High tax-payers set to gain max benefit from investment bonds: Foresters

Investors paying higher marginal tax rates should pay more attention to the benefits of investment bonds, according to Foresters Financial, with beneficial tax treatment just one of a host of advantages that come with including the product in portfolios.

Investment bonds, otherwise known as insurance bonds, are a tax-paid investment, meaning the earnings are taxed within the fund and don’t necessarily form part of an investor’s personal tax return. For this reason, Foresters chief executive Emma Sakellaris says, the after-tax return on a 10-year bond can outstrip that of a term deposit or managed fund held over the same period.

“Investment bonds have a maximum tax rate of 30 per cent on earnings in the bond paid at a fund level, so investors are able to invest and build wealth without increasing or adding to personal income tax liabilities,” Sakelaris explained in a recent note. “Additionally, if held for 10 years investors can access the funds as a tax-free lump sum or via tax-free regular withdrawals without any capital gains tax or personal income tax implications.”

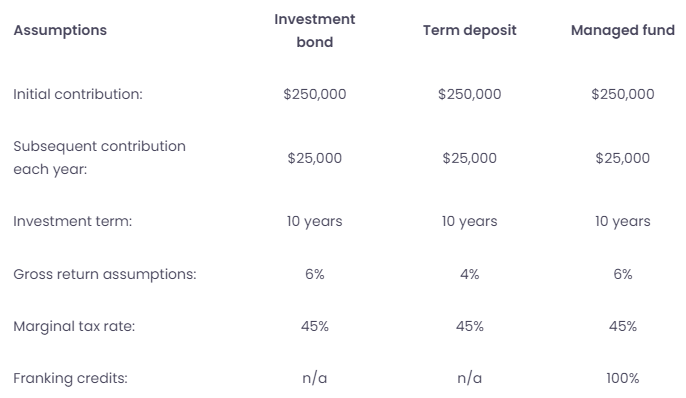

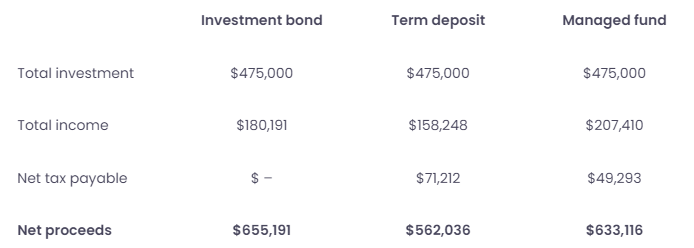

Foresters gave the example of a $250,000 initial investment, with a subsequent annual contribution of $25,000 (worth noting is that the bond holder can only invest up to 125 per cent of the previous year’s contribution). They then compared the returns of a comparable investment under the same terms directed towards a managed fund and a term deposit.

Incorporating reasonable assumptions as per the above chart, the investment bond had a superior after-tax return to the alternatives.

“Investment bonds are particularly useful investment option for high-income earners as the earnings from investment bonds are not declarable on tax returns unless withdrawn prior to the 10-year mark,” Sakellaris said, while acknowledging that pulling the bond earlier would offer a different result. “Of course, it is possible to access an investment bond before the 10-year mark, although some of the tax benefit will be lost.”

Investment bonds can suit a variety of investment needs depending on personal circumstance, she explained, whether it be as an alternative to superannuation, for estate planning or investing on behalf of children.

“For Australians who have reached their superannuation contribution limits and still plan to accumulate wealth, this is a great alternative strategy to consider as it comes with the added tax benefits as shown in our research,” Sakellaris added.