Market reverses gains, commodities, energy sink, Brambles cut CostCo deal

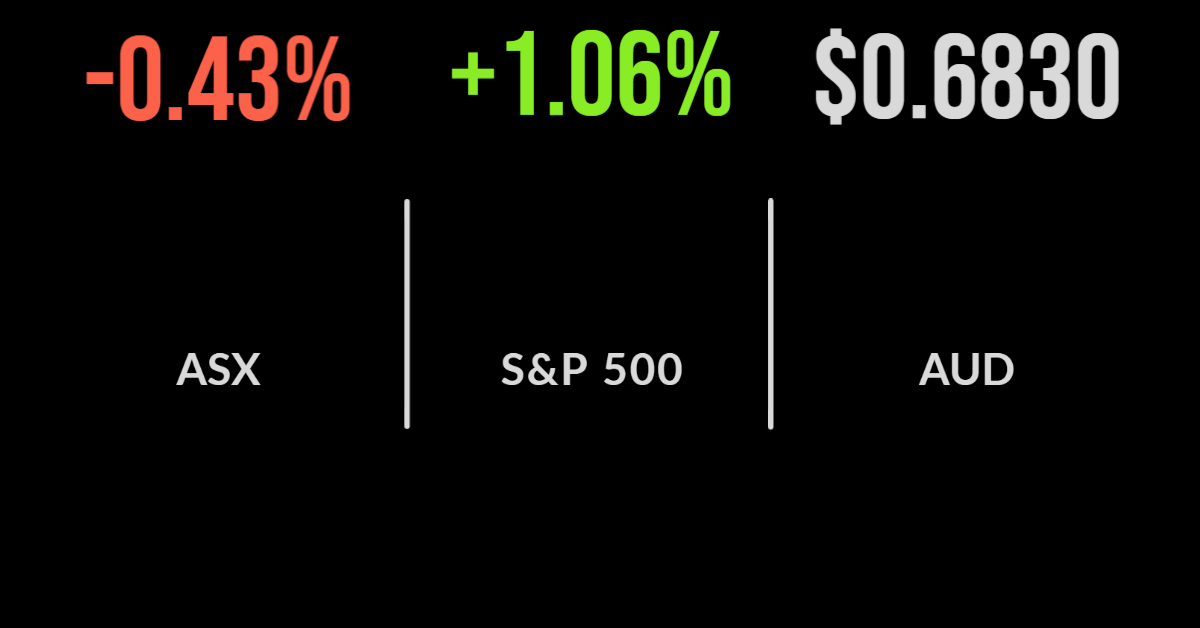

The Australian market started the session on a positive note, moving as much as 1 per cent higher on the first day of the new financial year but ultimately sank to a 0.4 per cent loss.

The realisation that an interest rate-driven slowdown in the global economy may hit commodity demand saw both energy and materials finish lower, falling 3.4 and 2.0 per cent.

The biggest detractors were Woodside (ASX: WDS) and BHP (ASX: BHP). Industrials and utilities were the highlights gaining 1.2 per cent each, with Qube (ASX: QUB) gaining 3.7 per cent on hopes of a bumper profit as grain and other commodity exports through their ports surged in the final quarter.

Shares in Brambles (ASX: BXB) gained 3.2 per cent despite management announcing they had ceased the development of a pool of plastic pallets for US giant CostCo (NYSE: COST) due to the elevated costs of doing so; they reiterated the relationship with CostCo remains strong regardless.

Shipbuilder Austal (ASX: AST) gained more than 26 per cent after announcing a $4 billion deal to assist in building US Coast Guard ships.

Over the week the S&P/ASX200 finished 0.6 per cent lower, led by Link (ASX: LNK) which fell 29.6 and Northern Star (ASX: NST) -14.8.

On the positive side was car seller AP Eagers (ASX: APE) gaining 18.2 and Collins Foods (ASX: CKF) up 14.4 per cent.

US markets gain on bad news, manufacturing contracts, GM flags semiconductor challenges

Global markets were able to post a positive start to the new financial year, despite it having less importance in the rest of the world.

All three benchmarks finished higher led by the S&P500 which gained 1.1 per cent, the Dow Jones added 1 per cent the Nasdaq 0.9.

Among the drivers were more signs of a slowdown in the economy along with easing of the supply chain issues that have driven inflation in recent months.

Manufacturing activity fell to a two-year low, however, inventories continue to increase, and shortages appear to be easing across multiple sectors.

Commodities underperformed once again as the copper price fell to a 17-month low while crypto markets remain under stress with Voyager Digital suspending withdrawals and trading due to ‘difficult market conditions’.

General Motors (NYSE: GM) shares gained more than 1 per cent despite the warning of a fall in earnings for the quarter due to the timing of semiconductor shipments and other supply chain disruptions.

Semiconductor company Micron (NYSE: MU) fell 3 per cent after the group beat earnings expectations but flagged falling demand for smartphone chips.

It was another negative week with the Nasdaq leading the way, falling 4.1 per cent, the S&P500 2.2 and the Dow Jones 1.3 per cent.

Currency to the rescue, winners and losers, causation or correlation

Once again it appears Australia’s floating exchange rate will save the day for investment returns, with unhedged overseas investments gaining on the back of a further weakening of the Australian dollar.

The risk-on nature of the AUD and direct link to commodity prices has seen it fluctuate significantly and offset some of the losses in global equities so far this year, highlighting a key benefit of global diversification.

With the financial year has come to a close there was likely little surprise that Woodside (ASX: WDS) topped the large-cap performance table, gaining 58 per cent for the year after finalising the merger with BHP and seeing the oil price surge after the invasion of Ukraine.

National Australia Bank (ASX: NAB) and Macquarie (ASX: MQG) were next best up more than 12 per cent for the 12 months.

It was the reverse for ANZ (ASX: ANZ) which fell 15 per cent, along with Westpac (ASX: WBC) down 18.1 per cent showing the significant importance of company selection in this environment.

At the smaller end of the market Sezzle (ASX: SZL), Zip (ASX: ZIP) and Marley Spoon (ASX: MMM) were all down more than 90 per cent over the 12 months.

In 2022 the story has been all about ‘value’ investors outperforming growth for the first time in decades.

Yet the S&P performance data shows a key reason for this was actually the energy sector, which was the sole positive returning sector, up 30 per cent, over the last 12 months.