Cap rates critical to assessing commercial property investment

While it’s an investment truism that past performance is no guarantee of future performance, smart investors shouldn’t ignore historical trends.

Recently, two charts prepared by Trilogy Funds to examine historical capitalisation (cap) rates for commercial property and the relationship between commercial property cap rates and interest rates caught the eye. Certainly, the trends should make any self-funding retiree wanting capital gain and income to sit up and take notice.

But before dissecting these charts, it’s critical to understand what cap rates are and why the concept is critical to commercial property investment.

Trilogy Funds’ Industrial Fund Manager, Laurence Parisi, says cap rates represent the yield on property assets.

“What’s important for investors to understand is that when cap rates are falling the price of the underlying asset is rising,” Parisi tells The Golden Times. “If this inverse relationship between cap rates and asset values sounds familiar, it’s because it is – we see the same inverse relationships between asset prices and yields in the bond market. Bond prices increase when interest rates fall and decrease when interest rates rise.”

He says this isn’t the only connection cap rates have to bond markets.

“Investors typically expect a premium over the risk-free rate to compensate for the risk and illiquidity of investing in property. Accordingly, there is a strong long-term correlation between cap rates and interest rates.”

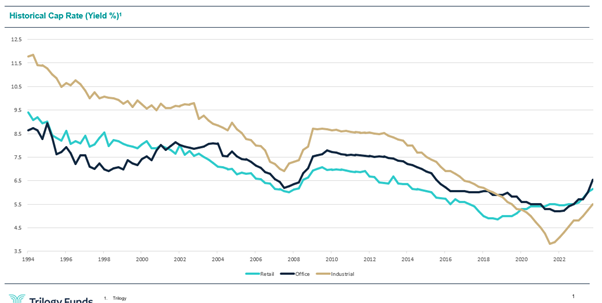

Chart One

It’s by understanding the cap rate that explains why these two graphs, which cover three decades (1994-2024), offer such fascinating insights into commercial property. Chart One plots historical cap rates for the office, retail and industrial commercial property markets – the three sectors comprising much of the commercial property market.

If we look at the left-hand side of the chart, from 1994 to around 2008, some interesting trends emerge.

The sectors were largely in sync, with cap rates falling up until late 2007. It could be deduced from this broad trend of falling cap rates that commercial property was becoming more attractive to investors between 1994 to 2007 because they were willing to accept increasingly lower yields and pay increasingly higher prices for those assets.

Then the GFC hit. Central banks initially tightened monetary policy. Across the nine months from August 2007 to March 2008 in Australia, for instance, the RBA incrementally increased the target cash rate by one per cent. In response, cap rates for all three sectors jumped.

Central banks globally then embarked on an interest rate easing cycle to stimulate economies, sparking another bull market in commercial property, demonstrated by the persistent cap rate compression from about 2009 to 2019.

A new trend became apparent later in the cycle – the growing attraction of industrial property where cap rates fell below office cap rates for the first time over this 30-year period in 2019 and then below retail in 2020.

“This indicates the growing appeal of industrial property, particularly compared with office assets in 2019 and retail in 2020,” Parisi says.

“What the graph also tells investors is that the bull markets last much longer than the bear markets, so while they experienced a hiccup in 2008 after enjoying a 14-year run, it only lasted two years before cap rates started falling again for about 12 years before the Reserve Bank brought this rally to an end when it started pushing up interest rates to curb inflationary pressures in the economy.”

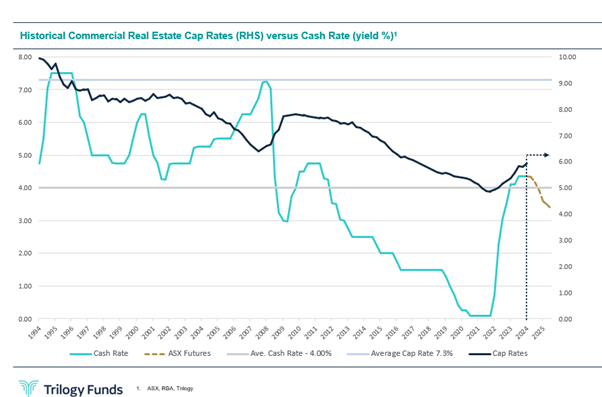

Chart Two

Chart Two, which compares the cash rate with the cap rate over the same 30-year period, shows that there is typically a healthy spread between the cash rate and cap rates, reflecting the risk premium. On average, this spread was 3.3 per cent across the period.

The chart also shows five instances where that spread decreases significantly or even inverts, all of those instances follow either a steep or persistent increase in the cash rate. Conversely, we see that after a fall in the cash rate, the spread between cap rates and cash rates widens, and a prolonged trend of cap rate compression follows.

So, with the current spread at just 1.6 per cent, and with growing evidence that interest rates have peaked and will start to fall again (the four major banks are all predicting interest rate cuts either later this year or in the first half of 2025), that spread between the cap rate and interest rates should begin to widen again.

If this is also a signal that commercial property cap rates will begin to fall, then this is something for self-funded retirees to pay attention to. Based on the evidence of the past three decades, that market trend should last at least a decade. So, the question will become what property sector to choose with the investment case for industrial remaining strong.