-

Sort By

-

Newest

-

Newest

-

Oldest

Two decades of investors being able to offset bonds against equities are over. Now investors must go back to the drawing boards to construct their portfolios to meet the challenges of inflation.

All five Living Cost Indexes jumped in the March 2024 quarter. But while employee households carried the brunt of higher prices, self-funded retirees emerged relatively unscathed.

With Australia facing difficult conditions as the impacts of rising interest rates continue flowing through the economy, credit remains one of the most reliable and attractive ways to add defensiveness to a portfolio, strategists from SQM Research and ICG told a recent Inside Network symposium.

Much of the 2.4 per cent decline in global wealth in 2022 – the second-biggest this century – stemmed from US dollar appreciation, but even controlling for exchange rates it was the slowest wealth increase since the GFC, UBS and Credit Suisse said in a new report. But global wealth inequality fell, as richer countries took the biggest hit.

The chief economist says rapidly falling inflation, high savings levels and a lack of excess are among the reasons this pivotal moment could pass without the major downturn that many have long dreaded. But AMP still puts recession odds at 50/50, and rate cuts will likely need to precede any growth rebound.

The steepest rate-hiking program in history has largely done its job, but softening inflation may not translate to an immediate pivot on official rates as cautious central banks seek a comfortable buffer, says Neuberger Berman.

While interest rate hikes can be painful, they are crucial tools in the fight against inflation, Integral Private Wealth’s David Simon writes. Anyone in doubt should consider the Zimbabwean hyperinflation crisis of the late 2000s and the perils of short-term fixes.

The current economic cycle is too changeable to set any portfolio to autopilot, according to Mason Stevens’ Jacqueline Fernley. Counterpoints to conviction are needed, and the devil’s advocate should be your friend.

While avoiding recession is possible, the continuation of restrictive macroeconomic policies for the near term is needed to fight inflation, according to the IMF’s annual economic report card for Australia – and tax reform and stronger housing policies would also help.

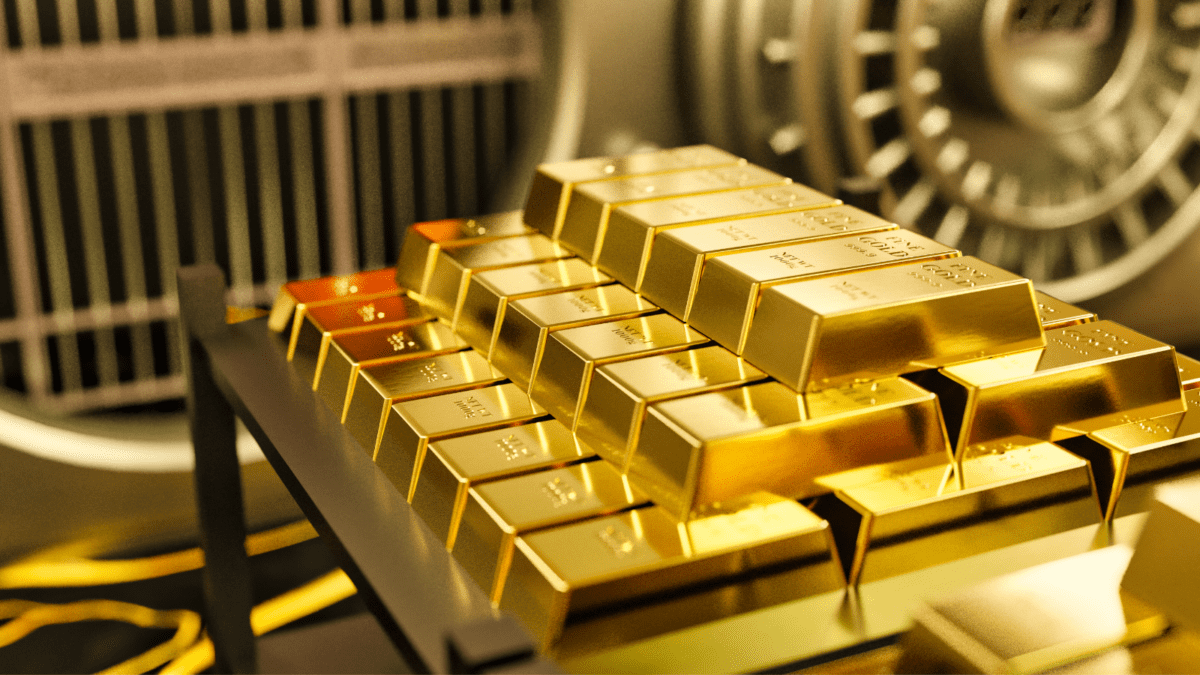

Gold has never held strong investment appeal for SMSFs, despite being seen as a hedge against inflation. With the precious metal beginning a so-far volatile 2023 full of steam, SMSFs looking to preserve capital have several reasons to consider incorporating gold into their portfolios.