-

Sort By

-

Newest

-

Newest

-

Oldest

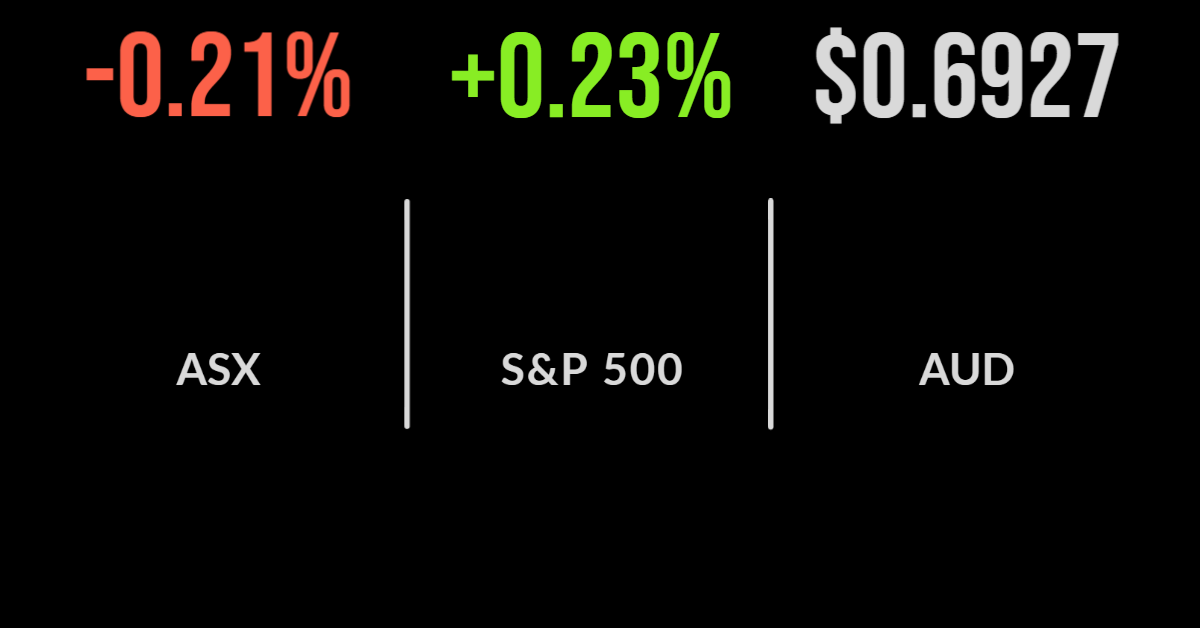

The Australian share market has experienced a similar reporting season trend to global markets with the trend being towards much better than expected results and far less volatility than predicted. The S&P/ASX200 fell 0.2 per cent with energy and healthcare both gaining more than 1 per cent, but technology and utilities reversing once again. On…

See what the brokers say about Australia’s largest bank and mining entity this reporting season.

An action-packed month of record dividends, soaring energy prices and rising inflation are all expected to be key trends this earnings season.

The local market gave up early gains to finish broadly flat on Thursday after a strong week in the market.

