-

Sort By

-

Newest

-

Newest

-

Oldest

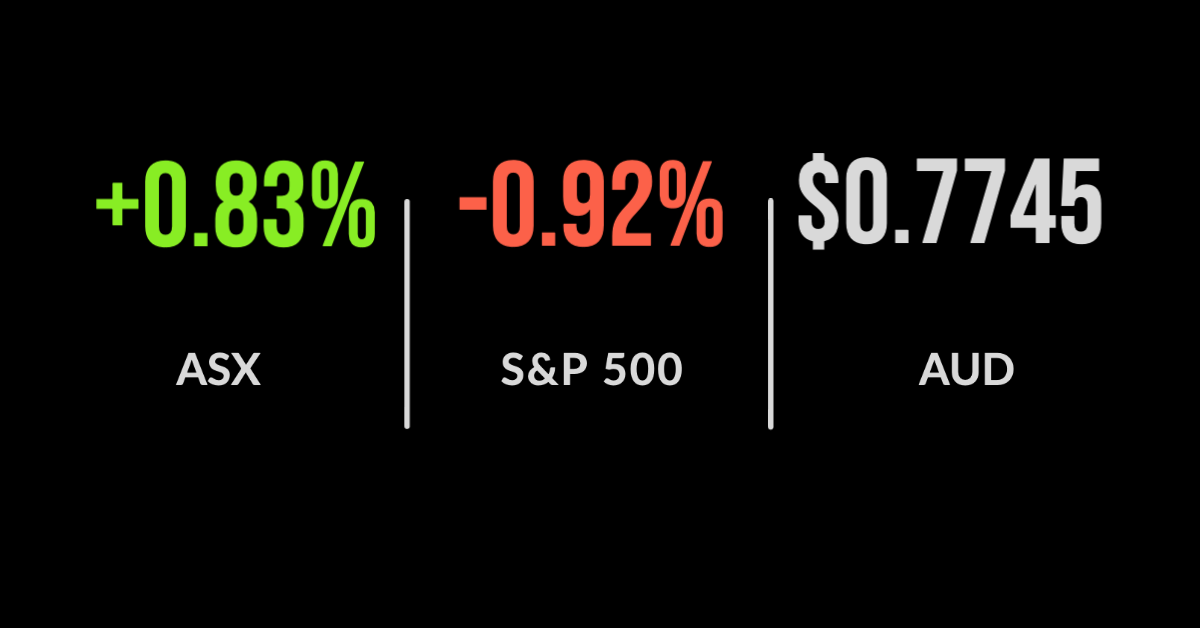

The first quarter of 2021 saw renewed confidence in global equity markets, supported by positive developments in the fight against coronavirus together with better-than-expected economic data. Fiscal stimulus and vaccine rollout have far exceeded expectations, causing equity markets to overcome bouts of volatility. The Dow Jones Industrial Average and S&P 500 indices hit new all-time…

Seventh consecutive monthly gain, Beach Energy smashed, ANZ takes $817m profit hit The ASX200 (ASX:XJO) finished Friday on a weaker note, down 0.8% and 0.5% for the week, however was able to deliver a seventh consecutive monthly gain, finishing 3.5% higher for the month of April. The news of the day was the capitulation in Beach Energy’s (ASX:BPT) share…

Mixed day but higher finish, new highs for stalwarts, Woolworths disappoints The ASX200 (ASX:XJO) managed another small gain, adding 0.3%, powered ahead by the technology sector; Afterpay (ASX”APT) and Zip Co (ASX:Z1P) adding 3.5% and 2.5% respectively. With half the sectors down, it was the consumer businesses that were the biggest detractors, Woolworths (ASX:WOW) falling 3.9% after delivering lackluster third quarter sales figures….

Markets rally on weak inflation data, Link deal pulled, JB Hi-Fi CEO stepping down The ASX200 (ASX:XJO) managed to deliver another 0.4% gain with the materials sector the only detractor falling 1.0%. The fall came despite the iron ore price hitting a record of US$193, marking a long recovery from the US$50 lows of 2015. JB HiFi (ASX:JBH) was among…

Superannuation research house Chant West, part of the Zenith Investment Consulting group, this week published its quarterly performance update on the industry fund sector. Despite the volatility experienced in March, which spanned both bond and equity markets, returns continued to surprise on the upside in March. Chant West’s research seeks to differentiate between the (at…

We recently covered the mechanics of short-selling in our article, ‘how short selling really works’. This followed the huge popularity of the investment strategy amid the Reddit and GameStop saga earlier this year. In this article a number of benefits were raised ranging from the additional liquidity it provided to markets, the transparency it demanded…

ASX stagnates at 7,000, Tabcorp receives another bid, Bingo deal approved The ASX200 (ASX:XJO) remains stubbornly anchored to the 7,000 point level, falling 0.2% on Tuesday as most sectors were once again hit by the threat of increasing inflation. The materials sector was the biggest positive contributor, with the likes of BHP Group (ASX:BHP), Rio Tinto (ASX:RIO), and Fortescue Metals (ASX:FMG) all adding 1%…

Perth in lockdown, ASX flat for the week, retailers smashed Perth has entered a ‘snap’ three-day lockdown following another hotel quarantine outbreak. Despite this, the market finished slightly ahead on Friday, 0.1%, and finished the week flat. The highlights over the week were Megaport (ASX:MP1) and Monadelphous (ASX:MND), which jumped 10.5% and 8.6% respectively. All attention has been on a number…

AGL CEO had enough, Brambles keeps shipping, markets break losing streak The ASX200 (ASX:XJO) broke a two-day losing streak, shooting 0.8% higher as business conditions and investment intentions hit their highest level in 27 years. The energy and IT sectors were the main laggards, with energy falling 0.6% as India reported the highest number of new cases…

ASX pares losses, defensives in favour again, Nuix downgrades again The ASX200 (ASX:XJO) trimmed losses to just 0.3% despite falling as low as 1.6% during the session. The selling pressure was driven primarily by the energy and property sectors as concerns about spiking global COVID-19 cases impacted confidence. The recently listed Nuix Ltd (ASX:NXL), a big data and analytics…