Short-dated, long-term: With closed-end funds, investors get best of both worlds

As diversification reasserts its importance amid rising inflation and interest rates, the benefits of closed-ended structures should have investors looking to listed investment companies (LICs) and listed investment trusts (LITs) for consistent income and inflation protection, a recent industry panel said.

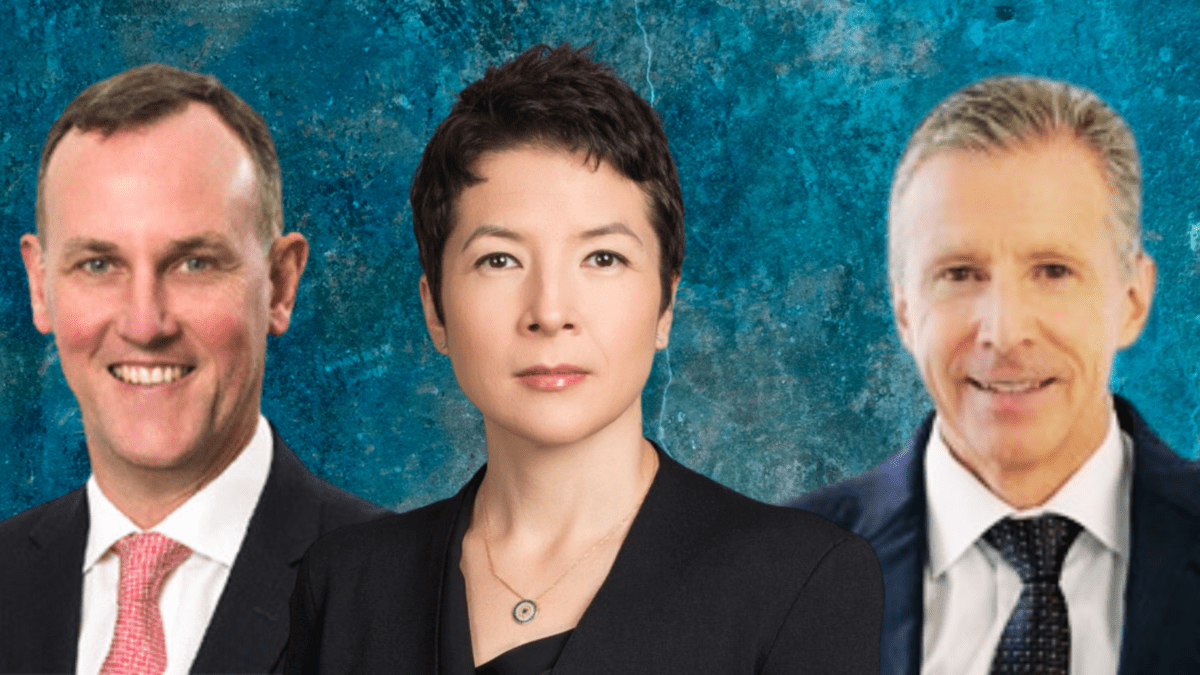

These structures provide diversification from listed equities and an alternative to bonds, giving retail investors short-dated exposure to long-term investment strategies, Wilson Asset Management (WAM) portfolio manager Dania Zinurova (pictured, centre) said at the Australian Shareholders’ Association’s 2023 Investor Conference. “The reality is, it’s the only [way] retail investors can invest in these types of assets,” she said, with core investments in some privately owned companies costing upwards of $10 million.

For example, WAM’s LICs have invested in Gosford Private Hospital, a large real estate investment valued at over $200 million that involves a long-term lease to a high-quality healthcare company and inflation-linked rental payments. Zinurova also cited Advara HeartCare, a privately owned business that is not otherwise accessible to investors in listed equities.

“What I’ve found talking to our predominantly retail shareholders is that liquidity is very important, and they often can’t afford to make those illiquid investments for the long term,” she said. “In a way, the listed investment company structure gives you this access point to a portfolio of illiquid assets.”

She also noted that LICs allow investors fund managers to be consistent and investors to benefit from a long-term approach to strategy and portfolio construction. “As a portfolio manager, you’re not dealing with inflows and outflows of capital depending on where the market is; it’s a nice, almost perpetual pool of capital that you can invest consistently over a long period of time.”

Investment income is especially key to those approaching or at retirement age, making LICs an important part of retirees’ portfolios from a tax perspective because of their ability to deliver fully franked dividends. Through a combination of income-producing and growth investments, LICs enable shareholders to generate predictable income as well as franking from capital gains, Zinurova said.

Benefits of debt investing

Listed investment trusts allow investors to participate in debt financing with strong creditor protections while enjoying similar benefits to LICs, but with income derived directly from the trust’s lending activities, Metrics Credit Partners managing director Lockhart (pictured, left) explained.

As a direct private lender, he said, Metrics covers four kinds of loan activity: lending to large publicly listed companies, financing commercial real estate, acquisition finance, and project and infrastructure funding.

By participating in a listed investment trust, investors share in the returns generated from providing those loans, with the fund’s income comprising company and establishment fees charged to the borrower. Loans are set at a floating rate and at a premium to the official cash rate, with an additional margin for risk and term.

“What that delivers for an investor is a very stable investment, because you’re investing in the debt part of the capital structure,” Lockhart said.

“You invest in debt to benefit from the protections that are afforded a lender, and, particularly under Australian corporate insolvency laws, the rights and powers and protections available to a secured lender make it an attractive asset class in terms of protecting and preserving investors’ capital.”

Franking on offer, or not

Unlike LICs, LITs do not generate franking benefits for investors, as the trust structure requires all net operating income from lending activity to be immediately passed through to investors through a monthly income distribution. But Lockhart believes that is appropriate for LIT investors, who are looking to generate reliable income, rather than capital gains. “What you’ll find with our unit trusts is that the value should be relatively stable, and it has proven to be so.”

Moreover, the LIT structure “gives the investor flexibility to determine when they want to get their money back – they can buy and sell on the stock exchange, gaining liquidity for their investment,” he added. “It’s an attractive way for an investor to gain access to an asset class that is very difficult to access outside institutional investors, in a way that provides liquidity.”

The regulatory changes that have transformed the lending landscape also act as a tailwind for private lending, as banks leave a funding void. “I believe there will be a continued movement away from companies raising debt financing from banks, and they’ll be looking for an alternative source of funding,” Lockhart said. “What we deliver to these companies is a very important source of non-bank capital, for which our investors should be appropriate rewarded.”

One benefit of the listed investment company structure is that the company can choose to retain income in a good year, then pay it out in a poor year, “allowing the LIC to act as a shock absorber”, according to Angus Gluskie (pictured, right), managing director of Whitefield. “It absorbs some of the volatility from the underlying asset class and then provides a smoother dividend experience for the underlying investors.”

He also pointed to the LIC structure’s franking benefits, saying the company’s role is to “handle all the tax complexities” and pay the relevant tax, “but when we translate that and pay our dividends to investors, it’s coming out as a very simple franked dividend”.