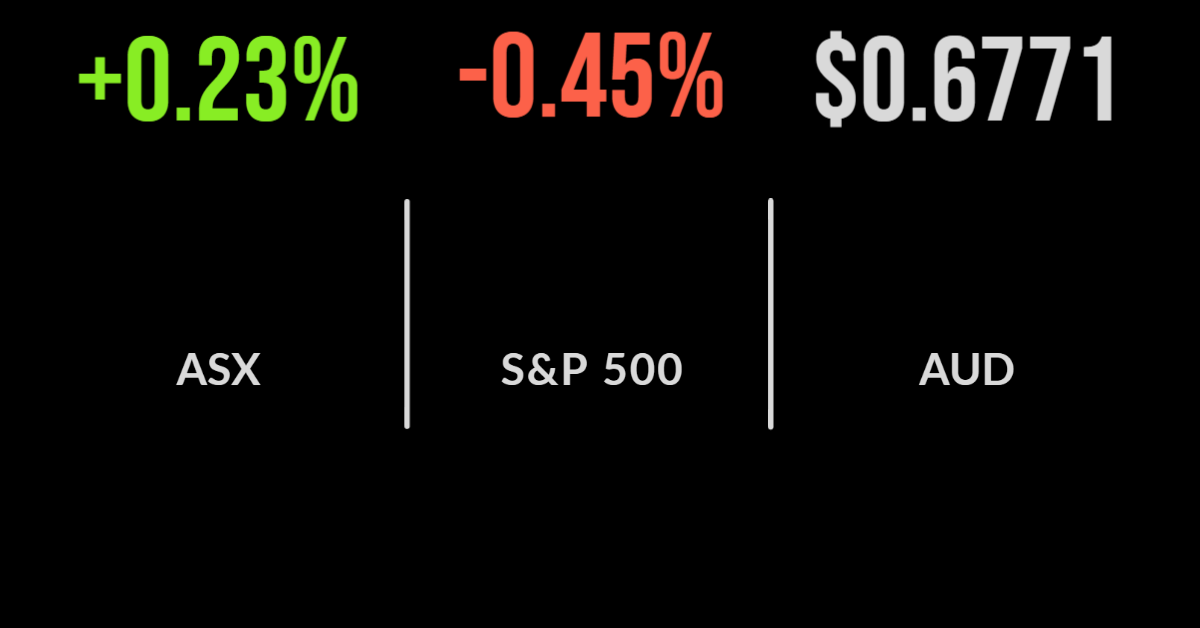

It was another positive, but mixed, day for the local market with seven of the 11 sectors finishing higher and contributing to a 0.2 per cent gain. The dispersion between the winners and losers is beginning to narrow after an incredibly volatile period. On the positive side were the consumer and technology sectors, which gained…

The Australian Securities Exchange (ASX) recently launched the S&P/ASX Agribusiness Index (XAG) to offer investors direct exposure to domestic public agribusinesses.

It was a solid week last week for the Australian market, advancing on four of the five days. The S&P/ASX 200 gained 138.1 points, or 2.1 per cent, for the week, to end at 6,678, while the broader S&P/ASX All Ordinaries index added 156.6 points, or 2.3 per cent, to 6,877. The All Tech index…

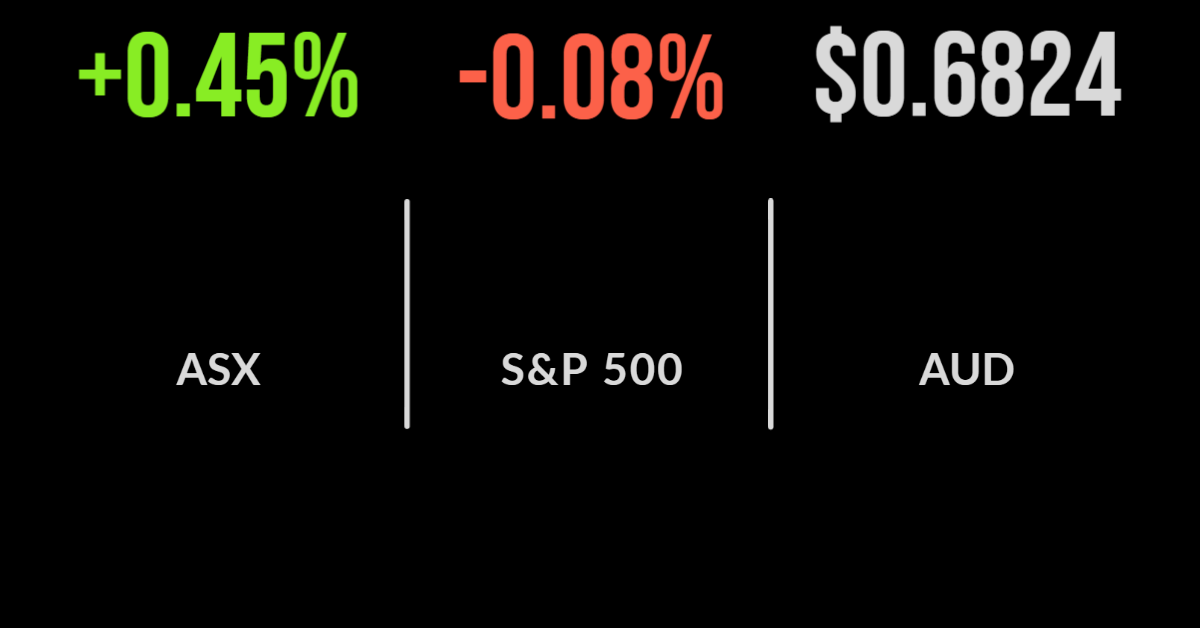

The Australian share market ended in the green on Monday, despite investor skittishness ahead of today’s Reserve Bank board meeting. The central bank is widely predicted to lift its cash rate by another 50 basis points today, which would take it to 1.35 per cent, in the intensifying effort to rein in surging inflation, which…

The exchange-traded fund (ETF) sector has been among the biggest winners of the pandemic, seeing significant inflows and more investors entering the market. Among the most popular strategies to come to market have been so-called ‘thematic’ ETFs, which offer exposure to a secular trend or opportunity.

It’s time to start buying quality stocks that have fallen sharply over the last six months. This is the view held by Roger Montgomery, founder of Montgomery Investment Management. Given that valuations have come off, Montgomery believes investors have a far better chance of making attractive returns buying now; with one big caveat – that these businesses grow their earnings.