Super funds pass performance test, but at a cost

Superannuation research house SuperRatings has analysed superannuation funds’ performance against official performance test criteria and found that around 90 per cent of funds are estimated to have passed the test based on 30 June 2022 data, a big improvement based on March 2022. However, other research finds that the improved performance could be coming at the expense of investment returns.

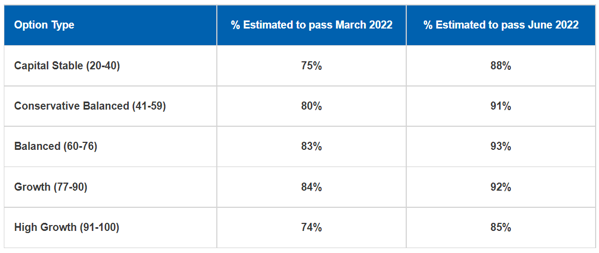

Based on data to the end of June, the firm found that 93 per cent of balanced options would have passed APRA’s test, including 69 per cent that met or exceeded the benchmark and 24 per cent that underperformed by 0.5 per cent or less as allowed under the test.

The performance test came into effect in July 2021 as part of the former federal government’s Your Future, Your Super laws (YFYS) laws. The annual test evaluates how default super products have performed over the past eight years, adjusted for fees. Funds that underperform their benchmark by 0.5 percentage points fail the performance test and would be banned from accepting new customers if they fail the test two years in a row.

This improved pass rate represents a significant improvement from the 31 March 2022 data which estimated that 20 per cent of the options assessed would have failed the performance test, according to the SuperRatings research.

The shift in the proportion of options passing the test highlights the significant impact that a single quarter can have on reported performance test outcomes, said Kirby Rappell Executive Director, SuperRatings.

“We expect that some products will likely fail the test a second time when the results are announced in late August, triggering the prevention of new members from joining these products, however with 10 of the 13 MySuper products that failed last year’s test having announced or completed mergers to date, the impact on members is expected to be minimal,” SuperRatings said.

Source: SuperRatings

However, other research has found that a sizeable portion of the super industry is in “limp mode” and close to failing the prudential regulator’s annual performance test, which some super funds say could lead to funds taking on less risk, lowering returns for members.

Conexus Institute executive director David Bell recently conducted interviews with 10 super fund chief investment officers to analyse how they have responded to the new YFYS laws and the performance test, and the findings are not encouraging for super fund members.

“Most, but not all of these ten funds expect returns will be adversely impacted over the medium to long term because they will take less active risk, and some believe it will be harder to manage risk. Investment time horizons are shorter for most, and most funds could readily identify where they are restricted. A number had already made portfolio changes,” said the Conexus Report, Assessing the impact of YFYS through interviews with CIOs of funds with performance “buffer”.

“Support for a performance test to protect consumers in default options was unanimous. But there was no clear cut solution to the problems identified,” the report said.

“Most agree that a purely benchmark-based approach is flawed and that it is important to account for asset allocations and risk-adjusted outcomes. Many believed that a qualitative oversight would create a more forward-looking outcome.”

Assistant Treasurer Stephen Jones recently asked Treasury to review the operation of the YFYS laws after the second round of MySuper performance tests are completed in August.

“The Government is aware of concerns that the YFYS laws have the potential to … [discourage] certain investment decisions or certain infrastructure investments. Treasury will be tasked in its review to examine and consider the operation of the new laws in this context,” Jones said. “With two rounds of annual tests completed, the review will consider whether the performance test has had any significant unintended consequences for MySuper products and assess how the test should be applied to other superannuation products.”

The federal government has paused the extension of the performance test beyond MySuper products for 12 months. “This will provide time for the review to take place and for the Government to consider and consult on any changes to ensure the test is fit for purpose given the significant variety and complexity of these products. In addition, the review will also consider whether there have been any unintended consequences from other YFYS reforms,” Jones said.

The latest performance analysis from SuperRatings reveals the median balanced option delivered a return of 3.1 per cent in July on the back of Australian and global equity markets. It said the median growth option rose by an estimated 3.5 per cent while the median capital stable option also delivered a positive result with an increase of 1.9 per cent.