-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Broker picks

-

Product launches

-

Top performers

-

Worst performers

Macquarie Investment Management is now a bigger manager than AMP Capital – and the outlook for the respective stocks appears to reflect that ranking. Macquarie Investment Management has taken AMP Capital’s crown as the largest Australian-owned manager of Australian assets, moving to $125.7 billion in assets in the year to September 2020, according to the…

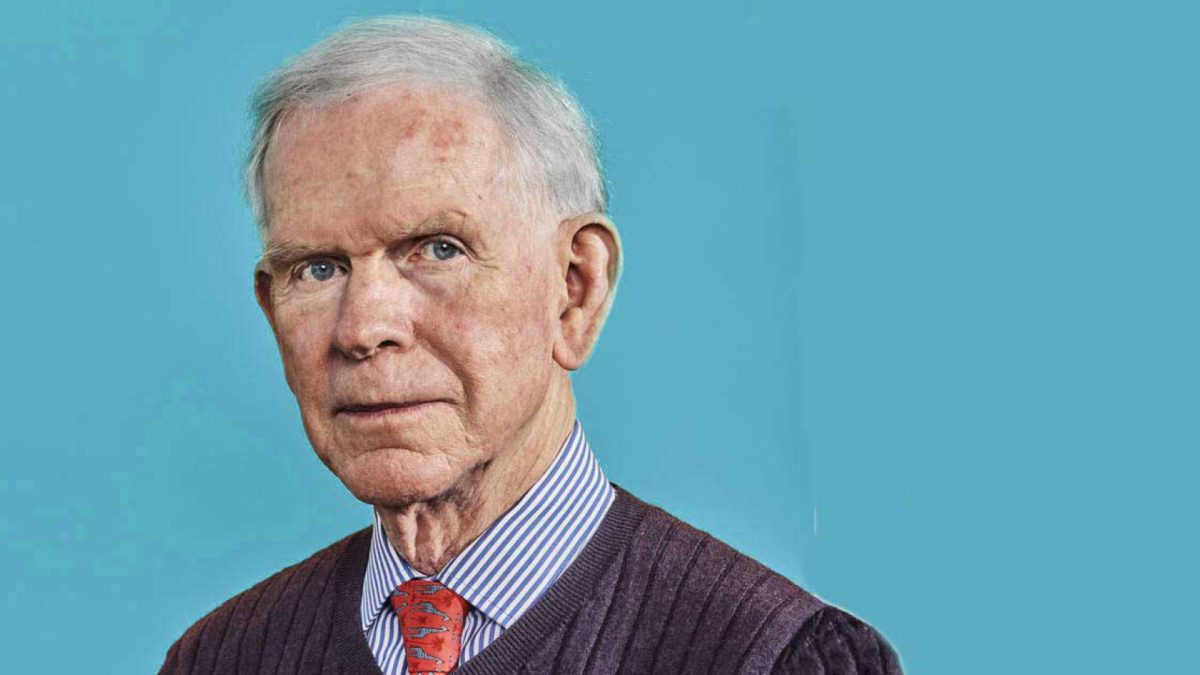

Legendary investor Jeremy Grantham has called bubble on the longest bull market in history. In a searing client newsletter, ‘Waiting for the Last Dance’, Grantham says current market conditions that feature “extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior” bear all the hallmarks of a last-gasp bubble expansion. The founder of value manager…

With interest rates at all-time lows, and term deposits lucky to be paying 0.5%, investors have simply been forced to look for alternative income-generating investments. The share market has obliged, but not only in the form of normal equity dividends – but in newer listed income-bearing investments. One of the most recent offerings came last…

Bitcoin is back. The first digital currency, introduced back in 2009, has once again gone on a mammoth bull run and reignited debate over its value. The price of Bitcoin hit all-time highs in 2020 reaching A$50,177, ending the year by doubling in less than a month. Its price is up by more than 330%…

It has been a tough 18 months on the share market for Inghams Group, but things could be starting to turn for Australia and New Zealand’s largest integrated poultry producer. Inghams is one of those classic disappointments for shareholders, in that the stock looked to be going great guns, but hit unexpected turbulence and gave…

Global investment manager Pacific Investment Management Corporation (PIMCO) released the results of an extensive survey of Australian investors this week. The first of what will be a regular temperature check for investment markets, the survey questioned 2,500 individual investors aged over 35 with liquid assets exceeding US$100,000 ($131,000), on major market indicators. The survey spanned…

Allegra Orthopaedics (AMT, 18.5 cents)Market capitalisation: $19 millionThree-year total return: +7.2% a yearAnalysts’ consensus target price: n/a Since 2014, orthopaedic manufacturer Allegra Orthopaedics has held an exclusive global licence to the composite bio-compatible and bio-degradable ceramic “synthetic bone” material Sr-HT-gahnite, developed at the University of Sydney: the lead product is a 3D-printed spinal cage, which…

With the onset of COVID-19 and the lockdowns that followed, the move to digitisation became one of necessity rather than choice. Traditional bricks-and-mortar retailers shifted online, triggering a frenzy of buy-now, pay-later (BNPL) vendors offering solutions to eventually replace physical cash. And quietly working in the background is the backbone supporting this transition: 5G. In…

It is often said that when the market takes a hit, that’s the best time to invest, and the COVID-19 pandemic is no different. Since the beginning of this pandemic, 2020 calendar year dividend expectations for the ASX 200 have fallen from ~$73bn to ~$58bn, which is broadly the same level of dividends that were…

The sound was deafening. It was the early stages of an unexpected global pandemic that had sent the entire world into meltdown. Both the short- and long-term impacts remained uncertain, the only certainty was that the movement of people around the world had ground to a complete halt: the worst-case scenario for investors in the…

And still they keep coming – here’s the fifth instalment of our series on the fascinating ASX cohort of medical device developers. As always, don’t let the impressive sexiness of the technology persuade you on its own that these stocks are headed for the stars. In each of the three cases presented here, previous investors…

If you’re looking for some generous dividend-paying stocks before the end of the year, you’ll find that the usual suspects – the banks, Telstra, and the real estate investment trusts (REITs) – have fallen in share price due to COVID-19, but that their dividend yields have remained quite high (although the REITs don’t offer franking)….