-

Sort By

-

Newest

-

Newest

-

Oldest

With markets starting to turn mildly positive, the driving factor seems to be cautious commentary from the RBA after several weeks of fuelling fears of a recession due to aggressive rate hikes.

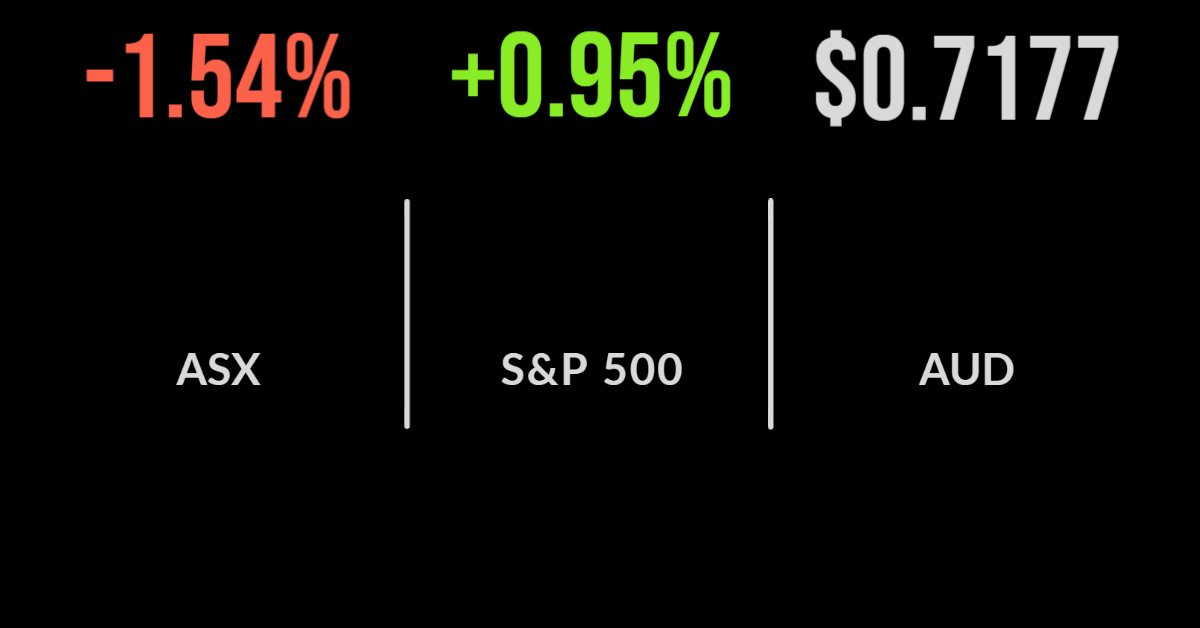

The local market open on an unexpectedly positive tone but ultimately finished 0.6 per cent lower as commodity and energy prices fell across the board. The selloff in energy and materials finished at 5.1 and 4.6 per cent respectively, amid growing concerns about the outlook for the global economy. Uranium miner Paladin (ASX: PDN) was…

With markets taking a battering, inflation soaring and central banks accelerating interest rate rises, it’s no easy task finding places to invest (or hide) on the ASX. One such company thought to thrive in economic downturns is Credit Corp Group Limited.

Emanuel Datt, chief investment officer and founder of Datt Capital, presents his views on Latitude’s bid for Hum Consumer Finance.

