Greens use new super tax proposal to put SMSFs in the firing line

What it is with the Australians Greens and self-managed super funds (SMSFs)? It seems any opportunity they have to denigrate this superannuation sector, they grab it with both hands. So, it was no surprise that the Greens’ minority report to the recent Economics Legislation Committee examining the Government’s proposed new tax on earnings in superannuation balances exceeding $3 million was as long on hyperbole as it was short on facts.

That the Greens argued the Government’s proposal would do nothing to change the fact that superannuation was now Australia’s premier tax haven for wealth accumulation and estate planning did not surprise. Nor did their proposal to reduce the cap from $3 million to $2 million.

Quoting the Grattan Institute submission, the Greens’ report stated that there’s no rationale for generous earnings tax breaks on balances between $2 million and $3 million, certainly not one that is consistent with the proposed objective for superannuation to ‘deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way’.

That’s a philosophical and political position the Greens are entitled to hold. What they’re not entitled to do in presenting this argument is to play fast and loose with the facts to impugn the motives as to why people establish SMSFs, arguing that the ‘overwhelming’ reason is to allow fund members to hold investment properties that can be held or transferred within a tax-sheltered superannuation framework.

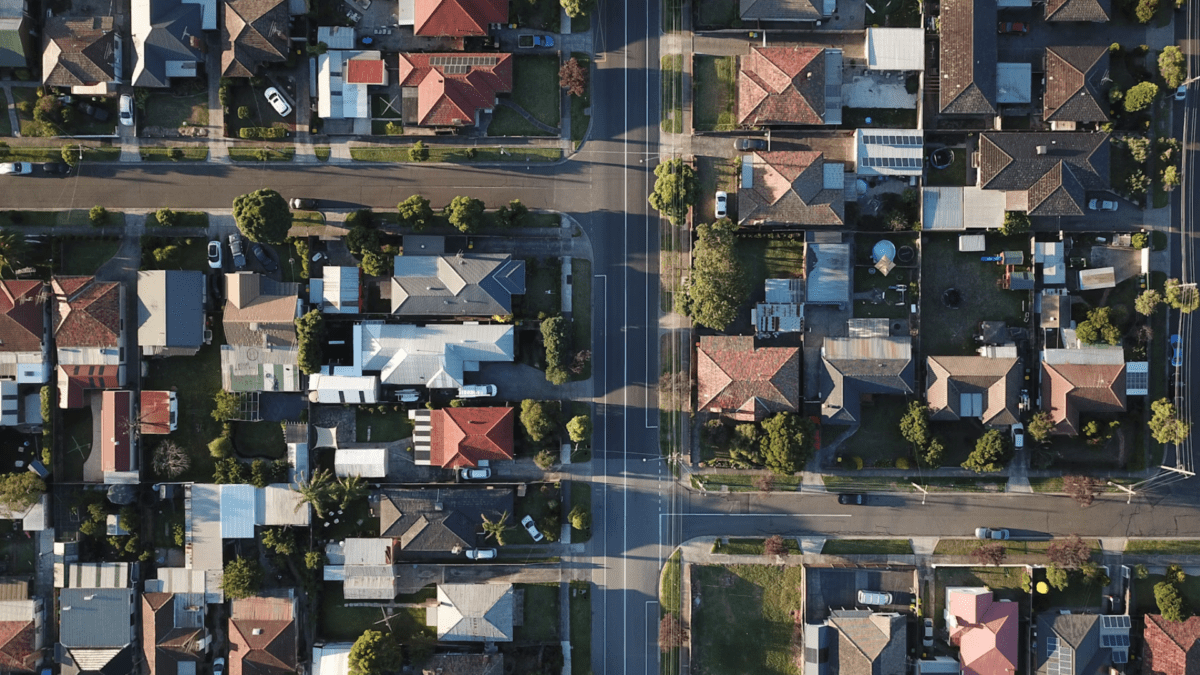

How do they know what motivates the more than 1.1 million SMSF members to establish their own fund? It’s elementary, my dear voter. ATO statistics show that 97 per cent of SMSFs using limited recourse borrowing arrangements (LRBAs) hold real estate, of which 86 per cent hold one property, 9 per cent two properties and three per cent hold three or more. To quote the Greens, “SMSFs are holding illiquid assets that are increasing in value at obscene rates”.

Now, it seems fair to assume from what the Greens are asserting that property must dominate the investment portfolios of the more than 600,000 SMSFs. So, what do the ATO statistics show?

At March 31, 2024, residential property, at $50 billion, comprised 5.6 per cent of total net SMSF assets of $896 billion. Add in commercial property at $92 billion, and that percentage only rises to 15.8 per cent. By contrast, Australians shares stood at $271 billion (30.2 per cent) and cash and term deposits at $145 billion (16.2 per cent).

Based on these numbers, it’s a long bow to say property is the ‘overwhelming’ reason why SMSFs are established. Could it be these individuals want to take personal control of their retirement savings? Could it be they get satisfaction from making investment decisions, with or without specialist advice? In retirement, does managing an SMSF bring personal satisfaction?

Don’t be silly. It’s all about accumulating investment properties – the implicit message is that it’s residential even though about two-thirds of SMSF property assets are commercial – that can be held in a tax-sheltered superannuation fund.

Even the LRBA figure of 97 per cent being used to acquire property requires context. No one argues with the fact the use of LRBAs has risen over the past decade. That said, in recent years they have stabilised or even fallen. Besides, SMSFs with an LRBA only comprise 10 per cent of all funds (of which more than 90 per cent are in the accumulation phase) and these borrowings only represent 3 per cent of total SMSF assets.

Remember, too, nearly half of all LRBA debt goes towards acquiring non-residential real property, giving small businesses and farms, in particular, more financial flexibility, as well as assisting them to better plan for retirement.

The Greens are entitled to play the SMSF card for political advantage. After all, they are courting votes from those renting and trying to acquire their first home. But they should stick to the facts when doing so.