Market gains on huge day of reporting, CSL returns to profit, Santos delivers records

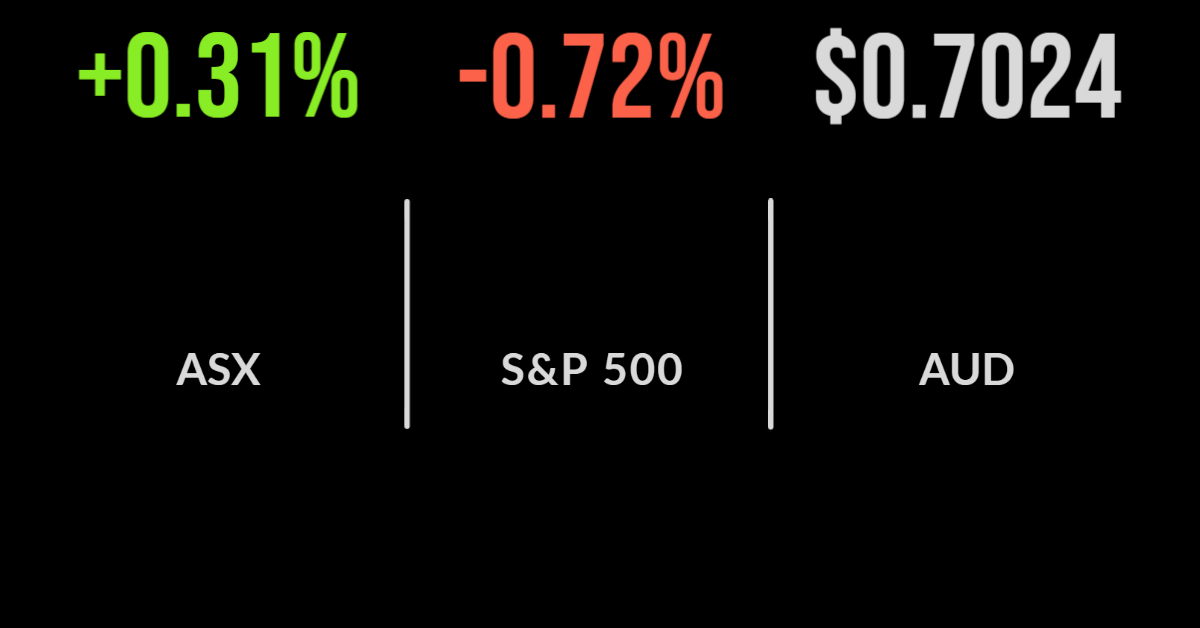

The local market overcame a brisk selloff in giant healthcare group CSL (ASX: CSL) to post another 0.3 per cent gain.

The consumer sectors were the key drivers, with staples and discretionary finishing 1.7 and 1.4 per cent higher respectively following Walmart’s strong report overnight.

The property sector also benefitted from a strong report by Vicinity Centres (ASX: VCX) while healthcare and energy fell.

All eyes were on CSL with shares ultimately dropping 3.4 per cent despite management confirming the company was set for a ‘return to growth’.

Net profit fell 6 per cent for the financial year as plasma collections suffered amid border closures, however, this is set to reverse in FY23.

Both plasma collections and costs are expected to remain high with each of the companies underlying treatments performing well; the dividend was increased by 6 per cent.

Pipelines of pre-committed work are set to buoy the building sector for at least the next 12 months with Fletcher Building (ASX: FBU) reporting a 42 per cent increase in profit to $390 million on the back of 5 per cent revenue growth.

Price increases have seen margins expand, with management increasing the dividend by 33 per cent and predicting another strong year for the materials company; shares gained 3.3 per cent.

The capitulation of once popular momentum stock Redbubble (ASX: RBL) continued with the company falling 36 per cent after reverting to a loss following a rare year of profit.

Santos delivers record, Redbubble capitulates again, Brambles overcomes inflation

Santos (ASX: STO) shares fell 2.1 per cent after the company reported record free cash flow for the first half of the year, hitting US$1.7 billion, with profit up three times to US$1.3 billion.

Half of this will be returned to shareholders in the form of a 38 per cent increase in the interim dividend, with the on-market buyback also set to increase by US$100 million.

Management announced their intention to proceed with a new Alaskan project, while also shortlisting buyers for a 5 per cent stake in the PNG LNG project. The news comes as oil hit the lowest point in 6 months.

Brambles (ASX: BXB) gained 4.3 per cent after overcoming “significant inflation” in lumber and other inputs to their pallets, reporting a 7 per cent increase in profit for the financial year.

The company flexed its pricing power muscle, increasing the cost of their pallets to support a 9 per cent increase in revenue.

Shares in Magellan (ASX: MFG) fell by more than 8 per cent, reversing recent gains after the company reported a 23 per cent fall in revenue to $553 million.

With assets under management have fallen by close to 50 per cent, the revenue result was a positive surprise, as was the dividend of 68.9 cents per share.

The group remains highly profitable and able to pursue a multitude of opportunities. Chadstone owner Vicinity (ASX: VCX) reported a 500 per cent swing in profit, from a loss of $258 million to a profit of $1.2 billion for the year, as funds from operations grew by more than 7.1 per cent amid a broad-based recovery in the retail sector.

Global markets slide on Fed minutes, Target disappoints again, Lowe’s rallies

The release of the July minutes from the Federal Reserve meeting appeared to hit sentiment on Wednesday, with all three benchmarks trading lower.

The Nasdaq fell hardest, down 1.2 per cent, with the Dow down 0.5 and the S&P500 0.7 per cent. Minutes from the Fed meeting following July’s 75 basis point rate hike showed a renewed willingness to be seen as combatting inflation by the Fed in an effort to ensure inflation expectations don’t get out of control.

Shares in Target (NYSE: TGT) fell by more than 2 per cent as the company continued to cut prices in an effort to clear excess inventory created by over-ordering post the pandemic.

Profit fell by close to 90 per cent for the quarter as the profit margin fell from 30 to 21 per cent, with revenue up just 3.5 per cent.

Home improvement retailer Lowe’s (NYSE: LOW) gained after reporting another profit that beat expectations, with profit flat on the prior year and slightly positive same-store sales growth despite strong comparables. Importantly, the profit margin was maintained at 33 per cent.