The Australian market managed to finish the quarter 0.7 per cent high in price terms, but down just over 1 per cent on an accumulation basis. This was despite the market finishing near its lows on Thursday, down 0.2 per cent. The only positive contributions came from the rare earth and commodities sector with materials…

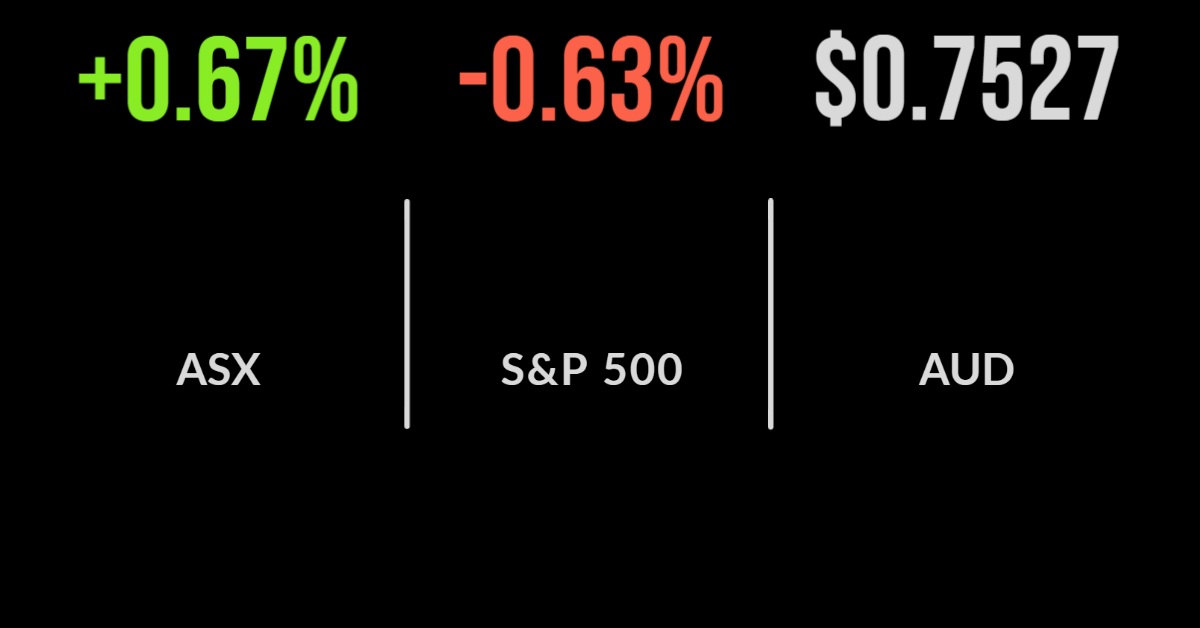

In what can only be described as a remarkable turnaround, the domestic sharemarket is closing in on breakeven for 2022, with the S&P/ASX200 gaining another 0.7 per cent on Wednesday. A positive lead from the US and signs of a ceasefire in Ukraine saw every sector barring energy and materials rally, with technology the standout,…

Whilst global sharemarkets have recovered much of the ground lost due to the Ukraine crisis, US Federal Reserve moves and surging energy costs, there is a general feeling that equities remain on the precipice of a bear market or extended correction. Whether it is our inherent pessimism towards markets, or simply tiring of one of…

Treasury Josh Frydenberg delivered his long-awaited, pre-election budget this week, seeking to offer respite to a ‘surge’ in the cost of living. The Federal Government, and next Government for that matter, face a difficult challenge in navigating what is likely a short-term surge in inflation and hit to the cost of living, with demands for…

There was little in the way of positive news on Monday, with the market ultimately capitulated to a lack of direction, gaining just six points to start the week. Just four of the 11 sectors finished higher but among them were the markets two biggest, being materials and financials, which gained 1.3 and 0.6 per…

