Energy boosts ASX to 0.2% gain, TPG slumps

Positive finish to volatile week, Novonix tanks, CSL lining up big deal

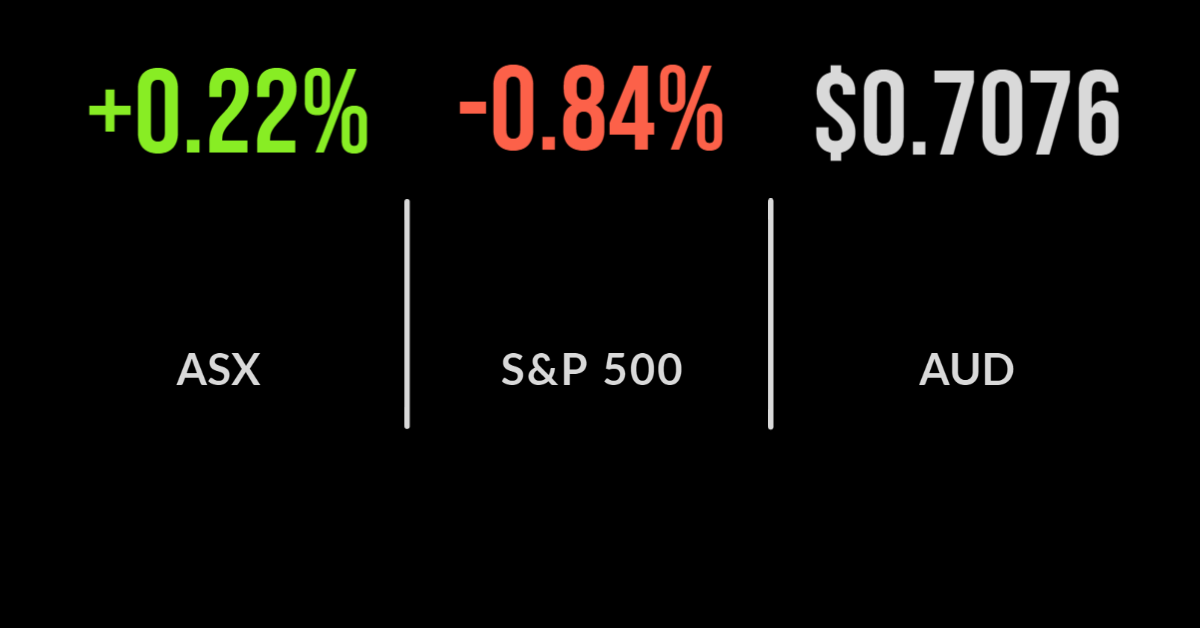

An increasingly volatile week finish on a positive note, with the S&P/ASX200 (ASX: XJO) gaining 0.2 per cent on Monday, trimming the weekly loss to just 0.5 per cent.

The famous Sohn Hearts & Minds Conference attracted all the attention with Berkshire Hathaway founder Charlie Munger delivering some scathing commentary.

On Friday both energy and financials led the way, with the former gaining 1.6 per cent after OPEC+ announced they would not be making any changes to the current production levels; OilSearch gained 3.3 per cent on the news.

Financials also recovered, gaining 1 per cent behind a 1.7 per cent bounce in Commonwealth Bank (ASX: CBA) shares after Moderna (NYSE: MRNA) management once again suggested Omicron may not be as dangerous as anticipated.

On the negative side was the healthcare sector, which fell 1.7 per cent dragged lower by CSL’s (ASX: CSL) 2.5 per cent drop after confirming they were considering a major acquisition in Europe.

Talk of a green bubble saw shares in traders favourite Novonix (ASX: NVX) fall by more than 32 per cent despite the lack of any news from the company.

Involved in battery materials and technology NVX has been a key beneficiary of the green wave of capital.

The story was similar over the week, with materials and financials the only sectors in the positive, gaining 1.3 and 0.6 per cent, with healthcare bearing the brunt of the sell-off.

TPG Telecom (ASX: TPG) fell 7 per cent for the week after founder David Teoh announced the sale of his entire holding.

Markets finish volatile week down, DocuSign tanks, DiDi bows to Chinese pressure

Global markets closed out a volatile week on a negative note, with the technology sector dragging down the broader market finishing 1.9 per cent lower on Friday.

The S&P500 and Dow Jones outperformed once again behind a strong finish by the financials sector losing 0.8 and 0.2 in comparison.

The unemployment rate dropped further in November, falling from 4.6 to 4.2 per cent despite another 594,000 joining the labour force in a sign that the worker shortage may be reversing.

Shares in Docusign (NASDAQ: DOCU) experienced a stunning fall, tanking by over 42 per cent in a single session after recurring revenue and new contract wins fell well short of expectations.

The company has now essentially given back all the gains since the beginning of the pandemic.

Chinese listed shares in the US remained under selling pressure with Alibaba (NYSE: BABA) falling another 8 per cent after DiDi Global (NYSE: DIDI) announced they would bow to Chinese Government pressure and delist from the NY stock exchange.

Across the week it was negative for all three benchmarks, the Dow Jones falling 0.9 per cent, S&P500 down 1.2 and the Nasdaq 2.6 per cent.

Munger: ‘ban cryptos’, leverage what you are good at, Sohn picks and trends

All eyes were on the Sohn Hearts & Minds conference on Friday, with brokers, investors and fund managers around Australia beaming in to see Charlie Munger in person.

The vice-chairman of Berkshire Hathaway didn’t lack commentary and quotable statements despite being 97 years of age.

In a wide-ranging speech that spanned geopolitics, leadership and company analysis he suggested that markets in 2021 were ‘crazier than the dotcom era’ and went as far as saying crypto ‘should never have been invented’.

He urged regulators to ban the currencies and highlighted his preference for making money by investing in companies that ‘sell things to people’.

The conference is renowned for delivering the hottest stock picks of the year with the likes of Megaport (ASX: MPT), Spotify (NASDAQ: SPOT), Bill.com (NYSE: BILL), and power semiconductor producer Onsemi (NASDAQ: ON).

Back to markets and it was a week where Australia’s leaders decided to double down on what they are good at.

Both Woolworths (ASX: WOW) and CSL (ASX: CSL) appear to be seeking major acquisitions that will leverage their already strong competitive advantages in the pursuit of growth, whilst BHP’s board approved the cancellation of the company’s dual listing