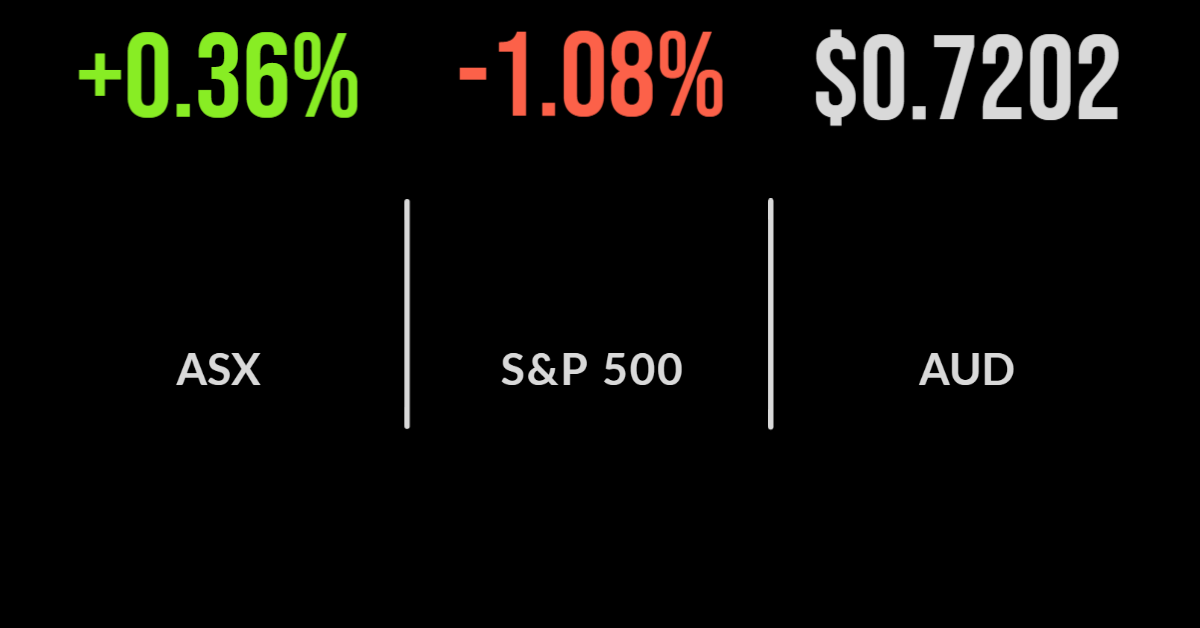

The local market capped its worst week since March 2020 falling 1.8 per cent on Friday and dragging the S&P/ASX200 down 6.6 per cent for the week. This followed a 4.2 per cent drop in the prior week which now has the index nearing a bear market. Comments from the RBA Governor this week heightened…

2022 has been a torrid year for both bond and equity markets, but particularly those outside Australia. Following Friday’s weak close, the S&P500 is now down close to 19 per cent for the calendar year to date and the US government bond index is down around 13 per cent. As readers in the finance professional would know, these are the two key inputs into the 40/60 or ‘balanced’ portfolio.

