-

Sort By

-

Newest

-

Newest

-

Oldest

The RBA’s sharp policy shift towards higher rates has put significant wind in the tail of “boring, old” bonds. But do Australians understand the role they play in the fixed income spectrum, and what they can do for portfolios?

Up until recently, alternative investments were only really open to institutional investors, but with these now available at a wholesale and retail level the retirement strategy game has changed.

Credit and equity markets both suffered a very bad 2022, as the collapse of negative correlation between stock and bond prices left no safe haven for investors. But 2023 could be a big year for bonds, and experts say investors waiting on the sidelines risk missing out.

While central banks around the world move to combat rising inflation through the aggressive hiking of interest rates, the knock-on effect has been broad-based sell-offs in global share markets as investors rotate away from risk assets into safer assets. At the same time, there has also been a sell-off in bond markets which has seen prices fall and yields rise higher.

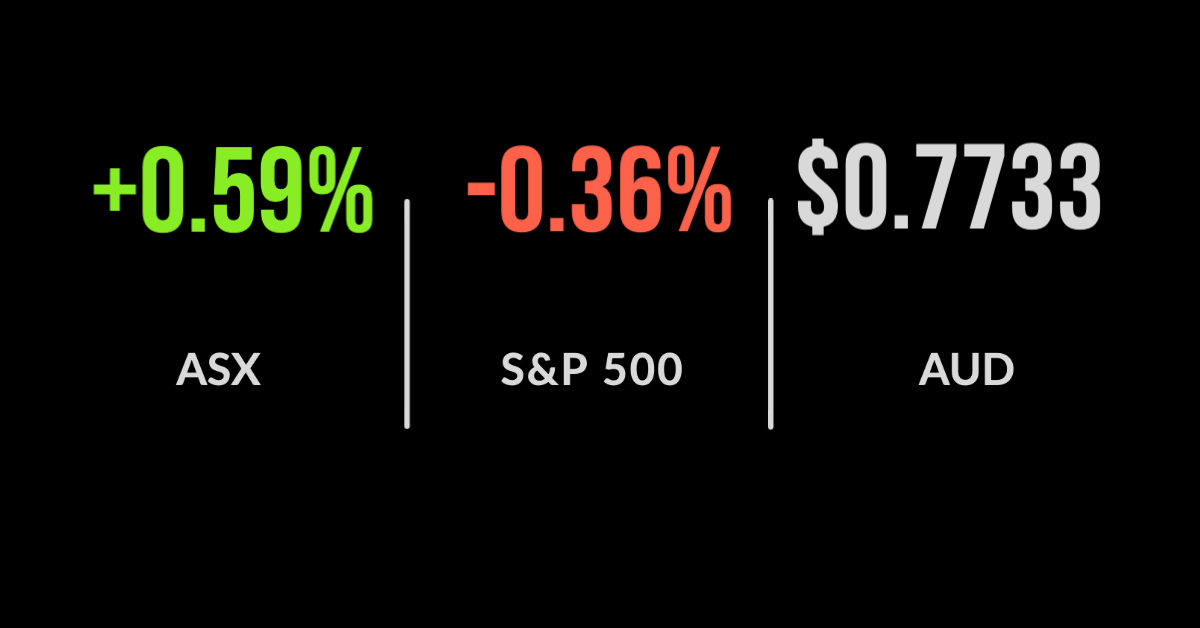

Another record, another lockdown, Nick Scali, Pinnacle dominates The ASX 200 (ASX: XJO) managed to eke out another consecutive record finish, despite adding just 8 points and finishing 0.1% higher. It continues a positive start to the month, driven by seven of the eleven key sectors finishing higher. This comes despite Victoria entering its sixth lockdown, another seven day…

Tech sell off drags ASX, banks, gamblers hit, Solomon ramps up push for Myer board spill The ASX 200 (ASX: XJO) followed a weak global lead to fall close to 1% on Friday, despite a late afternoon recovery. Every sector was lower across the board barring energy, which continues to benefit from the impasse between members of…

ASX trades off high, retail sales higher, Wesfarmers flags tough comparables The ASX 200 (ASX: XJO) finished at an all-time high, adding 0.6% on Thursday as the energy sector continued to rally. The energy sector was 3.3% higher along with utilities, up 2% again, whilst consumer discretionary was the only detractor, falling 1.1%. Worley Ltd (ASX: WOR), which…

Second quarter off to strong start, AMP’s CEO departs, Boral announces buyback The ASX200 (ASX:XJO) finished the week and commenced the new quarter on a strong note, finishing 0.5% higher with both IT, up 2.3%, and materials, 1.3%, contributing. It was a day for stock specific news with the worst kept secret in finance being confirmed, AMP’s CEO Francesco…

ASX powers ahead, lower bond yields, records broken at Premier (ASX:PMV) The ASX200 (ASX:XJO) delivered once again, pushing higher with falling bond yields and a finally weakening currency, which is now under 76 US cents. The much-anticipated release of the economic Purchasing Manager Index or PMI results, which offer an indicator of spending and investment intentions, hit…

ASX sinks to first loss in a month, retailers powering ahead, materials weaker The ASX200 (ASX:XJO) finished the week on a negative note, falling 0.6%, delivering the first weekly loss in over a month, down 0.9%. It seems the number of divergent outcomes for 2021 is increasing by the day, with talk of an inflation spike, countered…