Clean power drops in price, value seen in stocks

Until recently the world relied on fossil fuels to provide almost all its energy, but the falling cost of clean energy is encouraging households and businesses to move to renewable energy away from fossil fuels — and the good news is that renewable electricity bills are falling at the same time.

CSIRO and AEMO’s GenCost 2021-22 report recently confirmed that wind and solar are the cheapest source of electricity generation and storage in Australia, and despite short-term price pressures, will likely remain the cheapest source in the years ahead.

Amar Vasdev (pictured), an energy economist at BloombergNEF, says this year’s price rise in renewable energy is a short-term response to inflationary pressures rather than a long-term phenomenon.

“We see a return to long-term technology cost decline trajectories as demand continues to be strong, supply chain pressures ease and production capacity, particularly in China, comes back online,” Vasdev says.

Value seen in clean energy stocks

For investors, clean energy stocks are looking more attractive; an increasing demand for renewable energy has boosted earnings projections and combined with a recent dip in prices, stocks are now trading at attractive valuations.

VanEck senior associate Alice Shen says while some clean energy companies have been hit by higher US interest rates and bond yields this year, they are still performing relatively well overall. “Clean energy stocks have performed well since the beginning of the year showing a strong resurgence,” Shen says.

“The recent recovery of solar and wind energy companies is not only due to the favourable legislative environment,” she continues. “Wind energy stocks have done well recently due to a fall in the European steel prices to €1,500 at 30 June 2022 from €1,850 in March 2022. Steel is a major cost for wind energy production and its price could continue to fall as global growth slows amid fears of recession. Costs have also been reduced on the shipping side.”

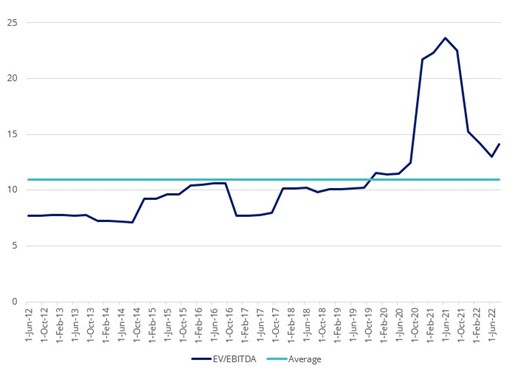

She notes that the valuation measure enterprise value (EV) to earnings before interest, taxes, depreciation, and amortisation (EBIDTA) are trending back to the long-term averages having been at historical highs during 2020 and 2021. EV/EBIDTA has fallen from a high of 22.5 in September 2021 to the current level of 14.1, indicating greater value, is the chart below shows.

Source: FactSet as at 31 July 2022. Clean Energy valuations as measured using a basket of companies with operations related to clean energy production and associated technology and equipment globally.

Will Baylis, portfolio manager for the Martin Currie Sustainable Equity strategy says that companies that can benefit from the long-term transition to renewable energy from fossil fuels include companies that are involved in consulting, engineering, construction and operation of renewable energy infrastructure. “Valuations of companies in this important industry do vary, with contractors trading at much lower multiples compared to the renewable generators and retailers,” he says.

Power is cheap, but more is needed

Separate research from BloombergNEF (BNEF) backs the finding that renewable power is the cheapest source of new bulk power in countries comprising two-thirds of the world population and nine-tenths of electricity generation in 2022.

Despite a temporary cost rise for renewables this year due to rising inflation, stemming from energy shortages, supply difficulties and the war in the Ukraine, the gap to fossil fuel power prices has widened due to fuel and carbon prices rising even faster.