Investors cool on private property as Blackstone limits redemptions

Blackstone’s decision to enforce redemption limits on its $103 billion real estate fund may be indicative of a wider shift in market sentiment as investors doubt the sustainability of private property returns.

In a letter to clients last Thursday, the alternative investment manager said withdrawal requests for the Blackstone Real Estate Income Trust (BREIT) had exceeded the monthly limit of 2 per cent of net asset value. It also surpassed the 5 per cent quarterly restriction.

The fund, which is exclusive to high-net-worth investors, processed just 43 per cent of redemption requests in November. As one of the largest property funds globally, BREIT is considered a bellwether for the property sector.

Blackstone is not alone, with Starwood Capital Group’s $22 billion real estate trust also limiting investor withdrawals this week.

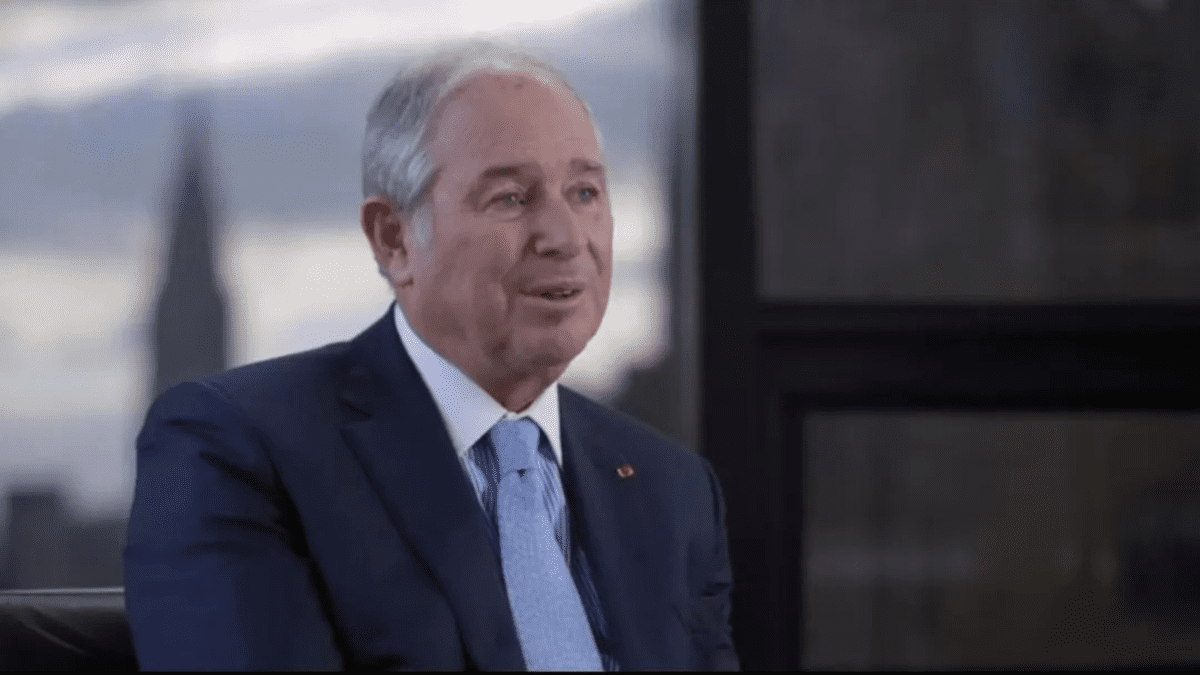

On Wednesday, Blackstone chief executive Stephen Schwarzman (pictured) attempted to reassure investors at the Goldman Sachs US Financial Services Conference in New York. He said the redemption requests were not reflective of the overall fund, but rather were coming from Asia-based clients who recently incurred margin calls.

“The idea that there is something going wrong with this product because people are redeeming is conflating completely incorrect assumptions,” Schwarzman said.

Valuations look stretched

However, investors have questioned how the fund has managed to maintain its strong performance when real estate more broadly has derated.

BREIT has delivered a positive return of 9 per cent year-to-date, compared with a 23 per cent fall in publicly traded real estate investment trusts (REITs).

Asset manager Janus Henderson said private valuations are mainly based on third-party appraisals, which rely heavily on comparable transactions for similar buildings and areas.

Since new commercial real estate transactions take at least six months to close, there is a lag between private valuations and valuations of publicly listed peers.

“When market conditions change rapidly… there tends to be a wide gap between buyer and seller price expectations, which often leads to lower transaction volumes and fewer recent comps,” Janus Henderson said. “We believe private real estate valuation methodology is designed to move slowly and smooth reported returns rather than to express the most current ‘on the ground’ values.”

The rapid increase in interest rates around the globe has led to higher property yields and placed downward pressure on prices. Blackrock, an unrelated fund manager, said it is underweight private markets in 2023, in part due to the bifurcation from public valuations.

It also said private assets won’t be immune to higher interest rates and market volatility, although it retained a broader view that investors seek greater private market exposure.

“In private markets, valuations have not caught up with the public market selloff, reducing their relative appeal,” Blackrock said. “Private allocations are long-term commitments, however, and we see opportunities as assets reprice over time.”

Liquidity lesson

Launched in 2017, BREIT rapidly bought up residential and industrial real estate assets in the United States and marketed them to wealthy private investors and family offices with semi-regular liquidity.

Typically funds with commercial real estate assets − which are inherently difficult to buy and sell − attract mandates from institutional investors on multi-year capital commitments. BREIT was a concerted effort by Blackstone to push into private wealth, where the margins are more attractive.

BREIT is unlisted, so there is no easy way for clients to buy and sells trust units. Because Blackstone doesn’t want to be a forced seller to fund redemptions, it implemented the restrictions to limit outflows.

Conversely, units in listed REITs are bought and sold on an exchange with no effect on the underlying assets under management.

The rush of redemptions is a pertinent reminder for investors of the liquidity constraints in private real estate. It’s integral that investors adopt a long-term investment horizon when investing in this asset class, rather than focus on short-term market gyrations.

“This was not meant to be a mutual fund with daily liquidity,” Schwarzman said.