There are few signs that the global selloff is slowing down, with a weak US lead on Friday contributing to another 1.2 per cent fall on the S&P/ASX200. The threat of higher interest rates and inflation are now been compounded by news that the Chinese government had extended lockdowns in key capital cities potentially adding…

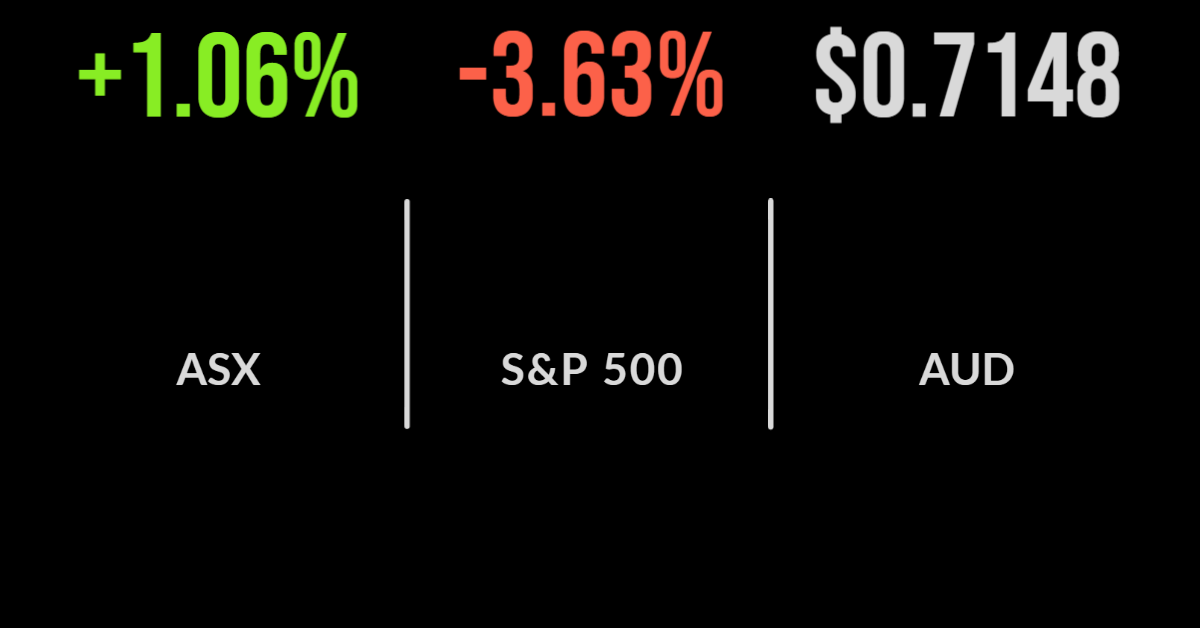

The local market closely followed the global lead with the S&P/ASX200 experiencing its worst session since Russia invaded Ukraine. All 11 sectors of the market were lower with technology and real estate the hardest hit, down 4.5 and 3.4 per cent for the day, whilst consumer staples naturally outperformed, falling just 0.2 per cent behind…

Exchange-traded funds (ETFs) have been all the rage in Australia and around the world for several years now. Despite their success and popularity, the sector at last count represents just $100 billion of a $4.3 trillion broader asset market in Australia. By and large, the vast majority of assets remain invested in traditional managed funds,…

