-

Sort By

-

Newest

-

Newest

-

Oldest

All that glitters, active vs. passive and why a closer look at infrastructure.

Most gold investors are quietly happy about the yellow metal’s 2020 rise from US$1,514.75 to US$1,728.70 – that’s a healthy 14.1 rise. But if you’re an Australian gold miner, you’re even happier about its 2020 movement in A$, from $2,164.67 to $2,591.91 – in local currency, gold is up almost 20%. And at that price,…

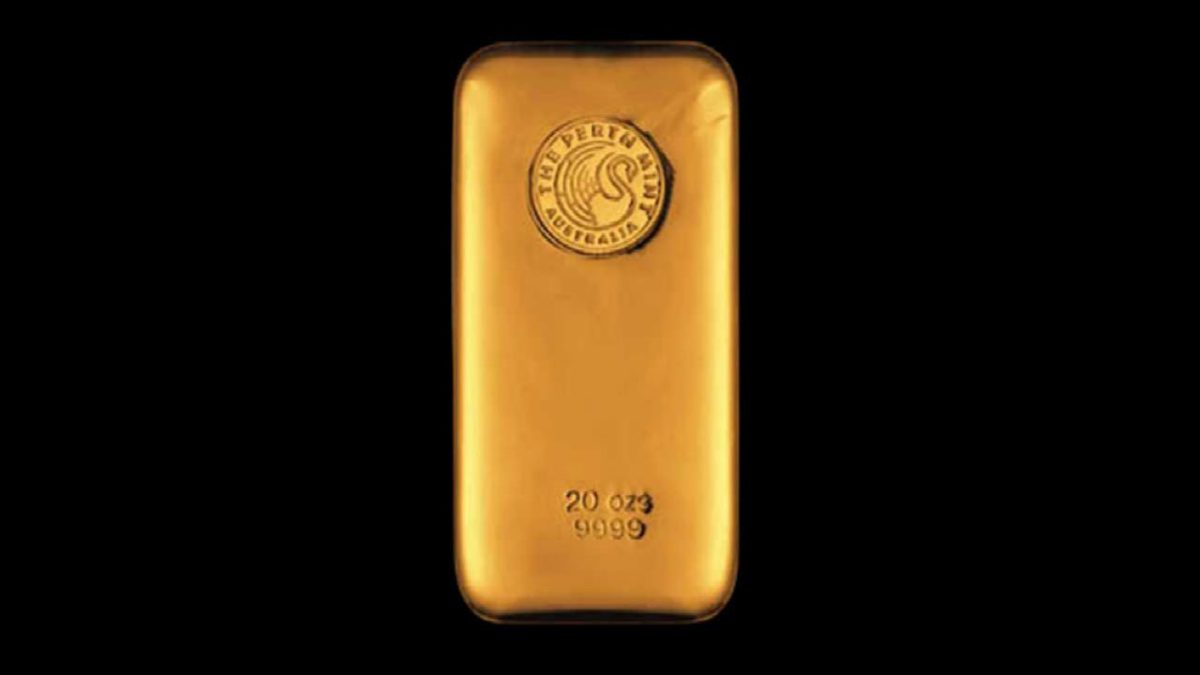

As a change of pace, I thought I would touch on one of the more popular investments in recent times, gold bullion. I have personally recommended clients hold gold within balanced portfolios for several years, and they have been rewarded with double-digit returns over the period. Despite its increasing popularity, the yellow metal remains misunderstood…

Gold is trending up, in price and discussion on its role in a portfolio. While European investors have typically included an allocation to gold as a matter of course, it is less common elsewhere. The European bias harks back to the debasement of currencies in early 1900, the safe-haven status during the war and the…