-

Sort By

-

Newest

-

Newest

-

Oldest

Financial, travel push market higher, bidding war for Priceline owner The S&P/ASX200 followed a positive global lead to post a strong opening to the week, finishing 0.6% higher. Most sectors improved outside of the ‘defensives’ with healthcare, down 1%, and consumer staples underperforming. Globally, markets were buoyed by a resurgent oil price as weaker supply collides with strong demand across highly…

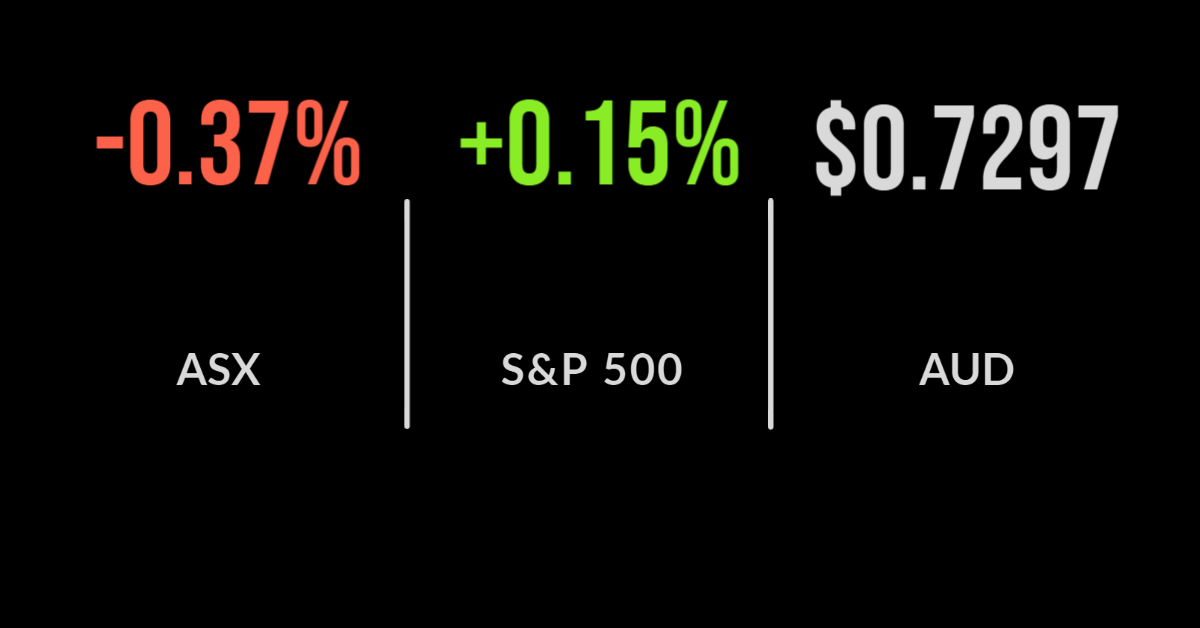

ASX falters, oil hits multi-year high, Domain’s record, central banks dominate The S&P/ASX200 (ASX: XJO) finished the week on a negative note, falling 0.4% dragged lower by the real estate sector, which fell 2.1%. The materials sector continued its recent weakness, down 1.3% behind another 1.7% fall in BHP (ASX: BHP) despite the iron ore price finally settling. The real estate sector sold off heavily seemingly on the…

Rally continues despite dividend drag, Premier profit doubles The S&P/ASX200 (ASX: XJO) continued its strong recovery adding another 1% on Thursday after the Federal Reserve committed to continue bond purchases until at least the end of the year. The strength was broad-based with every sector finishing higher, tech, energy and utilities were the highlights with each jumping…

Risk reduced, Evergrande default delayed, Zip’s expansion Amid growing concerns that the S&P/ASX200 (ASX: XJO) was set for a significant sell off, positive news from China saw the market rally throughout the session. The market ultimately finished 0.3% higher with materials and mining adding 2%, starting to recoup the losses of the last few weeks. Yesterday’s losers were today’s winners,…

Market fights back, APA bids for AusNet, iron ore stems the flow The S&P/ASX200 (ASX: XJO) looked to be moving into correction territory this morning, opening broadly lower and continuing the weak global trend. The market fell as much as 0.3% before finishing the same amount higher. Concern continues to grow about the outlook for the global economy but…