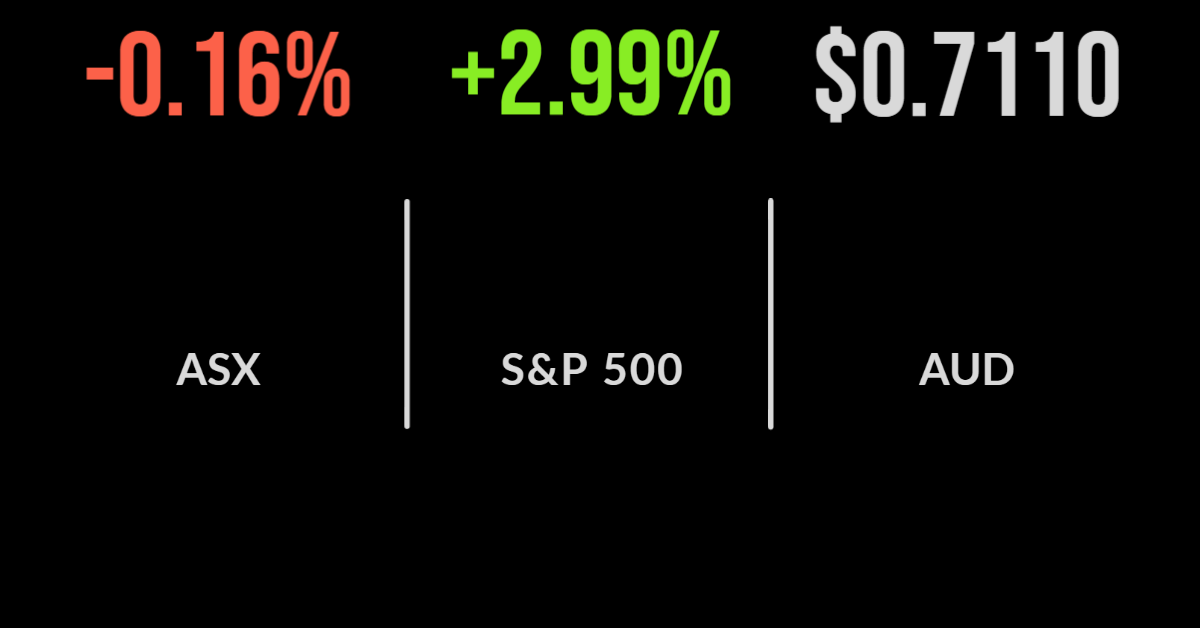

The first day of a new interest-rate environment was a slight downer for the Australian share market, with the benchmark S&P/ASX 200 easing 11.5 points, or 0.2 per cent, to 7304.7 points. The gauge has lost 1.8 per cent this week, to be down 1.9 per cent since the start of the year. The S&P/All…

Only those who completely avoid any sort of media, social or traditional, would not be aware that the Reserve Bank of Australia (RBA) this week hiked rates for the first time in more than a decade. Tuesday’s decision, which moved the cash rate from 0.1 to 0.35 per cent, has reverberated through the markets, however,…

