-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Economics

-

Investing

-

Legal

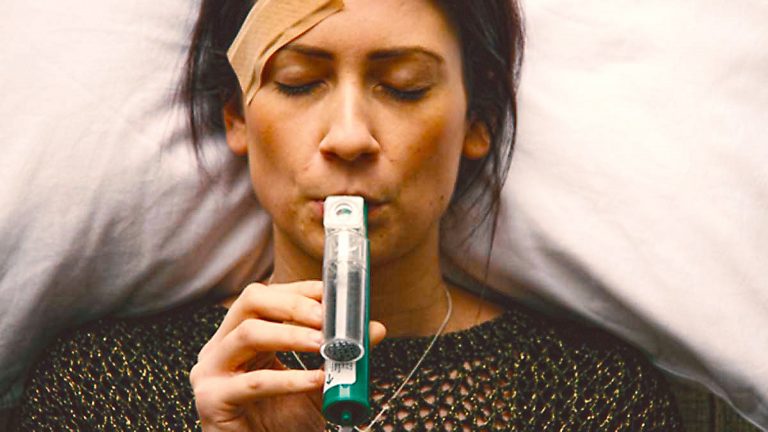

In the second of a series on Australian biotech success stories, here are some more representatives of the fascinating medical device cohort on the ASX. Medical Developments International (MVP, $5.97) Market capitalisation: $391 million Three-year total return: 6.3% a year Analysts’ consensus target price: $8.61 (Thomson Reuters) Medical Developments International is the company behind the…

In an environment of low interest rates and seemingly overvalued sharemarkets, advisers are naturally flocking to alternative asset classes to eke out returns. Yet not all alternative assets are created the same. The COVID-19 sell off and subsequent recovery has truly seperated the good from the bad. In this webinar, PIMCOs Chris Santore, will shine…

Gold prices have seen specialist Exchange Traded Fund provider, ETF Securities move beyond $3 billion in assets under management to start the new financial year.

Given the global outlook is clearly one of a high degree of risk, it is surprising that all forms of risk assets seem to continually defy all the negative outlooks. Traditional asset allocations have been heavily tied to equity market growth and the continual decline in risk free interest rates over the past 30 years….

Earlier in the year, the Federal Government announced a push to target cybercrime with $748 million to be spent on new initiatives and an expanded security workforce. The announcement came following a targeted cyber-attack on all levels of government, industry, political organisations, education, health, essential service providers and operators of other critical infrastructure. The cyber…

Most fund managers or asset owners you may question to about ESG have probably stated that they are a signatory of the UN PRI at the very beginning of the conversation. Most likely, this would be mentioned as evidence of their broader commitment to ESG investing.

During the month of August, most ASX listed companies report their earnings for the financial year. It’s an anxious time for both company management and investors. Any unexpected variation in earnings whether it be better or worse than expectations can cause a huge move in share prices. COVID-19 is no exception. It hit markets like…

Red Bubble (ASX:RBL) – The online retailer released a bumper business update which cause its shares to rise 17.11% on the day.

We’re in the second week of reporting season and it’s been a mixed bag of results.

If it wasn’t clear in 2019, it must be clear now; value investing is dead.

Currencies are the closest cousin to this age cohort in investment markets.

Sitting at home through another economic shutdown, I can’t help but notice the flood of industry super fund advertisements throughout breaks in the now daily AFL games.