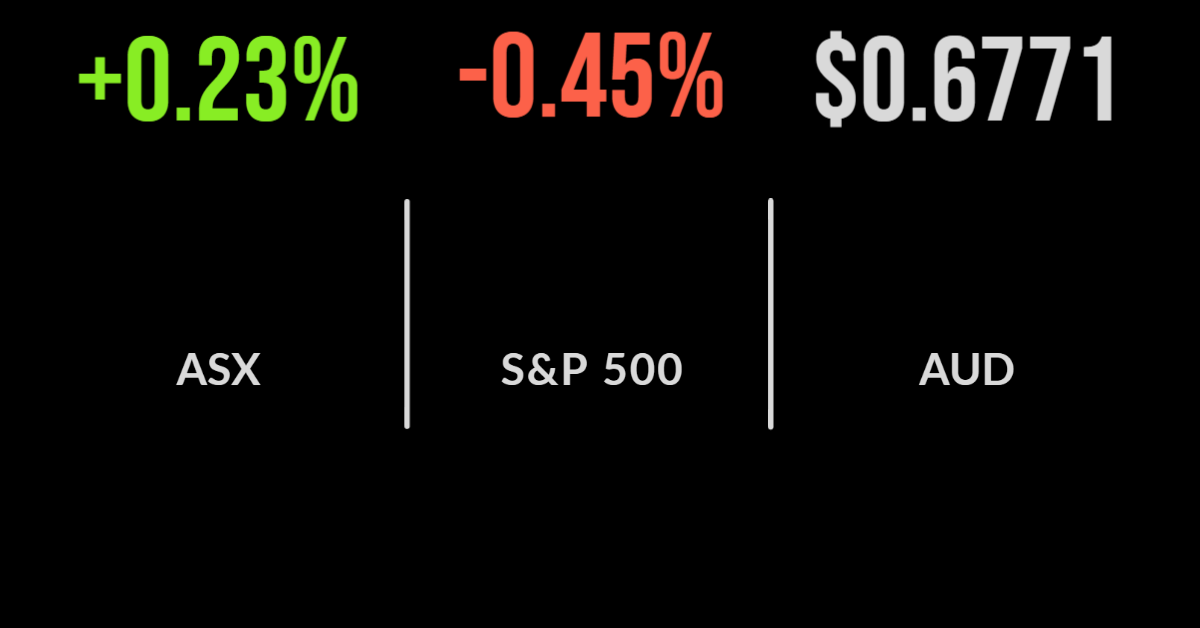

It was another positive, but mixed, day for the local market with seven of the 11 sectors finishing higher and contributing to a 0.2 per cent gain. The dispersion between the winners and losers is beginning to narrow after an incredibly volatile period. On the positive side were the consumer and technology sectors, which gained…

