-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Economics

-

Investing

-

Legal

The traditional 60/40 portfolio mix of shares and bonds may be due a shakeup in 2023, as market participants look to add fixed-income exposure to help offset a potentially weak year for equities.

After equity markets recalibrated during a volatile 2022, the market is anticipating a tale of two halves in 2023. Investors should look for opportunities in established and high-quality global stocks, with a focus on corporate earnings.

A review of the top stories from the past year reflects investors’ continuing anxiety over the direction of markets as central banks continue their battle against inflation and geopolitical turmoil remains a constant. Many of the same issues appear likely to shape the next 12 months as well.

Increasing government expenditure on social infrastructure is driving huge levels of investment into the sector. There are now several options for retail and wholesale investors to gain exposure to this asset class, which was previously open only to institutional investors.

Netwealth and HUB24 are expected to continue eating the incumbents’ lunch, according to UBS. Meanwhile, as adviser numbers have halved the average amount of money they manage has doubled.

While the greater housing market is already reflecting the pain of constricting economic conditions, a new property fund partnership between Trilogy Funds and Michael Birch’s Murray Darling Capital shows the potential of ‘rent roll’ portfolios of rental property management agreements to provide exposure to the supersized Australian property sector even as the outlook darkens.

Markets may not always do what’s expected, but fundamental valuations and adherence to timelines will usually win out eventually according to Atrium Investment Management.

The Australian dollar’s appreciation from recent lows is eroding returns from unhedged international investments. With analysts mixed on where the currency is heading, opting to hedge foreign currency exposures could provide investors with some peace of mind.

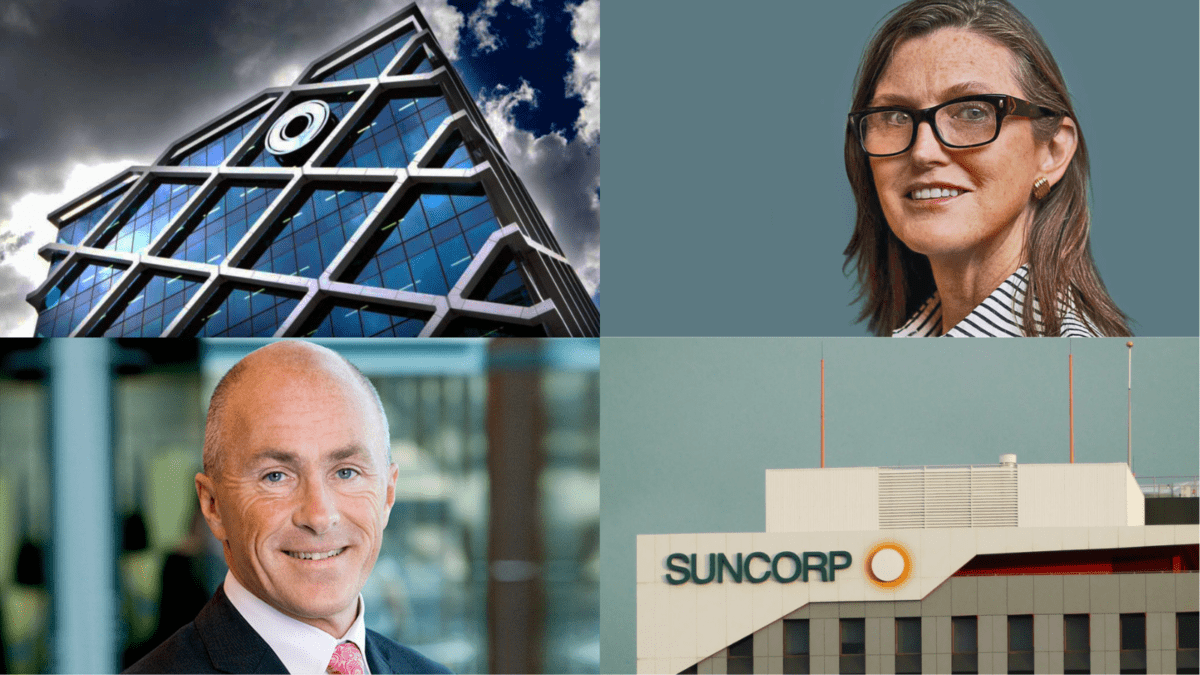

The long-running project has been shelved after a devastating Accenture report cited multiple areas of concern. ASIC chair Joe Longo said the ASX “failed to demonstrate appropriate control”.

7investing lead adviser Anirban Mahanti says companies have been thwarting cyber threats for a long time. However, as data moves to the cloud, systems have failed to keep up.

Senior secured loans act as an important inflationary hedge in times of rising inflation according to Invesco’s chief investment officer.

Australians should be putting more money into superannuation and diversifying out of property, some say, even as super performance remains a question mark.