-

Sort By

-

Newest

-

Newest

-

Oldest

Investor focus seems to have shifted back to the agricultural space following the release of two Government announcements which have highlighted the sector as a profitable era for farmers and potential growth opportunity for investors. The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) has given an optimistic outlook for the agricultural sector,…

Recent ASX initial public offering GQG Partners Inc. (ASX: GQG) looks to be moving in on Magellan Financial Group Ltd’s (ASX: MFG) turf. Both companies manage global equities portfolios for big institutions with funds under management (FUM) of $85.8 billion and $113.9 billion respectively. It will be a battle for the ages: Rajiv Jain vs. Hamish Douglass. If you’re new to either business, check…

ASX weakens on energy sell off, Boral jumps as Pointsbet tanks The S&P/ASX200 (ASX: XJO) finished 0.2% lower on Thursday dragged down by the energy sector, which fell by 2% after the coal price continued to fall significantly. A nuclear accord between the EU and Iran was also cited as a reasoning for the weaker oil price. Boral (ASX: BLD) overcame weakness in…

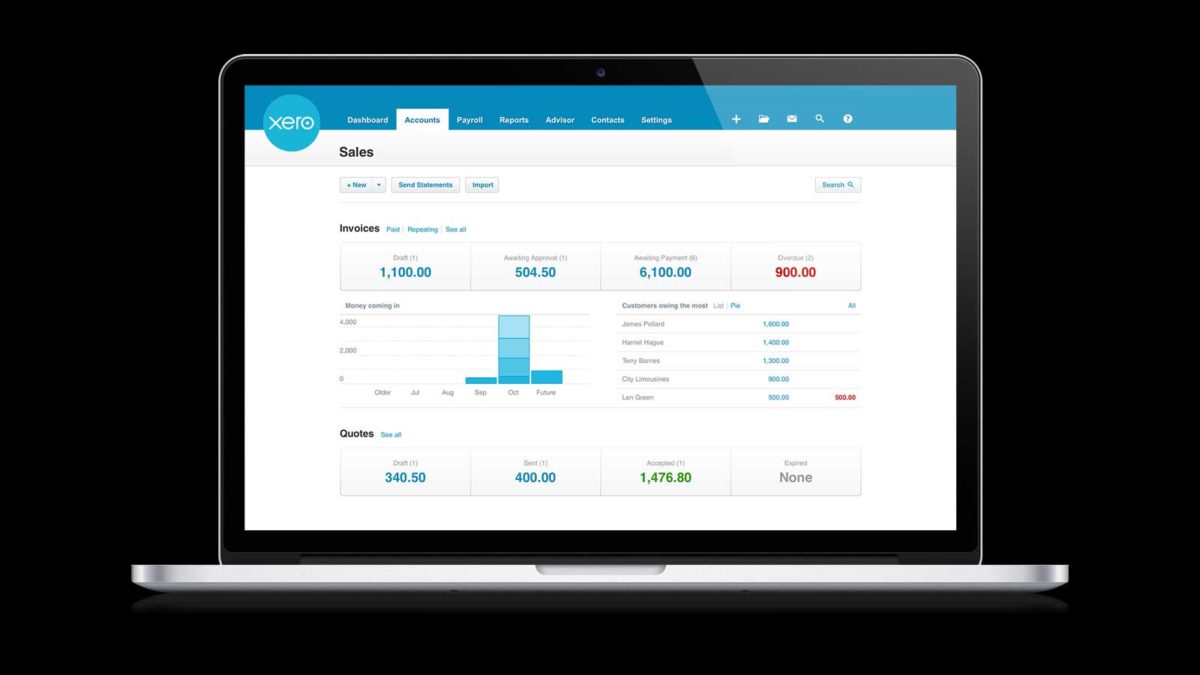

The stock market is a funny ol’ place. Think about it. Two people can have completely different perspectives – and both may be right. Let’s use an example in Xero Limited (ASX: XRO), the accounting software company. Me: “I think Xero is a fast-growth company, worth owning for 5 years.” Another investor: “I think Xero is overvalued because it doesn’t make a…

And just like that, Australia has joined the rest of the world in committing to be carbon-neutral, that is, in a net-zero-emissions state by 2050. While it may have taken a lot of toing and froing, we’re here. And it’s a big deal. According to research firm Climate Analytics, “Australia is often ranked as having…

SMSFs have been at the centre of the superannuation arms race for several decades. As a financial adviser, I am regularly stuck in the middle of administration and combative nightmares. On the one hand, we meet many investors, both advised and un-advised, who have SMSFs in place, but clearly don’t have the time, interest or…

Reading the media headlines this morning, “Is Crown too big to fail in Melbourne” and “Crown lucky to escape the Victorian Royal Commission with its licence intact,” was enough to recognise the power that Crown Casino still yields in Victoria, despite being brought to its knees by a Royal Commission hell-bent on making the casino…

The New Zealand-based Eroad Ltd (ASX: ERD) share price has moved into the red today after an underwhelming second-quarter update. Currently, the Eroad share price is down 8.33%, to $4.84. Eroad develops and markets technology solutions for managing vehicle fleets, improving driver safety and supporting regulatory compliance. Marginal growth offset by North America Key highlights for the…

The BlueScope Limited (ASX: BSL) share price is rising after it announced higher earnings guidance for the first half of FY22. BlueScope FY22 half year guidance The company is now expecting underlying earnings before interest and tax (EBIT) for the first half of FY22 to be between $2.1 billion and $2.3 billion. This updated guidance is above the previous…

Despite a growing chorus of calls for a significant market correction, as is usually the case in October, nothing has been forthcoming during the most dreaded of months. In fact, it has been a story of the opposite, with US markets near all-time highs and massive flow of dividends and buybacks combined with zero term…

Both Magellan (ASX:MFG) and Platinum Asset Management (ASX:PTM) have been gaining plenty of unwanted attention lately. Both their hallmark strategies are suffering from periods of underperformance, the former due to a lack of cyclical exposure and the latter an ingrained value focus. It is somewhat interesting therefore that both are banking on China as being…

“Money makes money. And the money that money makes, makes money” – Benjamin Franklin To many, this quote likely stands out as being among the most capitalist comments that would appeal to a billionaire professional investor, managing over $100 billion for investors all around the world. Yet at the core of this quote is the…