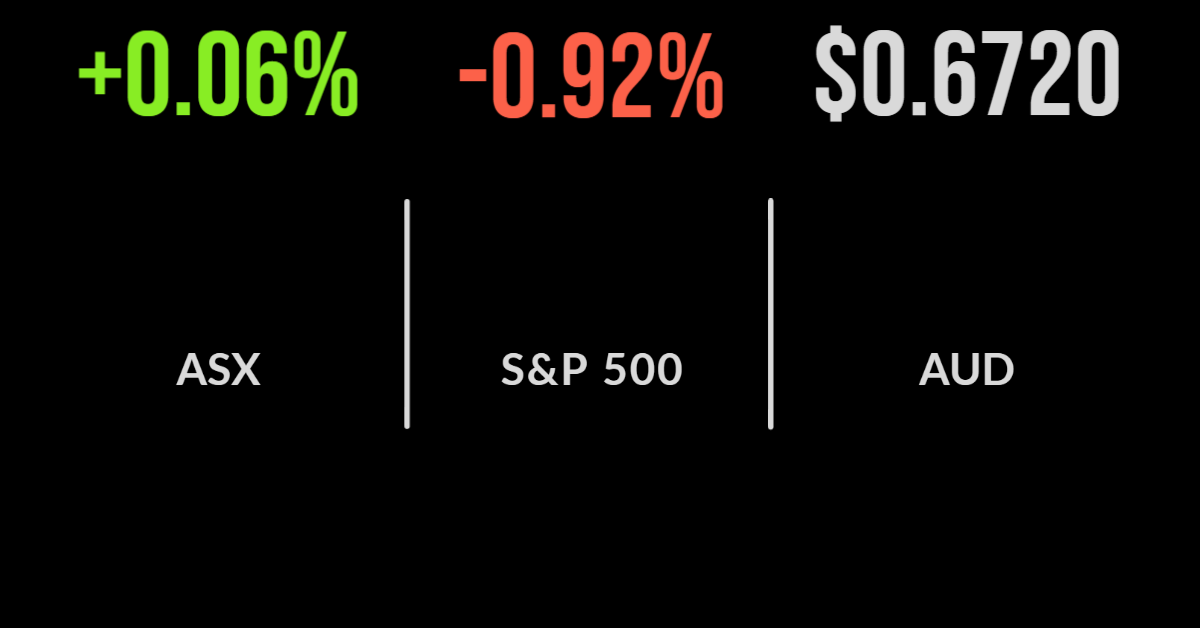

The local market managed to overcome increasingly negative global sentiment ahead of an important US earning season that begins later this week, finishing 0.1 per cent higher. The stalwart blue chips were the standout with financials, consumer staples and healthcare increasing 0.7, 1.2 and 1.1 per cent respectively. The Commonwealth Bank (ASX: CBA) gained 1.2…

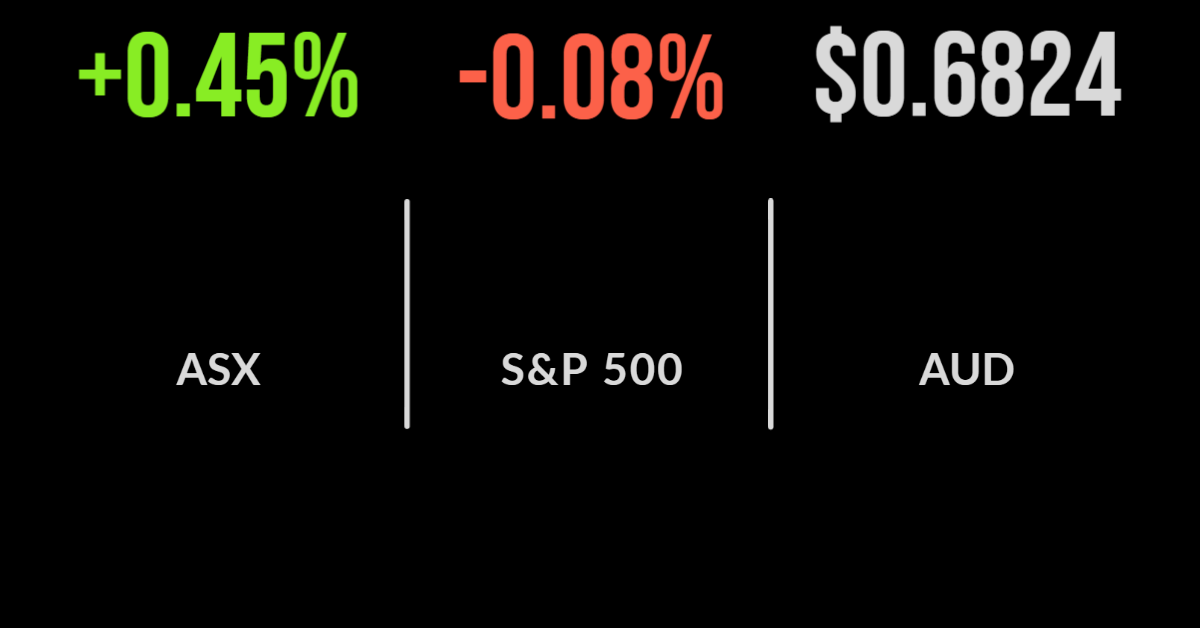

The Australian market couldn’t carry over a positive week for the US market, falling throughout the day to finish 1.1 per cent lower. There were very few highlights outside of the healthcare sector, which gained 0.1 per cent, while every other sector finished lower. Materials and technology continue to be hit on the back of…

It was a solid week last week for the Australian market, advancing on four of the five days. The S&P/ASX 200 gained 138.1 points, or 2.1 per cent, for the week, to end at 6,678, while the broader S&P/ASX All Ordinaries index added 156.6 points, or 2.3 per cent, to 6,877. The All Tech index…

The term “hold on for dear life” came to explain the events of 2020 and 2021, as did “buy the dip.” For those beginning investing for the first time, their experience couldn’t have been more positive. Every fall in the market was followed by another rally, and the prevailing view was that markets always go up if your holding period is long enough.