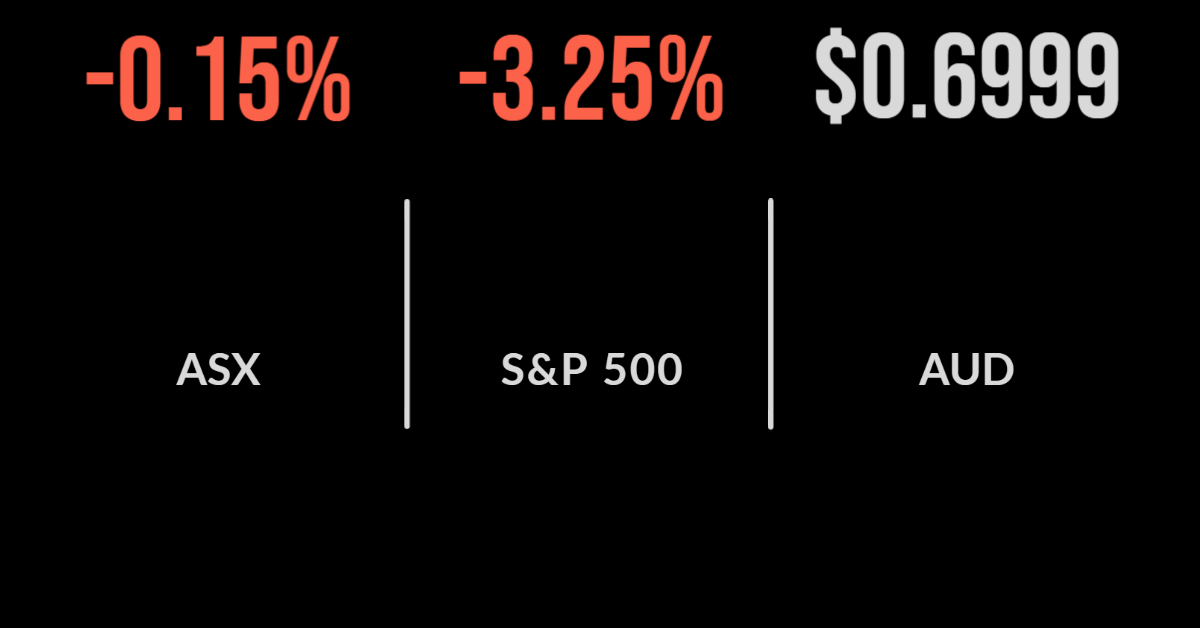

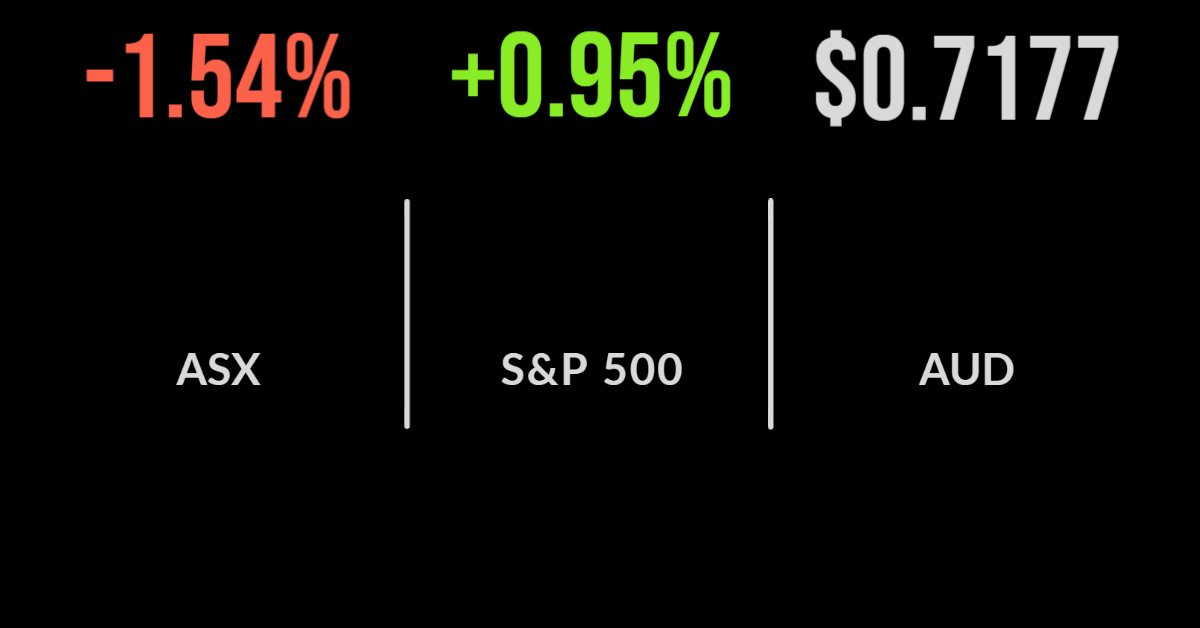

Australian shares were as much as 1.1 per cent higher during Thursday’s session following the Federal Reserve decision to hike interest rates by 0.75 per cent, but ultimately finished 0.1 per cent lower. The major detractors were the consumer staples and utilities sectors, falling 1 and 1.6 per cent with the latter hit by the…

Russia’s invasion of Ukraine will continue to have a significant impact on the outlook of the global economy and the human race for decades to come. This is something highlighted by global consultancy firm, McKinsey, in a recent post tracking the 12 major disruptions that are set to change the world as we know it.

Anyone keeping up with the news overnight is aware of the headlines. $88 billion lost in a single day, market crumbles, stocks tank; there will be no lack of hyperbole following the worst day for the S&P/ASX200 since March 2020. The market fell by close to 5 per cent during the session, following a rough…

