Is this the best dividend pick for 2022?

ASX dividend share investors can take comfort in the fact that falling share prices are leading to better opportunities.

When share prices fall, not only does that make a business cheaper, but it also has the bonus effect of boosting the yield for income-focused investors.

With some of the best ASX dividend shares seeing dropping prices, the yields are looking even more useful.

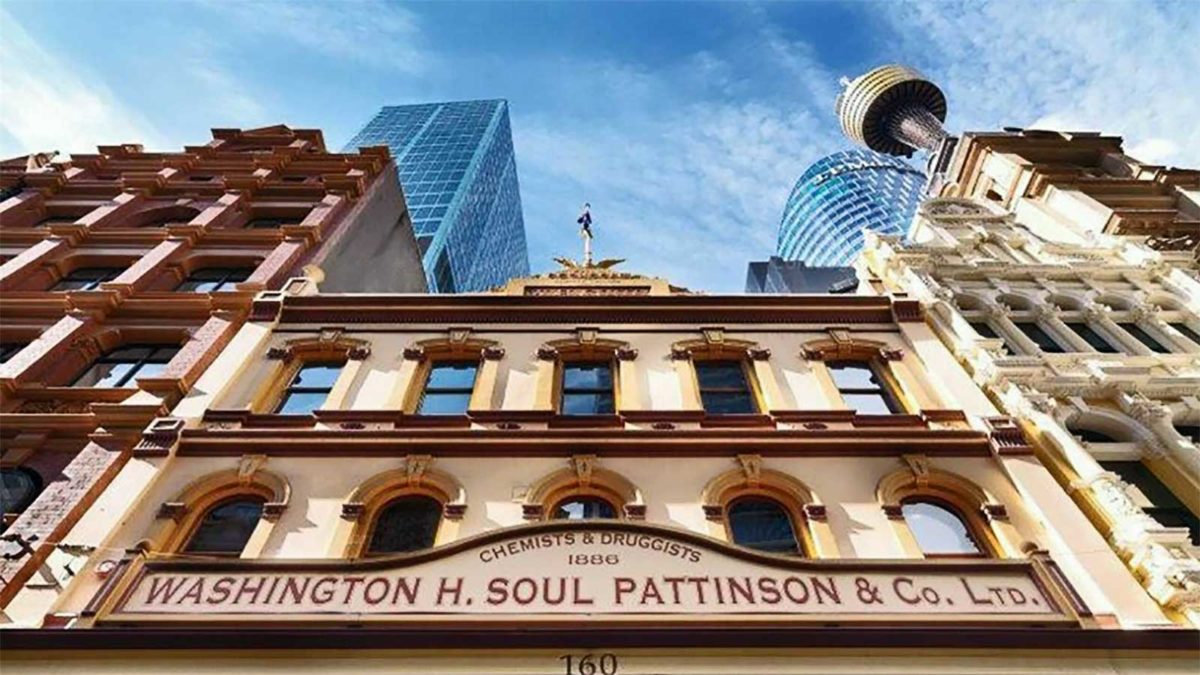

Washington H. Soul Pattinson and Co. Ltd (ASX: SOL)

WHSP is arguably the greatest ASX dividend share around. I say that because of the investment house’s history, setup and diversification.

Did you know this business is over 100 years old? It listed in 1903, making it one of the oldest on the ASX. But it has paid a dividend every year since then. That’s some record for reliability.

It has also grown its dividend every year since 2000. That’s the longest run of consecutive dividend increases on the ASX. WHSP offers investors a high chance of dividend growth every year.

Portfolio funds dividend increases

WHSP’s investment portfolio is full of defensive businesses with solid growth potential but are pretty different from each other.

Some of the investments includes: TPG Telecom Ltd (ASX: TPG), Brickworks Limited (ASX: BKW), Pengana Capital Ltd (ASX: PCG), agriculture, resources, swimming schools and so on.

Those investments send dividends to WHSP each year, with most of those investments keeping and re-investing some of their profit for more growth. WHSP then pays out a lot of its investment cashflow (after paying for expenses) as a dividend, but also keeps some of that to re-invest. So there’s two layers of growth there for the ASX dividend share. In FY21, WHSP paid out 82.3% of its regular operating cashflows.

Diversification

The WHSP portfolio is strongly diversified. I think the diversification is going to grow further once it starts putting the Milton capital to work into new opportunities like health and ageing, the energy transition, financial services, education and agriculture. It’s building around platforms for growth.

Interestingly, global equities could start to appear in the portfolio as well as more private equity and emerging companies opportunities.

Whilst wide diversification isn’t necessary for good returns (or may even impede outperformance), the WHSP portfolio is more likely to be able to deliver consistently with a wider range of great assets.

WHSP dividend yield

Looking at the last 12 months of dividends, WHSP’s dividend yield is 3.1% including the franking credits. In 2022, I think the yield could be 3.2%.

The recent WHSP share price decline to make the yield above 3% makes it more attractive to me as an ASX dividend share. I’d be happy to buy a small parcel of shares today and build the position if there’s further weakness.

Information warning: The information in this article was published by The Rask Group Pty Ltd (ABN: 36 622 810 995) is limited to factual information or (at most) general financial advice only. That means, the information and advice does not take into account your objectives, financial situation or needs. It is not specific to you, your needs, goals or objectives. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire a financial product. Please read our Terms and Conditions and Financial Services Guide before using this website. The Rask Group Pty Ltd is a Corporate Authorised Representative (#1280930) of AFSL #383169