Lots of Lithium; not enough mines

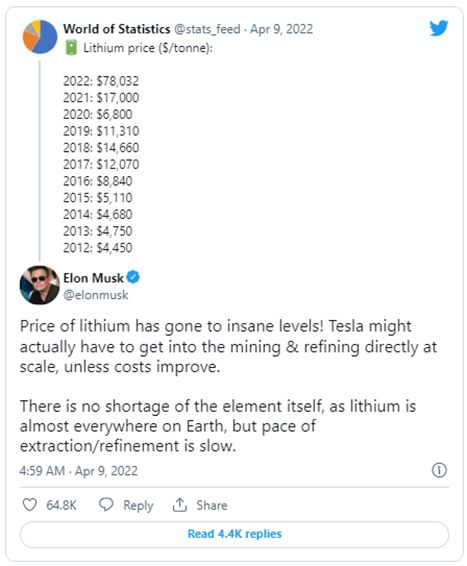

Elon Musk Tweeted this morning that his company, Tesla, may have to start mining due to the skyrocketing lithium prices it is paying in order to produce lithium batteries. Electric vehicle (EV) giant Tesla may look to mine its own supply after the lithium price rose from US$17,000 per tonne in 2021 to more than US$78,000/t this year. Musk sees these levels as insane: he says “Tesla might actually have to get into the mining and refining directly at scale unless costs improve.”

So why is lithium going nuts?

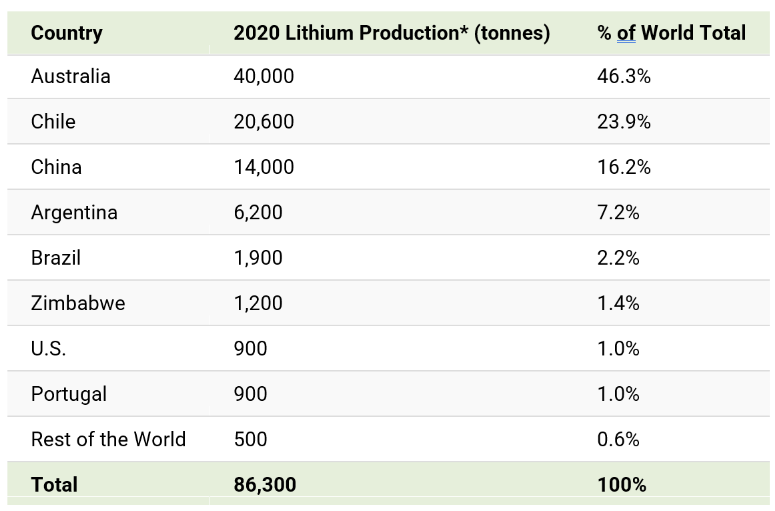

With the world on a path to decarbonisation, major car manufacturers say they will phase out petrol engine cars by 2030-2040, in favour of EVs. The adoption has fueled a global boom in lithium production with lithium production rising from 40,000 tonnes to 86,300 tonnes.

Firstly lithium, along with rare earths and a few other critical minerals, are the essential building blocks of the EV battery and renewable energy market. Lithium is the lightest and the least dense solid element. It is used as the anode in lithium batteries. During a discharge cycle, lithium ions move from the anode to the cathode, where they recombine with their electrons and electrically neutralize.

The largest lithium-producing countries (Australia, Chile, and China) make up 86% of total lithium supply.

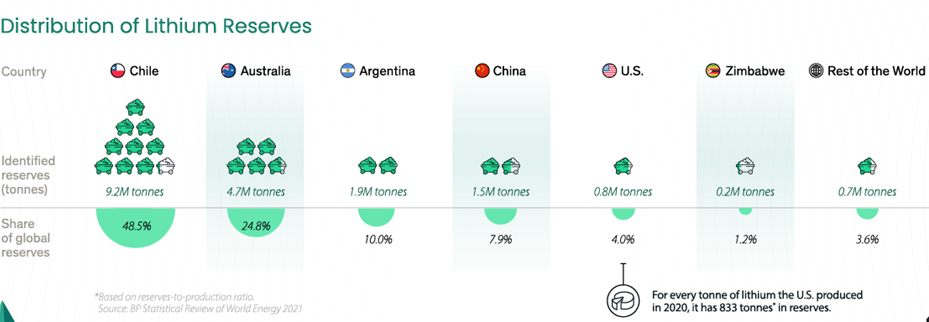

According to the US Geological Survey (USGS), there are approximately 86 million tonnes of identified reserves globally. With 9.2 million tonnes, Chile has the world’s largest known lithium reserves ahead of Australia (4.7 million tonnes), Argentina (1.9 million tonnes) and China (1.5 million tonnes). The total global reserves are estimated at 14 million tonnes.

Looking at the above table, there doesn’t seem to be a shortage of the mineral itself on a world-wide basis. As Musk Tweeted, “There is no shortage of the element itself, as lithium is almost everywhere on earth, but the pace of extraction/refinement is slow.” So, in other words, there’s lots of lithium, just not enough mines. According to analysts, to consume even 1% of the world’s in-ground lithium reserves over the next decade would be quite a feat. Nonetheless, new supplies need to be mined to feed the growing number of gigafactories worldwide.

Russian-owned Rosatom was aiming to achieve domestic lithium production equivalent to 3.5% of the world’s output by 2025. The discovery of reserves of more than 500,000 tonnes of lithium in Ukraine is thought to have reinforced Vladimir Putin’s interests in the country. Prior to the invasion, it was the Chinese and Australians lining up to explore for lithium. If found to be true, Ukraine’s lithium reserves would be one of the largest in the world.