Managed fund fees continue to fall

Despite their popularity in the institutional world, managed funds remain one of the most misunderstood investments by DIY investors. Thus far fund managers have done little to improve the education of end investors to the benefits of their ‘unit trust’ structure. The underlying premise of a managed fund is simple, to pool the capital of many investors and gain access to a broader or more difficult to access asset class ‘together’.

Yet the trust structure, as opposed to that of a ‘listed investment company’ seems to confuse most prospective investors who tend to pool all ‘managed funds’ into the same bucket regardless of where they invest.

To put it simply, managed funds are unit trusts, that issue units representing your ownership of the funds underlying investments. As a trust, a managed fund must distribute all income and capital gains to you each year, to be taxed in your own name. This is the opposite of listed investment companies who pay company tax on their earnings and then decide the size of their dividend each year. Such is the nature of managed funds, that a good manager, trading regularly, may not see their unit price increase, as the majority of their returns are paid out in distributions once or twice per year.

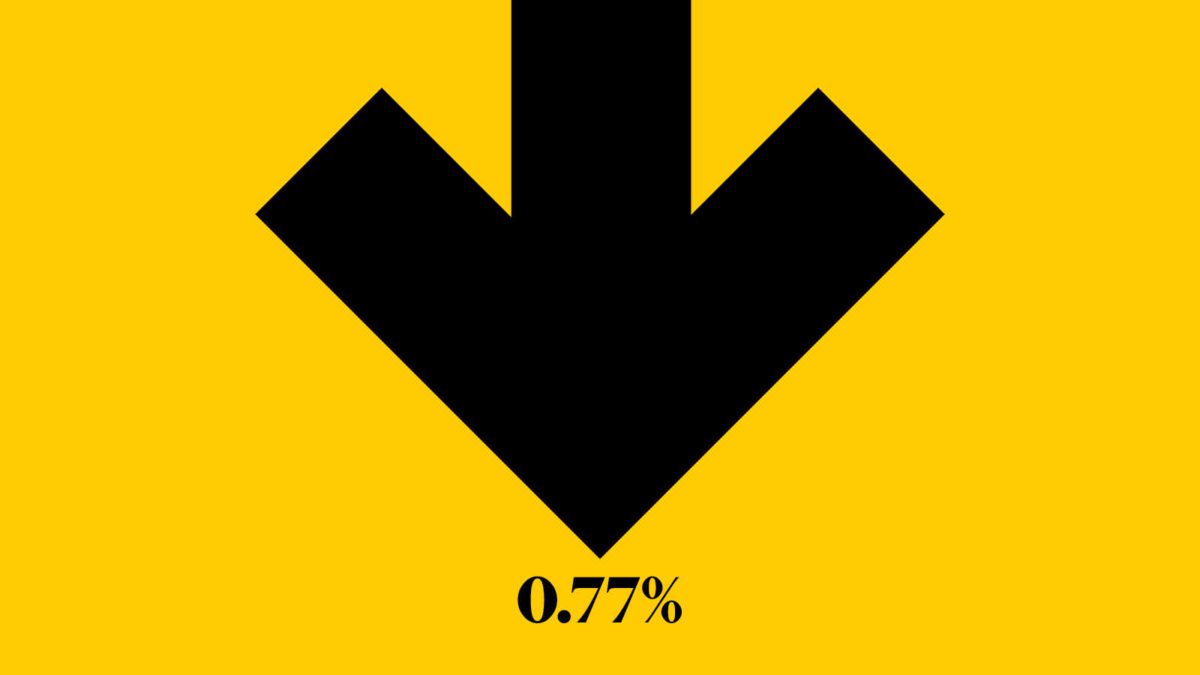

One of the other reasons that many investors avoid managed funds is due to the perceived higher fees. This trend may be changing, with a recent paper by Rainmaker Data reported that fees charged on wholesale managed funds had fallen another 6% in 2020 to just 0.77% of the $588 billion in funds under management. In their latest Wholesale Advantage Report, which analyses 1,000 Australian domiciled managed funds, they showed that managed funds have followed superannuation fees lower amid the pandemic.

According to the report, there is ‘no relationship between minimum investment amounts and fees charged’ meaning the wealthy aren’t getting better deals than others. According to the report, the median or middle fee charged by international equity funds was 1.0%, the most expensive behind only alternative assets like private equity. The higher fee is somewhat warranted by the strong performance, 9.5% per annum over three years, and higher cost of accessing global markets.

Australian equity strategies, in my view, standout as being the least value for money, charging 0.9%, just behind international equities, despite having a significantly smaller universe of investments to choose from and lower administration costs. So when choosing funds in this sector of the market, investors should ensure they are getting value for money or true active management to warrant higher average fees.

According to Rainmaker “one-in-five managed funds were found to charge performance fees, averaging 16 per cent of the excess return above an agreed benchmark. That is, if the managed fund outperforms by an acceptable margin, the investment manager will charge a share of the excess return”. This is an important measure of ‘alignment’ with the manager required to outperform significantly in order to be rewarded and also usually subject to a high watermark requirement.

Further, they suggest “investors, together with their financial advisers, should always check they are getting the best fee deal they can”. The inclusion of financial advisers here is key, as individual investors have little hope of obtaining the type of discounts afforded to institutions or financial advisers alone. This stands out as one of the many benefits of using a financial adviser, which is the ability to negotiate discounts with both leading and up and coming fund managers, ultimately reducing the cost to their clients and improving the diversification of their portfolios.