-

Sort By

-

Newest

-

Newest

-

Oldest

A new research report finds many older Australians are deeply worried about the cost of care and don’t understand how it interacts with the aged pension. For most, the best solution is to remain in the family home.

New AMP research questions the assumption that the younger generation is anxiously waiting to inherit from their retired parents. Instead, they are looking to forge their own financial futures.

AMP research finds baby boomers reluctant to sacrifice their living standards to bankroll their offspring into housing. But they (happily) let them keep living at home and paying their bills.

The financial services giant’s top economists look at the risks that dominated markets this year and how they’re likely to evolve in 2024, warning that the new year could be a “rougher and more constrained ride” compared with 2023.

Nearly nine in 10 older Australians believe they’ll still be paying off a mortgage when they retire, and most are preparing for lifestyle downgrades, as new AMP research shows rising household debt levels are threatening the “Australian dream”.

Investors today have no shortage of worries to keep them up at night. According to AMP’s chief economist, it’s an ideal time to revisit some crucial investment principles that can help protect capital and provide peace of mind.

Higher bond yields are making fixed income fundamentally more attractive than it was during years of ultra-low interest rates. AMP’s Diana Mousina and Chris Baker recently discussed the opportunity set as investors look to add income and defensiveness in a new paradigm.

Whether an investment is expensive or cheap is a key and often overlooked driver of future returns, explains AMP’s Shane Oliver. At the moment, starting points signal a brighter medium-term outlook for some asset classes than for others.

Australian consumers are showing real signs the largest and longest rate hiking cycle in 30 years is starting to bite. It might be the proof the RBA needs to see that its fight against inflation is working, adding further weight to the theory that rate rises are behind us.

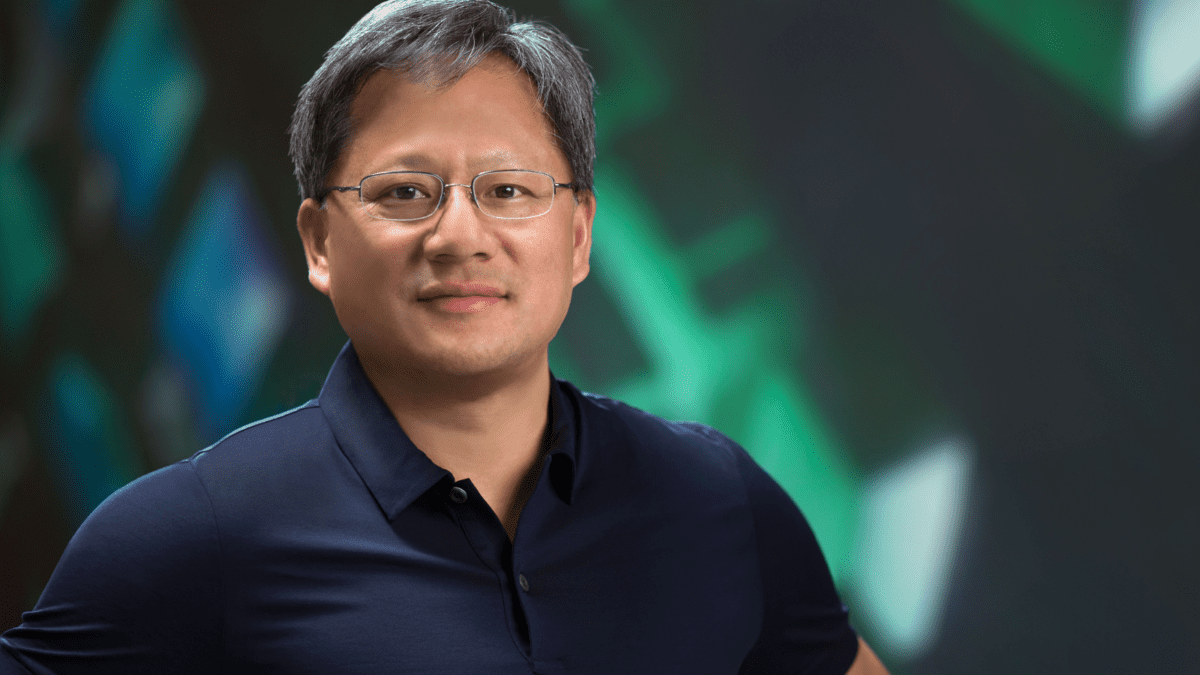

Shares of the in-demand chip maker hit an all-time high of US$502 on the back of a strong profit report, and analysts say it could be set for more gains, despite rising US bond yields complicating the outlook for equities and especially tech stocks.