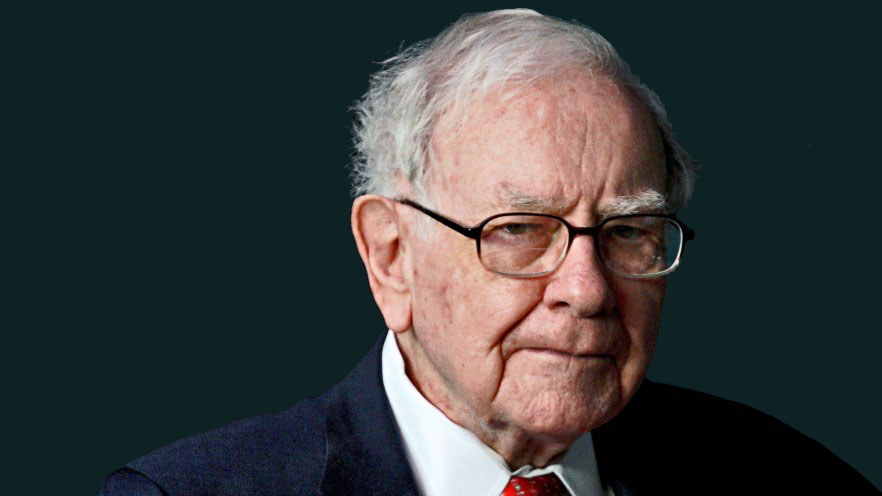

Warren Buffett is the first to admit that active investors can’t get it right every time, doing so once again at the Berkshire Hathaway Annual Shareholder’s meeting last week. The quotes of Buffett are an enigma of themselves, with the man himself suggesting investors adopt an index approach, but being amongst the most active investors…

Media pressure continues to grow on Hamish Douglass and the $100 billion Magellan Financial Group. After years of outperformance the flagship fund has been caught off guard by what Douglass himself described as ‘the best month in 26 years’ that was November 2020. As markets continue to move forward, Douglass and Magellan remained steadfast deciding…

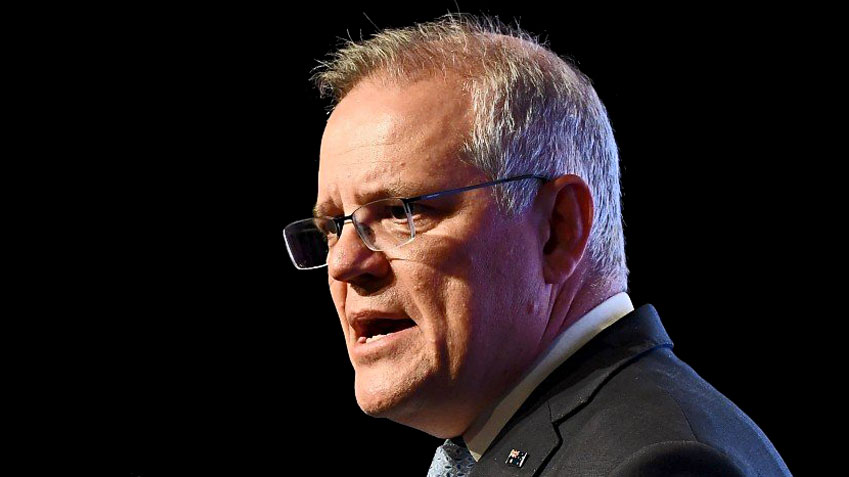

While all the headlines are dedicated to the ballooning budget deficit, tax cuts and a departure from the traditional “balance the budget” approach of the Coalition, there were a number of positive takeaways for both older and younger Australians. The announcements have increased the flexibility and attractiveness of both the superannuation and self-managed super fund…

