Despite widespread geopolitical and societal tension, be it from US protests or the threat of a renewed trade war with China, the market seem to keep powering through exhibiting the disconnect between Wall Street and Main Street.

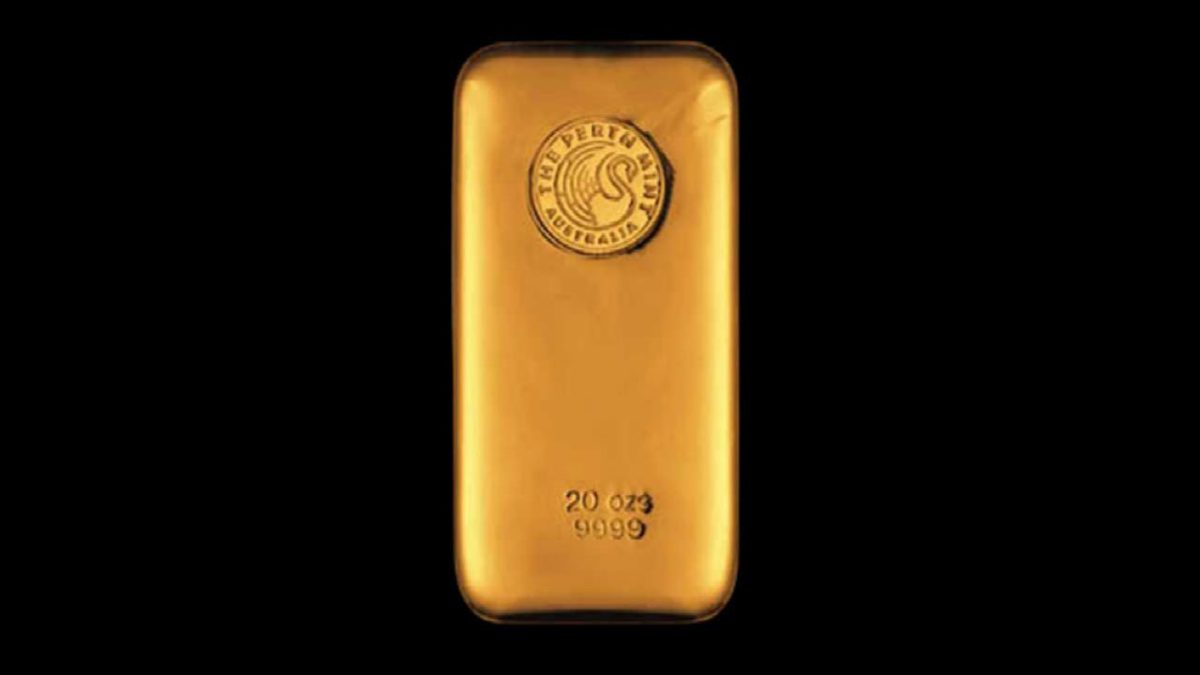

Most gold investors are quietly happy about the yellow metal’s 2020 rise from US$1,514.75 to US$1,728.70 – that’s a healthy 14.1 rise. But if you’re an Australian gold miner, you’re even happier about its 2020 movement in A$, from $2,164.67 to $2,591.91 – in local currency, gold is up almost 20%. And at that price,…

Double-digit returns seem to be a thing of the past for many investors. But one global equity growth fund has withstood the test of time and volatility to continually deliver high returns and outperform the index. Growth managers have continued to show their wares this year and Franklin Templeton’s $405 million (as at 30 April…

Investors and SMSF trustees looking to diversify away from low interest rate term deposits in search of fixed income strategies now have greater access to Australian bonds. Bond investing enables investors to diversify income sources and is a defensive strategy to reduce equity portfolio risk. Typically, Australian investors have less invested in fixed income than…

COVID-19 has started a property downturn in Melbourne and Sydney, according to results released by Corelogic. May 2020 property downturn starts CoreLogic Home Value Index results for May showed that five of the eight capital city regions dropped in value. Property transactions had completely dropped off in April 2020 as the restrictions limited property buyers…

This week we take a look at the often misunderstood, bulk retailing business Costco (NASDAQ:COST). Similarly to Woolworth’s (ASX:WOW) the company has performed reasonably well throughout the COVID-19 shutdowns benefitting from hoarding and its business model of offering incredibly low prices for bulk purchases. The company sells all kinds of food, automotive supplies, toys, hardware,…

If any part of the economy is experiencing a sharp, ‘V-shaped’ recovery, it is car use. A number of ASX-listed companies stand to benefit from widespread avoidance of public transport. Macquarie Securities has ‘outperform’ ratings on toll road operators Transurban Group and Atlas Arteria, online automotive classifieds business carsales.com and auto parts and accessories supplier…

With markets waiting with baited breath for President Trump’s speech on his policy towards China. The ASX 200 (ASX:XJO) fell heavily in the afternoon to finish down 1.6% for the day.

With markets waiting with baited breath for President Trump’s speech on his policy towards China. The ASX 200 (ASX:XJO) fell heavily in the afternoon to finish down 1.6% for the day.

Sustainability focused investing has been gathering pace over the last decade, with equity funds attracting a lion’s share of interest from investors focused on ESG. According to IMF data as of mid-June last year, fixed income strategies account for less than one-fifth of the assets under management. Yet, the bond market is almost double the…