-

Sort By

-

Newest

-

Newest

-

Oldest

Renewable energy is in the spotlight and the battery technology supply chain is key to the transition. Wind and solar energy are forecast to supply around 48% of world electricity needs by 2050, with battery technology, gas peakers (turbines or engines that burn natural gas) and dynamic demand anticipated to drive market penetration of solar…

Vanguard this week released its ETF Quarterly Report highlighting some of the key trends emerging from the fast-growing ETF sector. The analysis covered every exchange-traded fund on offer, including the reasonably new “active ETFs” such as those issued by Magellan, Munro Partners and Loftus Peak. It was another quarter of records, with the sector seeing…

With the onset of COVID-19 and the lockdowns that followed, the move to digital accelerated, becoming a shift of necessity rather than choice. The move occurred almost seamlessly. Bricks-and-mortar retailers shifted online, triggering a move to digital with buy-now, pay-later (BNPL) vendors popping up offering solutions to replace physical cash. This is just one example…

With tensions rising in the South China Sea and regulatory pressure on the likes of Alibaba (NYSE: BABA) continuing to grow, the Chinese market is becoming an increasingly difficult one to navigate as Beijing seeks to exert itself on a global stage. China has long been seen as the investment darling, supported by an expanding…

Even though Lithium Boom II is well underway, there may still be time to jump on board the bandwagon and capture significant upside from battery material manufacturers. Despite some staggering company performance, it is clear that the future of the global economy is battery-powered, with investment required at a scale scarcely believable. The lithium boom…

The Dow Jones was the latest index to join the all-time high club in 2020, breaching 30,000 points this week. Despite being owned by Standard & Poor’s the index is regularly seen as the poorer cousin of the S&P 500 or tech focused Nasdaq Composite. Why is that the case? Despite being around since 1896…

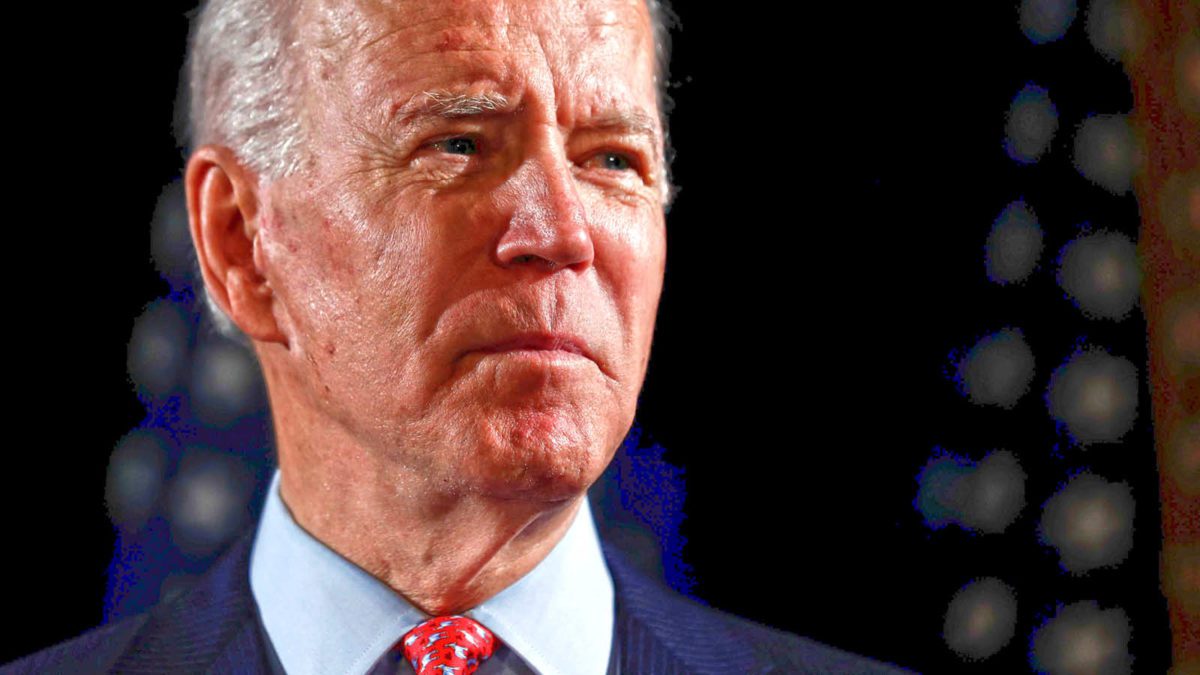

A recent discussion on the likely local impact of the US election between three leading investment experts from ETF Securities (Kanish Chugh, Head of Distribution), Pitcher Partners (David Lane, Director and Senior Adviser) and Evans and Partners (Timothy Rocks, CIO) concluded with consensus advice for Australian investors to maintain their long-term strategy, have an allocation…

Gold prices have seen specialist Exchange Traded Fund provider, ETF Securities move beyond $3 billion in assets under management to start the new financial year.

In uncertain times such as the present, with asset prices and exchange rates fluctuating unpredictably, many investors are looking to make sure their portfolios are well-diversified, a and to shore-up the defensive areas of their portfolios; while also looking to hedge risk in other parts of the portfolio – and even to take advantage of…

In hindsight, March 2nd, 2020, as the world started to get to grips with the scale of the global health emergency that was unfolding in the form of the Covid-19 pandemic, was an inauspicious time to launch a new investment product. In fact, the S&P/ASX 200 Index is down 19% since that day – after…