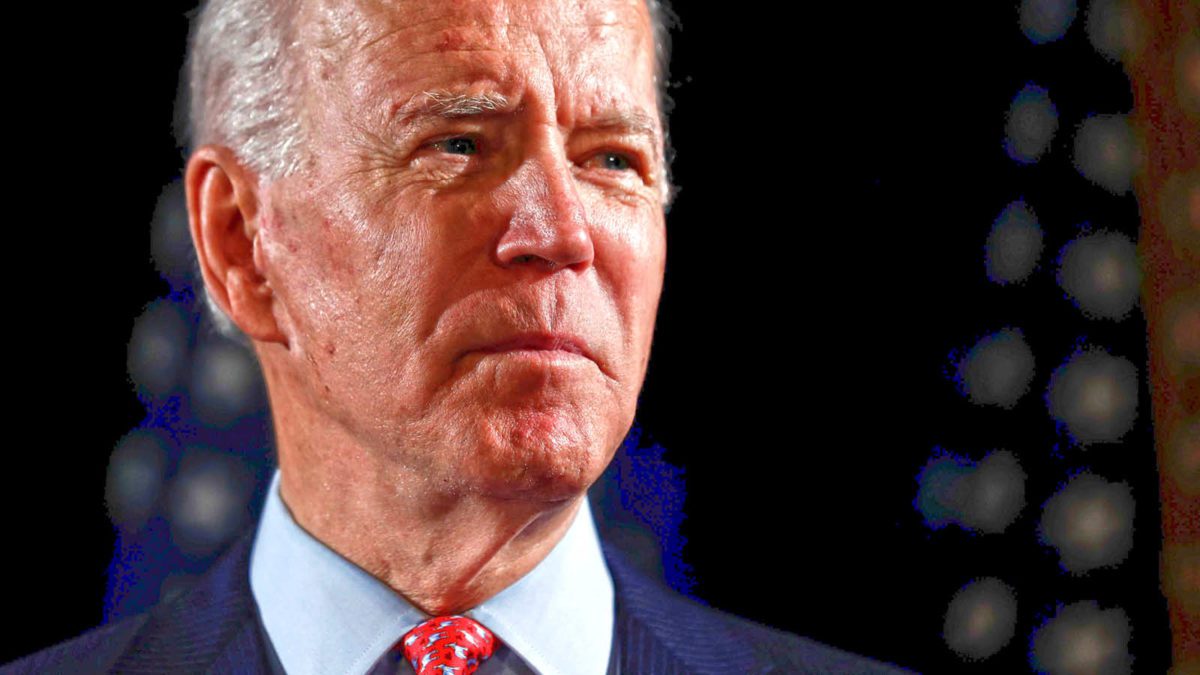

Local investors get ready for a Biden victory

A recent discussion on the likely local impact of the US election between three leading investment experts from ETF Securities (Kanish Chugh, Head of Distribution), Pitcher Partners (David Lane, Director and Senior Adviser) and Evans and Partners (Timothy Rocks, CIO) concluded with consensus advice for Australian investors to maintain their long-term strategy, have an allocation for defensive assets such as cash and gold, and look for buying opportunities in any drawdowns brought on by any post-election induced volatility.

US-based healthcare stocks and companies based in Asia, where the virus has been better handled than in the west, are opportunities on the radar for most of these investors.

The consensus expectation was for a Biden victory, which may have a short-term downward effect on markets but with the COVID situation, and its management, including progress on vaccines, will likely have a bigger impact on general market direction than the actual election outcome, these experts note.

Also, increased stimulus spending resulting from a Democrat in the White House and a ‘blue wave’ delivering both Houses to the Biden forces, and countering the impacts of likely higher corporate taxes under a Biden administration, was flagged as a possibility.

“When you historically look at markets reacting to US elections, in most periods you actually find that the volatility of markets increases for the three months prior to the election. That hasn’t actually been the case this year. We had so much volatility earlier in the year that last few months have been relatively modest in terms of volatility,” noted David Lane director and senior adviser at Pitcher Partners.

“Now is the time to be defensive in our portfolios. We feel uncertain about the three to five-year story for markets than we’ve ever been. Now is the time for investors to maintain healthy levels of defensive assets, including cash and gold,” says Evans and Partners’ Rocks.

From a tactical perspective, both advisory firms see healthcare as potentially benefiting from a Democrat victory.

“Healthcare is that one sector that will probably have the biggest impact. It is a sector that strangely enough has probably underperformed over the last six months in spite of everything that’s been going on around the world, and the general increase in government spending towards healthcare. We still see overall the sector as being good value, but there’s the potential of a short-term impact,” says Lane.

Lane also noted that, “one of the geographies that we’re looking at from an investment perspective is Asia on the basis that the Asian economies have come out of COVID quite well, compared to the rest of the world. And potentially, if we do have a Biden victory, they may well be, or he may well be, more amenable to negotiating a trade with China and the rest of Asia. So, we could see a bit of a positive skew towards Asia into the future.”

Focusing on the defensive theme of the discussion,Chugh noted that for Australian investors, one of the simplest, if not the simplest pure-play gold avenues for Australian investors is ETF Securities’ Physical Gold ETF (ASX code: GOLD).

“GOLD offers low-cost access to physical gold via the stock exchange and avoids the need for investors to personally store their own bullion,” he says.