Is a commodity super cycle possible in a greening economy?

Leading investment bank JP Morgan this month released an article titled ‘Are commodities still a good inflation hedge amid decarbonization’. The piece, penned by Kerry Craig, Ian Hui and Gareth Lam, offers a detailed analysis of what may be one of the most popular ‘reflation’ trades occurring at the present time.

One would struggle to meet a fund manager in Australia at the present time who isn’t talking about the potential for another commodity ‘supercycle’ or the huge opportunity in the ‘cyclical’ commodity sector as the global economy recovers from its pandemic-induced slumber.

According to JP Morgan, ‘inflation is front of mind given the history of being an inflation hedge and the economic recovery’ and so it should be given the close correlation of the Bloomberg Commodities Index with the US CPI results. Oil, industrials metals and precious metals have traditionally delivered the best returns during periods of low and rising inflation.

But the ‘transition to a carbon neutral world will inevitably impact commodities and their role as an inflation hedge’, at least in the long-term. The team at JP Morgan reviewed the short, medium and long-term supply and demand outlook for each commodity, beginning with oil.

Commenting on the energy, but specifically oil, sector that note that it has ‘historically moved very closely with inflation’ partially because of its important weighting in the CPI Index itself. However, ‘this relationship will be challenged in the future as energy demand changes from fossil fuels to renewable sources’. They note that whilst the clean energy trend has gained ‘significant momentum’ it hasn’t been matched with a displacement of fossil fuels just yet.

They note that due to the slow transition particularly in heavy industry which consumes 29% of total energy, demand is going nowhere. Similarly on the consumer demand side, the take up of EVs and reduction of fossil fuel use will be a ‘long process’. As a result, oil and energy performance is expected to continue to be determined by traditional fossil fuel demand and supply balances for the time being.

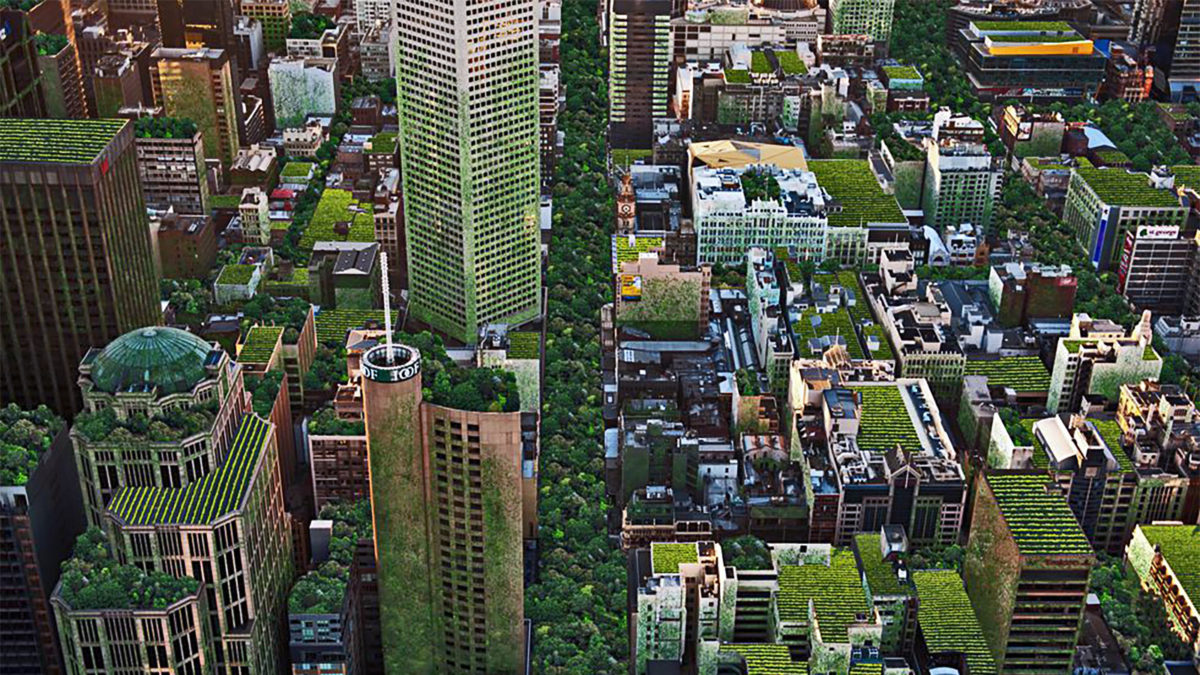

Moving onto industrial metals such as copper, aluminium and lithium, they highlight the massive impact of climate change policies amid a focus on green infrastructure spending. This has immediately boosted demand as renewable energy sources are very metal-intensive, they suggest.

‘The expectations of the increased demand from these initiatives has boosted the price of industrial metals since 2020’, however, they note that ‘the demand created by these policies may not displace the traditional fundamentals, such as global industrial production, U.S. dollar strength and inflation for many years’. Therefore, despite strong momentum, industrial metals are likely to ‘remain driven by traditional fundamentals’.

A simple answer to the question posed is that decarbonisation will likely have little impact on the performance of oil and industrial metals in the short to medium term. However, ‘over the longer term, if the current trajectory of decarbonization continues, the approach of using commodities as a hedge will become more nuanced’.