Superannuation fees can add up to a huge long-term expenditure, costing Australians with modest super balances thousands of dollars a year. But costs may start to fall, with some funds and new players working to disrupt the structure.

While Australian household wealth is hitting new records, research shows much of it is held by just a few people, with the richest 5 per cent of Australians seeing their assets grow in value by 86 per cent over the last 20 years.

The value of Australian’s superannuation pool rose to a record high of $3.62 trillion in the June quarter, a highlight of the managed funds industry’s surging overall performance over the past year as rising rates and rebounding markets improved asset values.

Australian companies’ dividend payouts are down 24 per cent from a year ago, as higher interest rates and cash flow challenges darken the outlook. Payouts from miners decreased significantly, although the dividend picture remains positive for banks.

Australian consumers are showing real signs the largest and longest rate hiking cycle in 30 years is starting to bite. It might be the proof the RBA needs to see that its fight against inflation is working, adding further weight to the theory that rate rises are behind us.

One of the most surprising outcomes from the better-than-expected August reporting season was the strong performance of consumer discretionary retailers, as Australians continued to weather higher interest rates and inflation better than many analysts had feared.

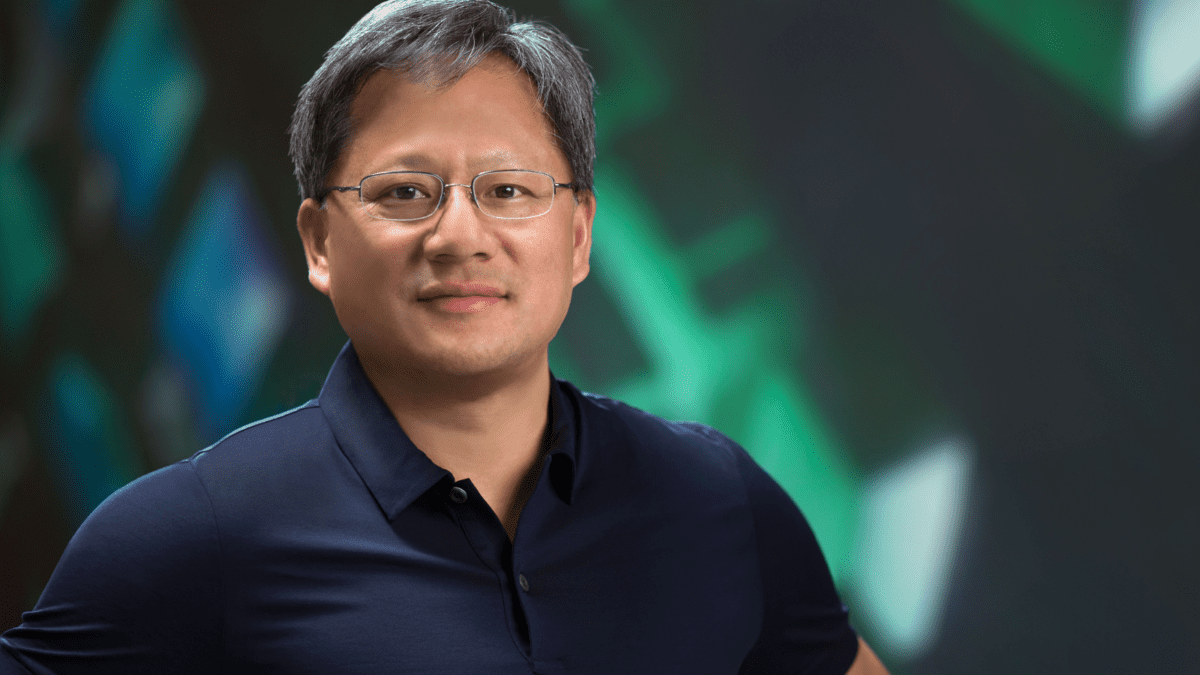

Shares of the in-demand chip maker hit an all-time high of US$502 on the back of a strong profit report, and analysts say it could be set for more gains, despite rising US bond yields complicating the outlook for equities and especially tech stocks.

Recently released wages data increased the likelihood the RBA will pause its rate hiking campaign for the near term, economists say. Meanwhile, an increase in full-time employment, and the wages they earn for it, has helped narrow Australia’s gender wages gap to its lowest-ever level.

Switching to a sustainable pension fund is one of the most effective ways to reduce a person’s carbon footprint, with no performance tradeoff required. As the need for climate solutions grows more urgent, the momentum for environmentally friendly investment options in Australia’s $3.5 trillion super sector is gathering pace.

A BlackRock bitcoin ETF could add an extra $100 million in daily demand for the cryptocurrency, pumping up the price. If US regulators approve the product as expected, analysts expect big tailwinds for the entire crypto ecosystem.