-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Asset allocation

-

Economics

-

Markets

-

Opportunities

-

Property

Global asset manager, Nanuk Asset Management, which specialises in sustainability, presented its “Hydrogen or Hamburgers” webinar to investors last week. It was an interesting take on some of the confronting issues, such as the global efforts to address climate change and the realisation that technologies like solar, wind and batteries have widely become a success,…

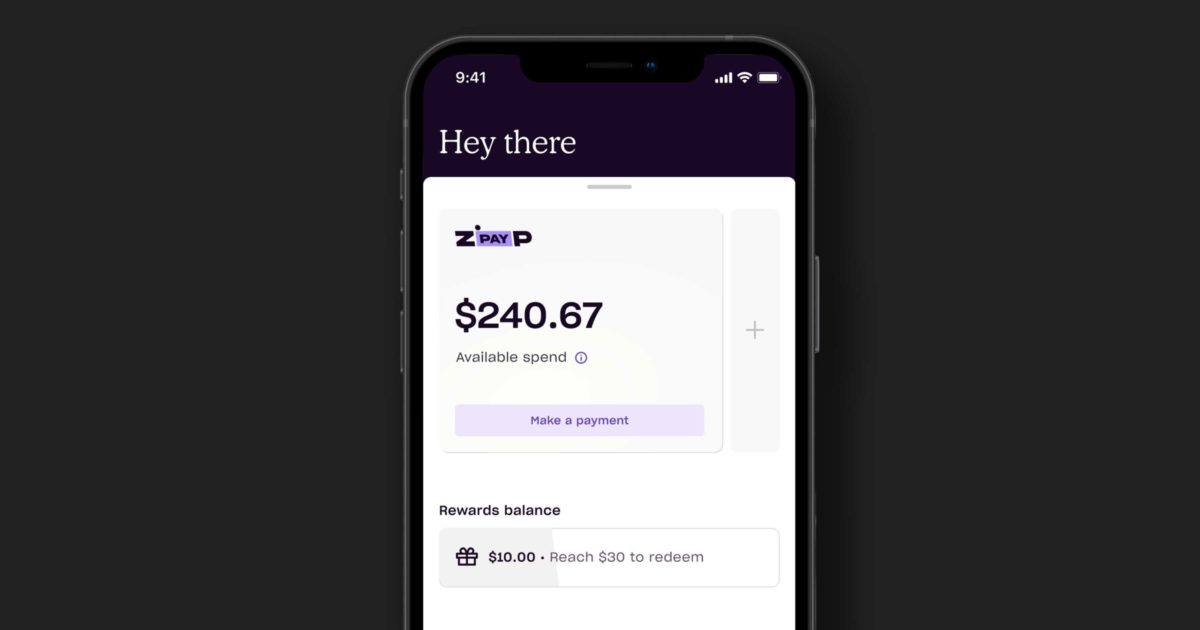

The last 12 months has been a very difficult time for the Zip Co Ltd (ASX: Z1P) share price after falling by 76%. What is the outlook for Zip in 2022? For anyone that doesn’t know, Zip is one of the biggest buy now, pay later businesses in Australia. It operates in a similar way to Afterpay….

The price of Copper, chemical symbol Cu, touched an all-time high in November 2021, reaching a tick over US$10,700 a tonne, and copper is still holding above US$10,000 a tonne. We believe that the long-term pathway for growth in copper will likely see price continue to trend upwards over the next decade. The conviction behind…

Australia’s premier iron ore miner, Fortescue Metals Group (ASX:FMG) has posted its interim result, for the December 2021 half, with an underlying net profit of US$2.78 billion, which was a touch above an expected $2.70 billion. Here are the highlights: Total revenue of US$8.1 billion, down 13% (H1 FY22 US$9.3 billion) Underlying earnings before interest,…

CSL – Shares in Australia’s largest pharma company are up 6 per cent at the time of writing, following a $US1.76 billion ($2.46 billion) interim profit which was down 5 per cent, but in line with expectations given the tough environment brought about by the Covid pandemic. One of the biggest challenges the company faced…

The BHP Group Ltd (ASX: BHP) share price is rising after the ASX 200 (ASX: XJO) resources giant reported a giant half-year dividend in its result. BHP’s strong HY22 result BHP revealed that its profit soared in the first six months of FY22 to 31 December 2021. It said that continuing operations profit from operations rose 50% to US$14.8 billion, with underlying EBITDA rising by…

An army of ASX shares has been updating the market today with their first-half results for FY22. Here are the seven I like the look of and are on my watch list. Keep up to date with the February 2022 reporting season calendar. 1. EML Payments Ltd (ASX: EML) The EML share price has fallen…

The Nasdaq 100 powered to all-time highs last year, driven by the famous “FANG+” stocks. Nasdaq Total Returns While making up just nine of the 100 stocks in the Nasdaq, the ten FANG+ stocks – Facebook (now called Meta Platforms, which ruins the acronym a touch), Amazon, Apple, Nvidia, Netflix, Google (which trades under the…

The proliferation of data and information has done little to improve the outcomes for self-directed investors. With information on almost any issue and a social media system built to reinforce our own beliefs or views in many cases, making sound investment decisions has never been harder. As an experienced financial adviser, I like to think…

In the weird and wonderful world of cryptocurrency, almost every day a new buzz-word is added to our vocabulary to reflect the fast changing scene. For example, NFT, or non-fungible token, was made the Word of the Year by Collins Dictionary in 2021. For those that don’t know, NFTs are certificates that prove you own…

The Commonwealth Bank of Australia (ASX: CBA) share price is under the spotlight today after reporting its FY22 first half result, with a sizeable dividend boost. CBA’s solid HY22 profit growth Commonwealth Bank has reported its result for the six months to 31 December 2021, putting the CBA share price in focus. These are some of the highlights from…

Could the Australian Foundation Investment Co.Ltd. (ASX: AFI) (AFIC) share price be a buy for the long-term? The listed investment company (LIC), which has the job of investing in other shares for shareholders, is one of the oldest LICs. It has been investing since 1928. Why is the AFIC share price worth considering? One of the most effective ways…