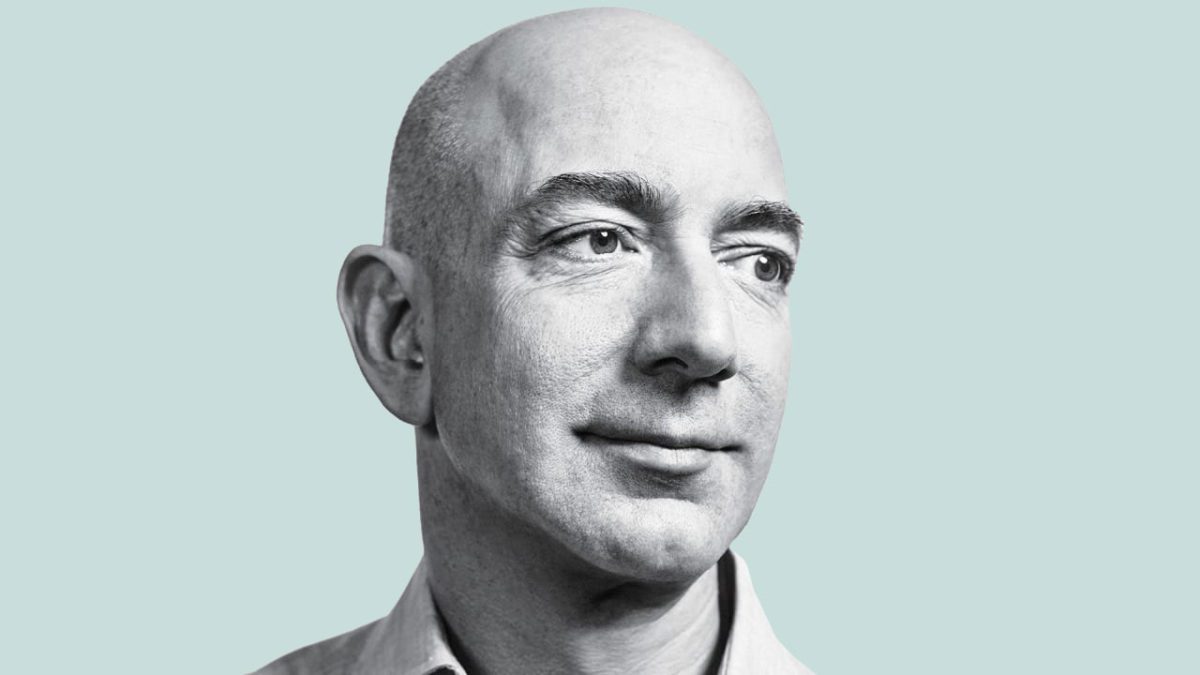

The growth vs. value debate has been well trodden. Growth has clearly won the day and the decade, almost solely due to the majority of technology companies falling into the growth camp. Powered by an incredible digitalisation and disruptive innovation trend, if you bought anything growing earnings it will likely have paid off. Value investing…

The value vs. growth debate has been played out in numerous ways for close to a decade. The results today are clear. Those who remained steadfastly invested in value stocks have significantly underperformed the benchmark and may well have left investors with less capital than the same time ten years ago. Traditional value stocks remain…

Superannuation research house Chant West, part of the Zenith Investment Consulting group, this week published its quarterly performance update on the industry fund sector. Despite the volatility experienced in March, which spanned both bond and equity markets, returns continued to surprise on the upside in March. Chant West’s research seeks to differentiate between the (at…

We recently covered the mechanics of short-selling in our article, ‘how short selling really works’. This followed the huge popularity of the investment strategy amid the Reddit and GameStop saga earlier this year. In this article a number of benefits were raised ranging from the additional liquidity it provided to markets, the transparency it demanded…

Similar to the Australian Investor’s Association in Australia, the AAII or American Association of Individual Investors, is a significant source of information for self-directed investors of all types. Running a series of events and with a huge following the association is well positioned to measure the pulse of the industry. According to their latest Asset…

Emerging markets including China and India have been among the most popular destinations for investors in recent months, with many attracted to their diversification benefits. There remains a common misconception that these countries are still the ‘manufacturer for the world’, but the companies that now inhabit these countries, in many cases, have surpassed their developed…

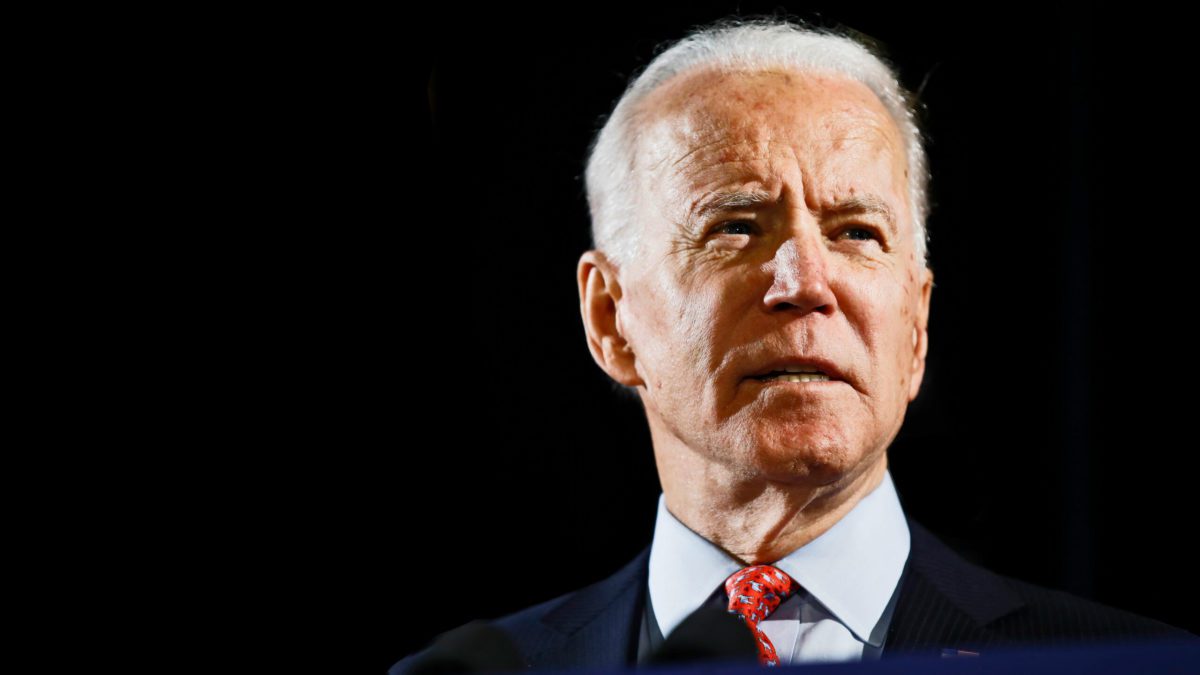

In this regular quarterly analysis, we assess the key economic events of the March quarter and seek to identify key opportunities or drivers for the years ahead. Australia Government bond rates were the story of the quarter, with the Australian 10-year yield, an important input into property and other asset valuations, reaching a multi-year high…