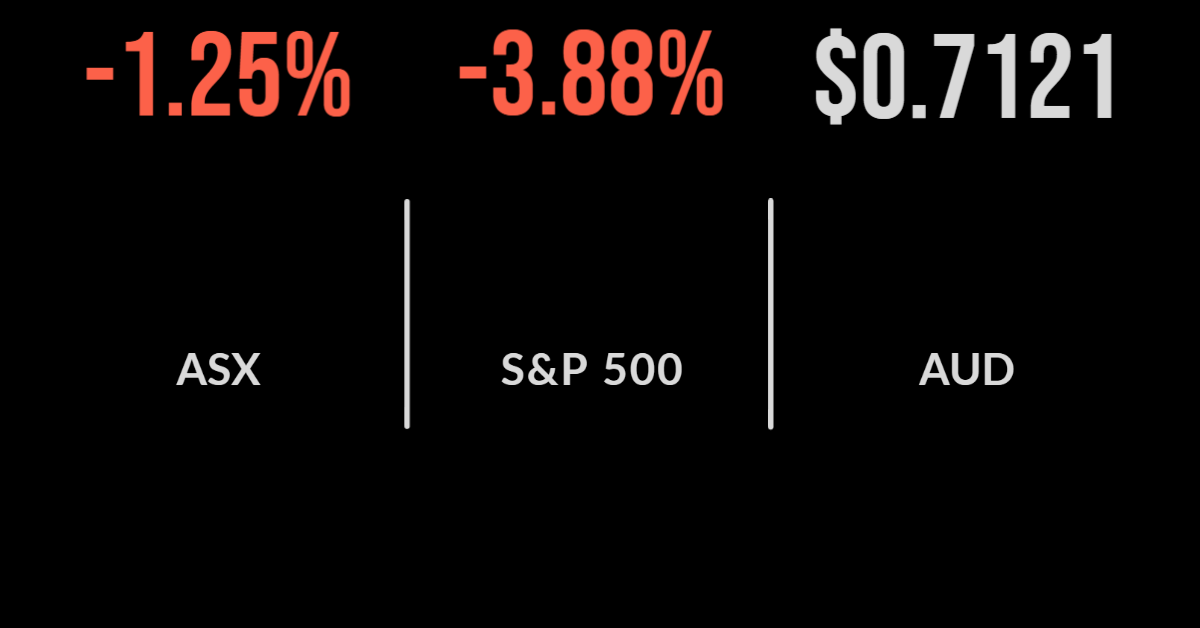

The local market was pushed lower by the global turnaround in interest rates with the S&P/ASX200 falling 1.3 per cent to finish the week. Every sector was lower, led by property, which fell 2.9 per cent on concerns that higher interest rates will hit valuations, while another six sectors dropped more than 1 per cent,…

The Australian sharemarket was on hold ahead of the RBA’s latest board meeting and interest rate decision. A somewhat unexpected 0.50 per cent increase in the cash rate to 0.85 per cent saw the S&P/ASX200 slump by 1.5 per cent. The large move was predicted by only a few experts with the RBA highlighted the fact that inflation had…

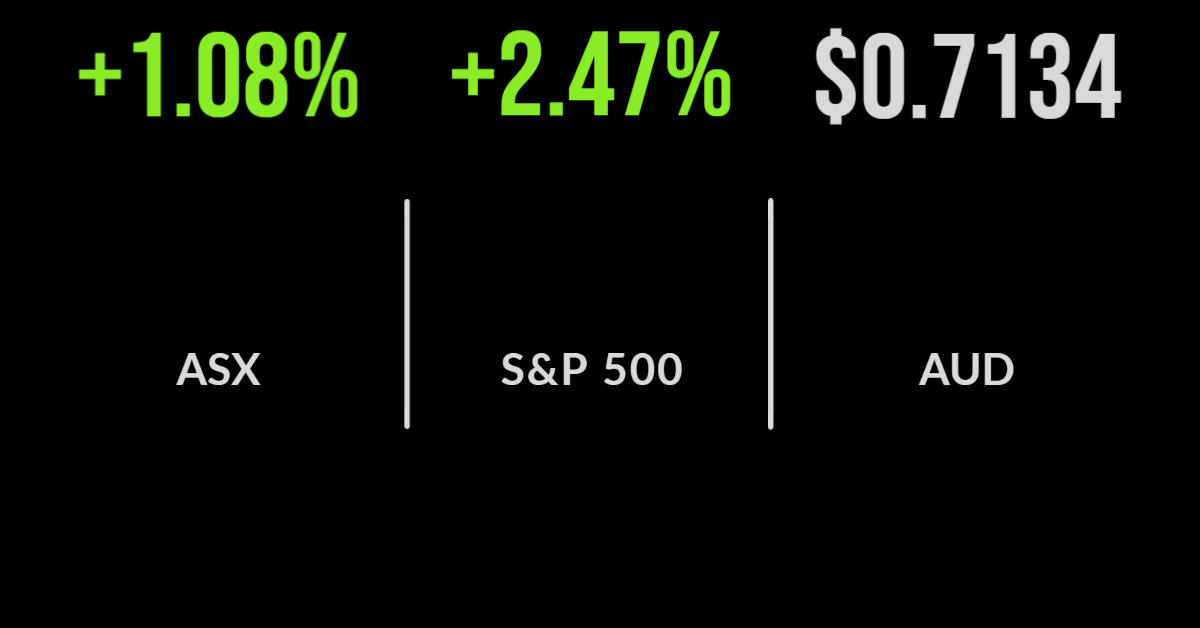

The local market delivered a strong finish to the week, gaining 1.1 per cent on the back of a strong global lead. The primary driver was a weakening of the rhetoric from Chair Powell in relation to the course of rate hikes in the coming months. Energy and discretionary retailers were the standouts, gaining more…

Aussie market creeps higher Despite a steady diet of news of war, global slowdowns, China lockdowns, inflation and higher rates, the Australian share market managed to rise on Wednesday, as measured by the benchmark indices. The S&P/ASX200 index added 26.4 points, or 0.4 per cent, to finish at 7,155.2, while the broader S&P/ASX All Ordinaries index…

China sniffles hurt market The Australian share market was weighed down on Tuesday by concerns that COVID-19 lockdowns have hurt economic growth in China, the benchmark S&P/ASX 200 index finished down 20.1 points, or 0.3 per cent, to 7,128.8, while the broader S&P/ASX All Ordinaries closed 0.35 per cent, or 25.7 points, lower to 7,373.2. Commonwealth Bank…

The Aussie market benefitted from the news that the Chinese Government had cut a key interest rate and a late rally in US markets to post a 1.2 per cent gain to finish the week. The result was driven by a jump in the technology and discretionary sectors, up 4.6 and 2.0 per cent after…