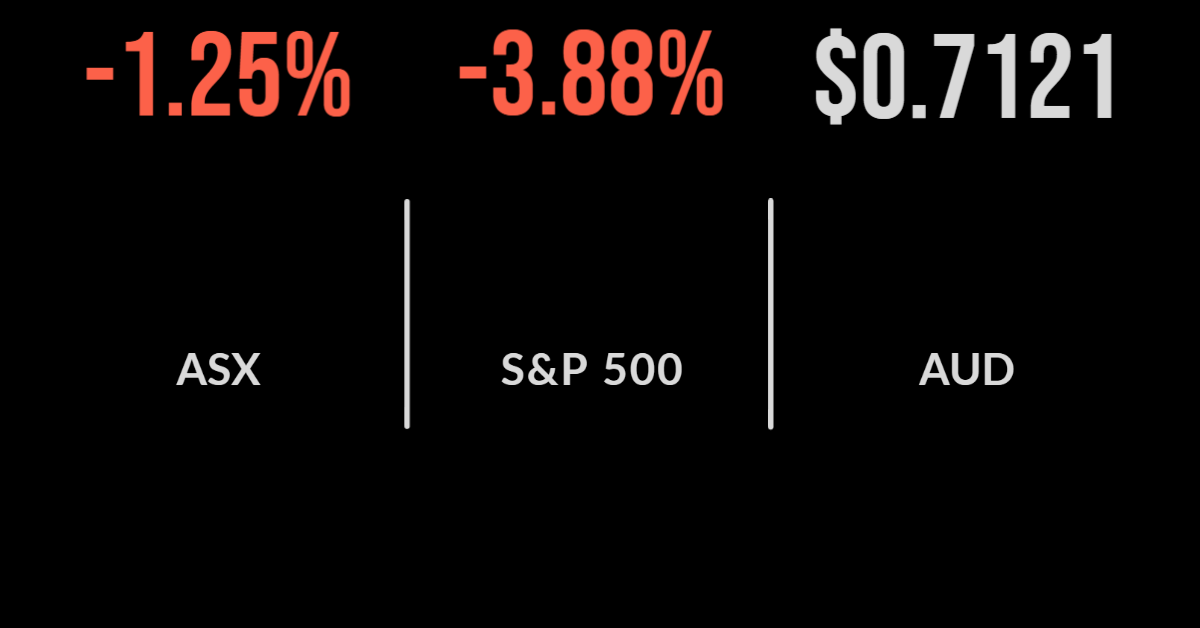

The local market was pushed lower by the global turnaround in interest rates with the S&P/ASX200 falling 1.3 per cent to finish the week. Every sector was lower, led by property, which fell 2.9 per cent on concerns that higher interest rates will hit valuations, while another six sectors dropped more than 1 per cent,…

The struggles of the big banks and mortgage lenders in the wake of this week’s rate rise continued on Thursday, with the financials sub-index losing 2.2 per cent and helping to drag the benchmark S&P/ASX200 index 101.4 points, or 1.4 per cent lower, to an almost four-week low of 7019.7. The broader S&P/ASX All Ordinaries fell 106.6 points, or…

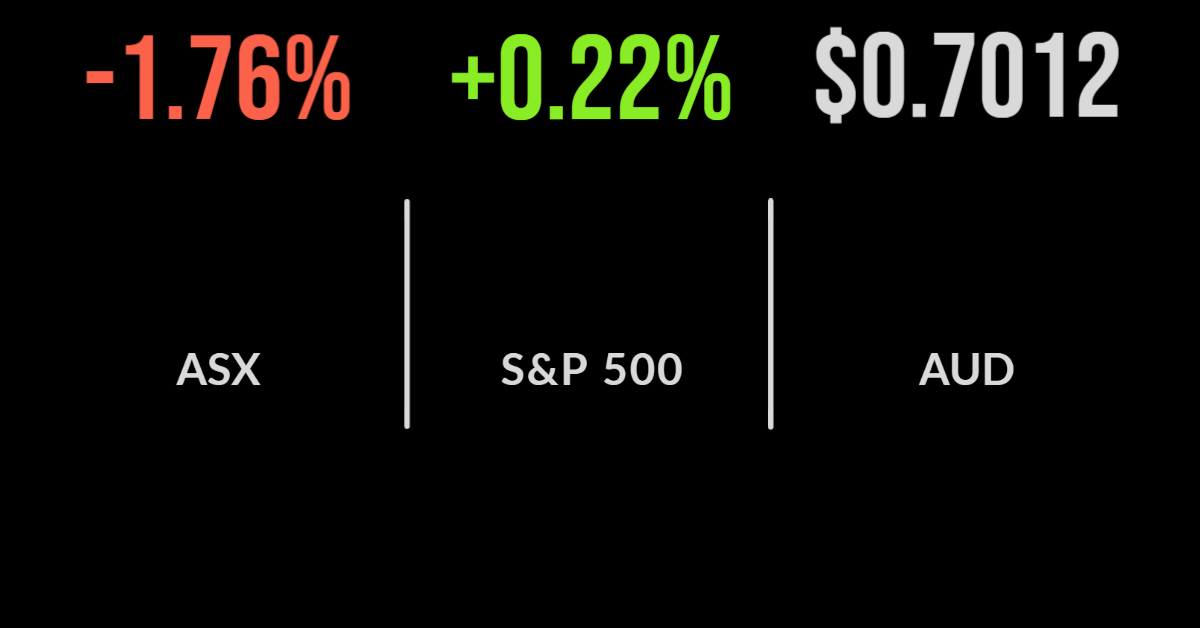

Yellow glow on ASX Resources came to the rescue on the Australian share market on Wednesday, with surging uranium and oil and gas stocks more than compensating for a shocker from the banks. A call from Goldman Sachs that Brent crude would average US$140 a barrel between July and September, up 17 per cent from its prevailing…

Whilst it is clear that leaving interest rates at an ’emergency’ level isn’t appropriate, it is difficult to believe that the Australian cash rate will be above 3 per cent, as the market predicts, in 2023. A 50-basis point increase in mortgage rates that are in many cases below 2 per cent will hit people and businesses, but most likely property prices, hard.

The Australian sharemarket was on hold ahead of the RBA’s latest board meeting and interest rate decision. A somewhat unexpected 0.50 per cent increase in the cash rate to 0.85 per cent saw the S&P/ASX200 slump by 1.5 per cent. The large move was predicted by only a few experts with the RBA highlighted the fact that inflation had…