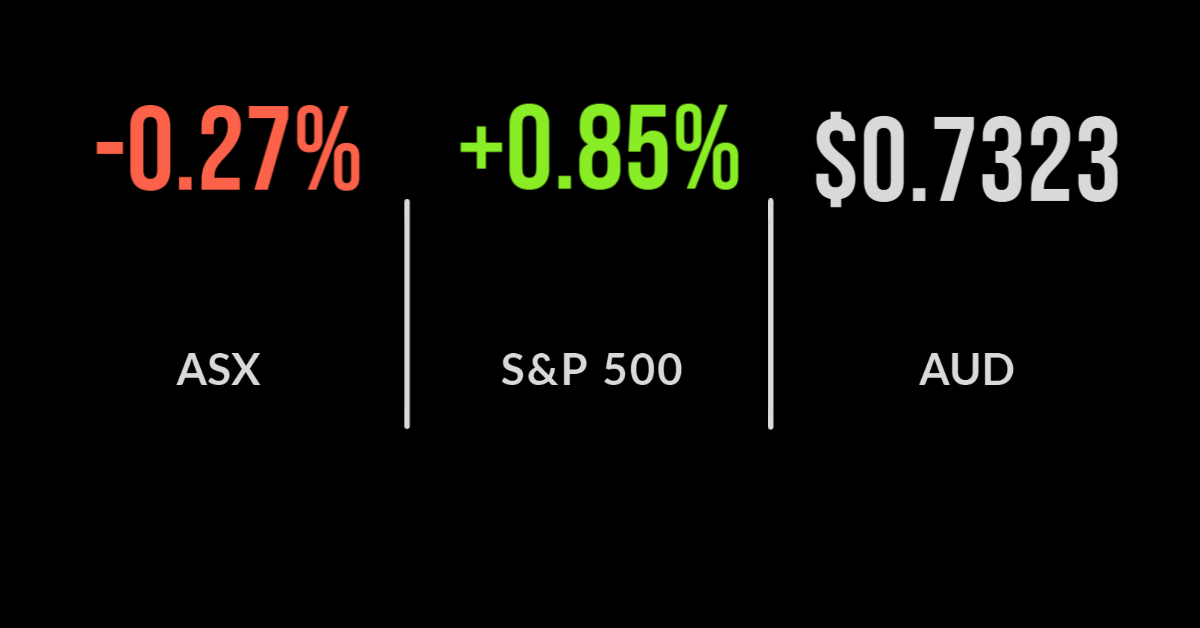

Correction continues, iron ore futures hit US$90, Ausnet takeover The S&P/ASX200 (ASX: XJO) suffered its worst day since February falling 2.1% on the back of ongoing weakness in the commodity sector. The market hit its lowest point in three months with just ten stocks out of two hundred finishing in the positive, including Boral (ASX: BLD) which added 0.3%….

ASX flat despite iron ore falls, IRESS deal pulled, AMP’s new low The S&P/ASX200 fell 0.8% on Friday erasing the week’s gains and ultimately leaving the index down three points for the week. After being the hottest sector for most of the year, the materials and mining companies continue to drag the market lower. On Friday it was all about iron ore with…

ASX falls, AGL hits record low, IRESS deal slowed, Pilbara hits record The S&P/ASX200 (ASX: XJO) dropped another 0.3% on Wednesday as the rally in the energy sector reverse, dropping 2.2%. The key driver was an announcement that OPEC+ expects the oil market to balance earlier than expected. Every major company fell with Santos (ASX: STO) and BHP (ASX: BHP) both falling 3.5%….

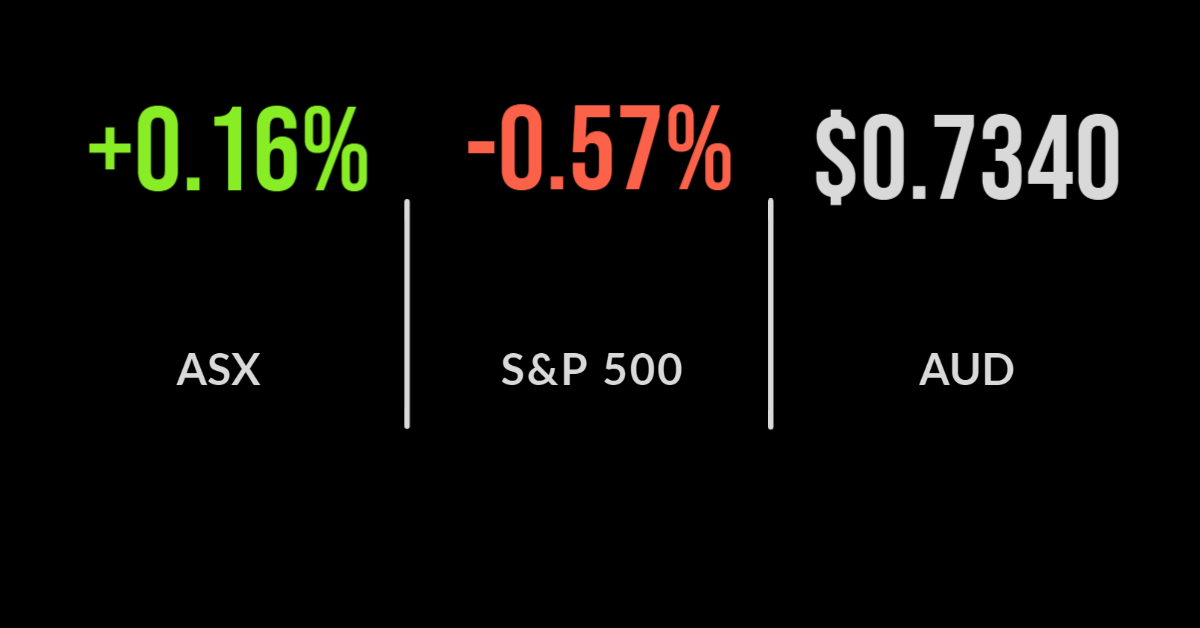

RBA spurs turnaround, energy sector surprise, Brambles profit hit The S&P/ASX200 (ASX: XJO) experienced a choppy session, initially falling 0.4%, before trading 0.5% higher but ultimately closing with a gain of just 12 points. Six of the 11 major sectors were higher led by energy which had its strongest day in seven months, gaining 4.4%. An oil…

ASX finishes higher, miners continue to run, Sydney Airport deal increased The ASX200 (ASX: XJO) overcame another negative lead to finish 0.3% higher with both energy and materials central to the positive result. The energy sector was 1.2% higher as the likes of Woodside Petroleum (ASX: WPL) and Santos (ASX: STO) gained on the back of approximately 1 million barrels of supply being…