-

Sort By

-

Newest

-

Newest

-

Oldest

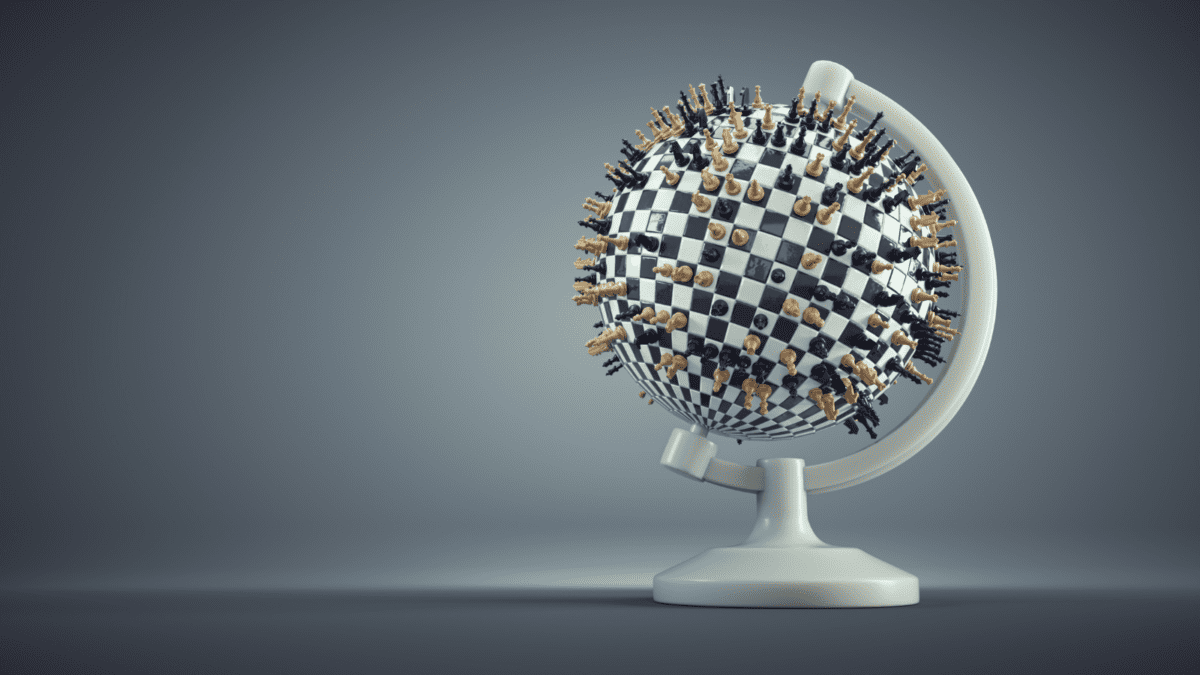

Shock events like the Israel-Palestine and Russia-Ukraine conflicts are not a reason for investors to panic sell, as history tells us geopolitical risk, which is always present and therefore factored in by markets, has little correlation with long-term economic upheavals.

Demand for the metals needed for the energy transition and a falling iron ore price are encouraging Rio Tinto and BHP to expand investment and production, analysts say, with the big dividends shareholders have come to expect likely to take a hit.

An emerging global supply shortfall and booming demand due to the clean-energy transition are set to support big gains in the price of copper, leaving investors hunting exposure to the few mining projects currently online.

The world’s second-largest economy remains handicapped by zero-COVID policies, hampering iron ore demand. Sean Sequeira, Australian Eagle Asset Management chief investment officer, discusses the longer-term outlook amid increasing inflation pressures.

Falling resource and commodities prices are worrying investors and resource companies have dropped sharply in price in July. Analysts are mixed on their outlook for resources companies, with some tipping energy companies to outperform while other experts favour diversified resources companies.

And there goes the 2022 financial year. It flew by at the blink of an eye. A pandemic, a few supply-chain disruptions, a war in Europe, rising energy prices, climate change and soaring inflation. What more could you ask?

While gold has long been regarded as the “safe haven” asset during times of fear and peak volatility, the investment team at ETF Securities has highlighted a group of investment assets that share similar qualities to that of gold, allowing the same safe-haven status.

The world is running out of available copper and that is causing copper prices to hit record highs. The copper price hit an all-time high of $4.9375 a tonne, which is a 125 percent rise from its March 2020 lows. It joins the list of essential commodities that have hit record highs since the pandemic began and there are several factors all contributing to its rise.

ASX gains on travel boost, inflation expectations tempered, but confidence key The ASX200 (ASX:XJO) finished the week strongly, adding 0.8% on Friday, enough to deliver the second straight week of gains. Stimulus was at the top of the agenda this week, with a combination of comments by the Reserve Bank of Australia and the Federal Government setting the direction of markets….

Global markets drop, ASX200 down most in five months, Orica (ASX:ORI) and Afterpay (ASX:APT) smashed The ASX200 (ASX:XJO) fell 2.4% on Friday, the worst daily fall in five months, taking the weekly performance down 1.8% but still managed to deliver a 1% return for February. On Friday it was all about tech or anything that has benefitted…