How seniors can unlock housing equity while retaining legal title

With its recent acquisition of Homesafe Solutions, which boasts nearly two decades’ experience in the home equity release market, the private equity manager Federation Asset Management is firmly setting its sights on the more than $2 trillion that retirees have locked up in their housing.

It will give these retirees, sometimes described as asset rich but cashflow poor, the opportunity to unleash up to $1 million of equity in their properties while retaining legal title and not incurring debt at a time in their lives when they no longer receive a weekly pay cheque.

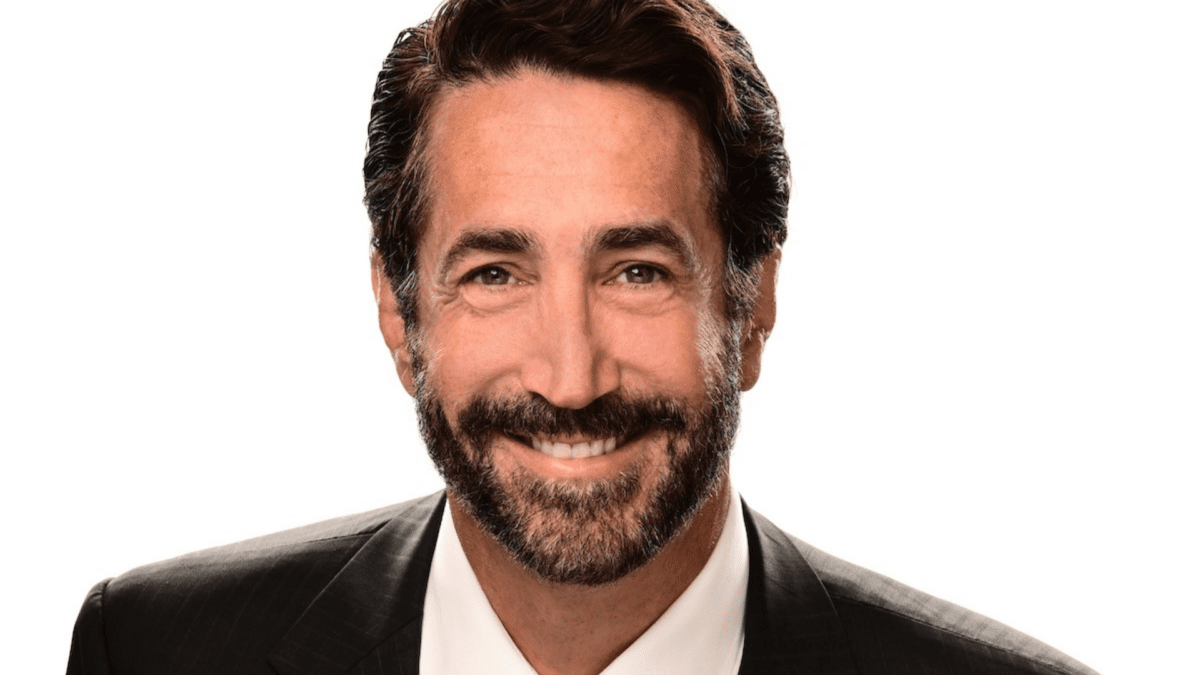

It is those two concepts – debt free and retaining legal title – that best describe this equity release solution. As Federation chief executive officer Cameron Brownjohn succinctly puts it, “the Homesafe solution has no repayments, no compounding interest charges and provides significant protections for the homeowner to remain in their homes, debt free, for the rest of their lives.

“It’s designed to enable senior homeowners to access the wealth tied up in their homes by selling a share of the future sale proceeds and to avoid going into debt.”

By contrast, reverse mortgages, which have had a chequered history since being introduced by Advance Bank (later acquired by St George Bank) in 1986, provide a lump sum or regular income stream to homeowners over 62. But the debt is typically expensive and can put the borrower at risk of foreclosure.

Homesafe’s solution allows the homeowner to sell part of the property today for a debt-free lump sum and still protect a share of the home’s future equity for their own needs or to leave to their estate.

It is only available to Melbourne and Sydney homeowners (there are plans to extend it to other cities) and has an age limit of 60 in the former while at least one homeowner must be 55 in the latter. In addition, the house must be free-standing or, if part of a strata title, the maximum number of dwellings on the title is six.

Other conditions include the property being the principal place of residence, the mortgage is paid off, the land comprises at least 60 per cent of the total market value of the home – valuations are conducted independently – and all permanent residents are either owners or can be added to the title.

In addition, the maximum share that can be sold is 65 per cent of the future sale proceeds, while the lump sums available range from $25,000 to $1 million.

Brownjohn adds that some retiree homeowners suffer financial stress, yet often don’t qualify for additional government assistance. Volatile markets or falling interest rates – the 90-bank bill rate sat at 0.10 per cent from November 2020 to May 2022 – can dent their superannuation balances, as can sudden expenses such as medical.

“Using some of the equity in the home provides a way to meet living expenses or pay out the mortgage to achieve some peace of mind.”

Two other macro-economic trends will favour the Homesafe solution. In November 2020, the Federal Government’s Retirement Income Review Report was handed down and the final report of the Aged Care Taskforce was published in March 2024.

Since then, there have been ongoing discussions about funding aged care – importantly, and unusually, in a bipartisan manner – that will allow the family home, which represents the largest share of net wealth for Australians aged 65 and over, to have a critical role in the future policy settings for the retirement income system.

“As the number of baby boomers reaching retirement continues to grow, the role of equity release will become ever more important. It is crucial that seniors understand the options that are available to them now, and what impact their decisions may have in years to come,” Brownjohn says.

The other trend is the massive wealth transfer underway that the Productivity Commission estimates to reach $3.5 trillion by 2050. Much of this wealth is tied up in residential property. So, it seems likely that a home equity release market solution that comes without debt or loss of title will be one avenue to allow this wealth transfer to occur.