The benchmark S&P/ASX200 index finished at the highs of the day on Thursday, up 53.5 points, or 0.81 per cent, to 6648.0. The broader All Ordinaries rose 52.6 points, or 0.78 per cent, to 6836.9. A 1.9 per cent rise in Singapore iron ore futures, to $US113.30 a tonne, helped the big miners, with BHP up…

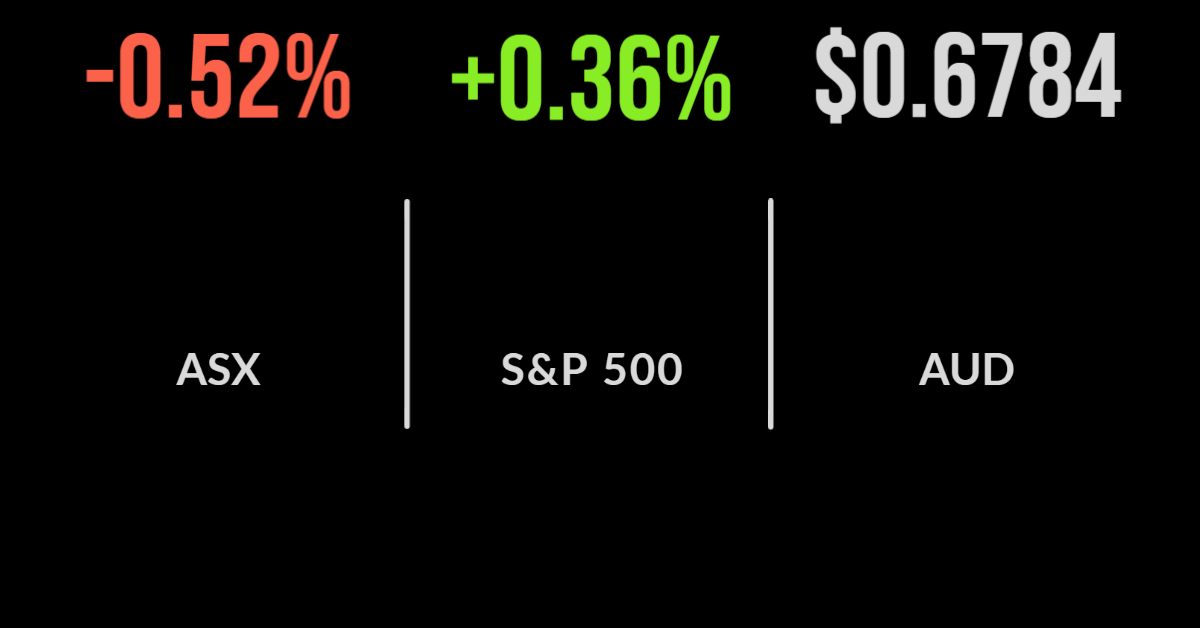

A tech rebound – possibly a dead-cat bounce – tried to drive the Australian market higher on Wednesday, but the concerns on commodity prices more than outweighed this. By the close, the benchmark S&P/ASX 200 had shed 34.8 points, or 0.52 per cent, to 6,594.5, while the broader All Ordinaries surrendered 33.8 points, or 0.5…

Price-to-sales ratios were viewed as something of a badge of honour by many in the venture capital and technology sector in 2020 and beyond. While those intricately involved in the sector couldn’t predict the future, the sheer number and successful listing of hundreds of tech unicorns in 2020 and 2021 may well have marked the end of this valuation measure.

As widely expected, the RBA raised the cash rate by 0.5 percentage points yesterday, taking it to 1.35%, as widely expected. This is the fastest back-to-back increase in rates since increases of 0.75% and 1% in November and December 1994 respectively. But the RBA remains upbeat on the economy and employment, despite remaining concerned about…