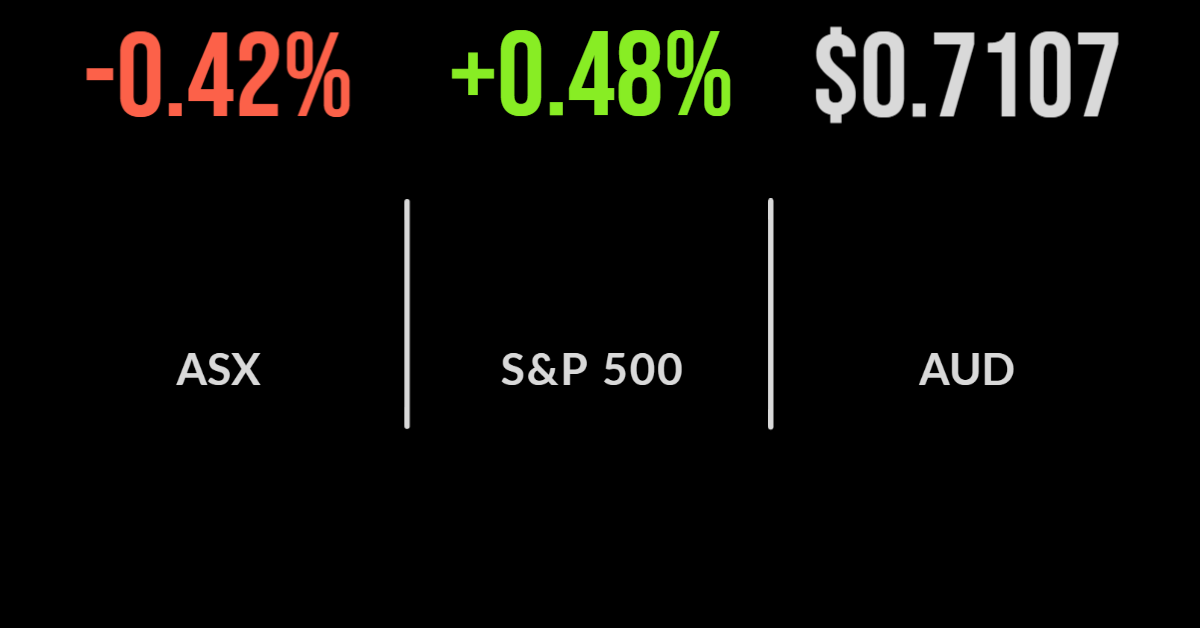

The first interest rate hike in Australia in 11-and-a-half years took centre stage on the Australian markets yesterday. The Reserve Bank of Australia (RBA) lifted the cash rate by 25 basis points, or 0.25 percentage points, taking it to 0.35 per cent, and signalled that more rate rises were ahead, as the central bank seeks…

The domestic market continues to outperform our global peers, with the S&P/ASX200 gaining 1.1 per cent on Friday, but still finishing the week 0.5 per cent lower. Every sector was higher, led by technology and communications which gained 2.2 and 1.9 per cent, and nine of the market’s 11 sectors gained more than 1 per…

From the outset, it is important to highlight that I do not disagree that interest rates should be higher than the current ’emergency’ settings by the Reserve Bank of Australia (RBA). Rather, in my view, much of the data suggests that interest rate hikes will do little to solve the inflation challenge facing not just…

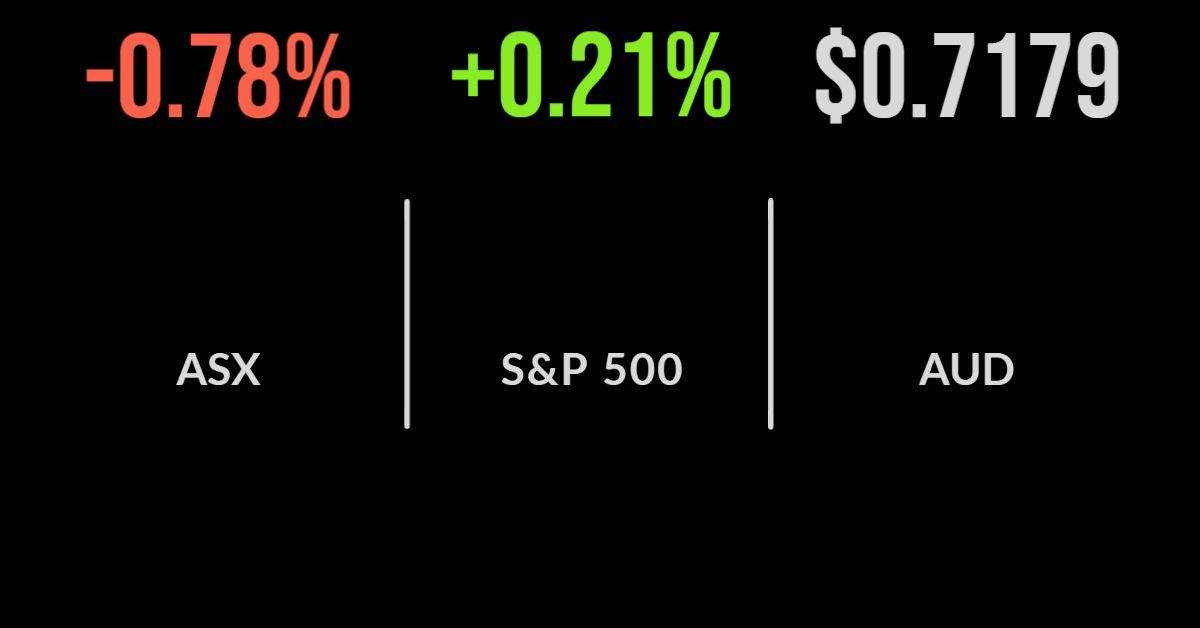

The local sharemarket followed a weak global lead, falling 0.8 per cent on Wednesday but with the fear spreading to broader sectors of the market. In the opposite to yesterday’s trade, energy and utilities outperformed gaining 1 and 0.6 per cent respectively, with the materials sector also benefitting from a breather on Chinese selling. Whitehaven…

One of the more interesting and powerful implications of the pandemic, relating to investment markets at least, is the velocity at which every new piece of news or data is priced-into markets. We only need to look back at the events of March and April 2020 to be reminded that we experienced both the fastest…