Industrials, property push ASX lower, RBA hikes again, Woolworths guides to higher sales

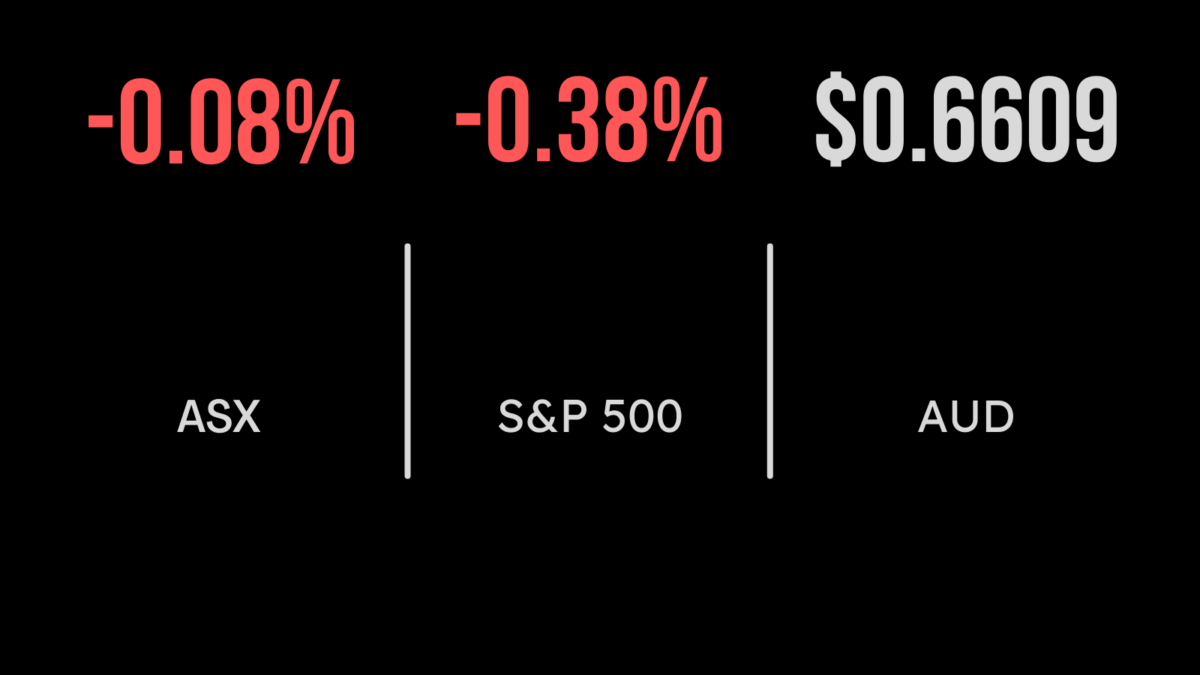

The local market fell sharply on the back of an unexpected 0.25 per cent interest rate increase by the Reserve Bank of Australia. The news took the cash rate to 3.85 per cent, adding more pressure to household balance sheets and came despite most experts suggesting hikes had come to an end. The hardest hit sectors were those sensitive to bond yields, with property sinking 2.1 per cent dragged lower by the likes of Mirvac (ASX:MGR) and Charter Hall (ASX:CHC) which fell 4.2 and 3.6 per cent respectively on concerns higher rates will hit property values further. The highlights were Pinnacle Investment (ASX:PNI) which gained 6.1 per cent and waste collection group Cleanaway (ASX:CWY) which gained 5.8 per cent after announcing labour shortage issues impacting the availability of truck drivers had begun to ease. Shares in Woolworths (ASX:WOW) fell 0.8 per cent despite management reporting an 8 per cent increase in sales to $16.34 billion for the quarter, with greater product availability and more stay-at-home cooking driving the result.

Wesfarmers targets bolt-ons, Endeavour benefits from return to the pub, Liontown enters halt

Shares in Wesfarmers (ASX:WES) underperformed the broader market after the company presented at the closed door Macquarie conference on Tuesday. The CEO highlighted growing potential for bolt-on acquisitions as a key source of long-term growth, referencing the recent bid for SILK Laser Clinics and Beaumont Tiles. Patrons returning to pubs across Australia was central to a strong update from Endeavour Group (ASX:EDV), with management reporting a 3.7 per cent increase in total sales in the third quarter. This was primarily driven by an 18.5 per cent increase in hotel revenue across food and beverages. Despite the strong result, shares fell by more than 3 per cent on the news amid growing concern about cost of living pressures hitting spending. Shares in lithium miner Liontown (ASX:LTR) entered another trading halt on speculation that the company may have received a new takeover bid following global giant Abermarle’s offer several weeks ago.

US markets sink on weakening jobs, debt ceiling, Uber tops expectations

Every US benchmark fell by more than 1 per cent on Tuesday, as signs that the labour market was showing signs of weakening muddied the somewhat rosy outlook. Job openings decreased in March to the lowest point since April 2021, at the same time that concerns about the debt ceiling raised their heads once again. The result was a 1.1 per cent fall in the Dow Jones and Nasdaq and a 1.2 per cent fall in the S&P500. With Apple (NYSE:AAPL) still yet to report, all eyes were on the likes of Uber (NYSE:UBER) and Pfizer (NYSE:PFI) with the former jumping 10 per cent on an upgrade.

Uber is standing out as the ride share winner after reporting another 18 per cent in booking value and a near 20 per cent increase in revenue for the quarter. Importantly, the group continues to attract the majority of drivers to its stable. Shares in Pfizer fell as the boom in vaccine sales cycles out, with management reporting a 24 per cent fall in earning and 75 per cent fall in COVID-19 vaccine sales. The Fed meets Wednesday and expected to hike rates another 25 basis points.