The Australian market remains resilient to the threat of higher energy prices with the S&P/ASX200 gaining another 0.3 per cent to finish the week. The result was driven by a rally in the energy, materials and utilities sectors, which gained 0.9, 1.3 and 1 per cent respectively. Investors are clearly flocking to perceived inflation hedges…

Computershare (ASX:CPU) is a name synonymous with investing in Australia. Touted as “world leaders in financial administration” on its iwb website, the group is the dominant provider of share registry services in the country. After floating on the ASX nearly three decades ago, in 1994, with a market capitalisation of just $36 million, the company…

The local market managed to eke out another small gain on Thursday finishing 0.1 per cent higher powered by the utilities sector which gained 2.6 per cent. The sector is benefitting from growing demand for energy and improving gas prices with Origin (ASX: ORG) a major contributor gaining 3.0 per cent. The energy sector also…

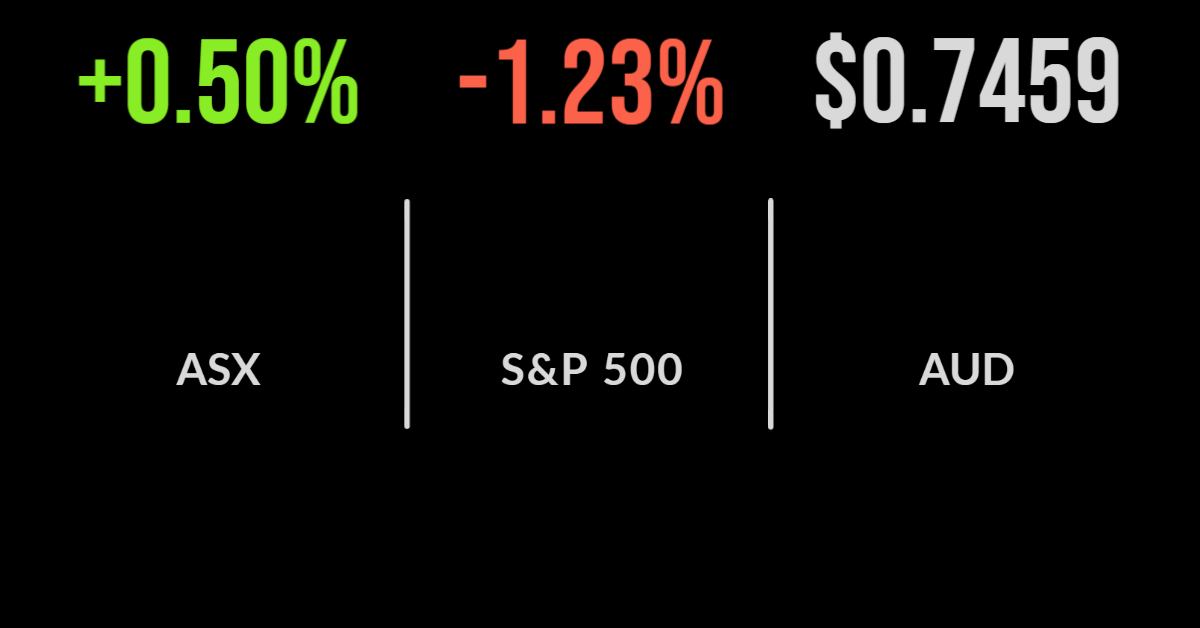

The run of positive days continues to defy expert predictions of market chaos as bond yields increase, with the S&P/ASX200 gaining another 0.5 per cent despite another bump in the 10-year government bond yield. The technology sector tracked the gains of the Nasdaq adding 3.5 per cent as sector leader Block (ASX: SQ2) jumped 7.5…

First, it was GameStop and the era of the ‘meme’ stocks. Then it was the Archegos hedge fund making massive bets on well-known technology companies. More recently, it was a massive spike in the price of Nickel. What all these events have in common was that they all involved a ‘short squeeze’. Short squeezes have…