-

Sort By

-

Newest

-

Newest

-

Oldest

Strongest day in four months, Fed backs off, lithium miners rally The ASX 200 (ASX: XJO) experienced its best session in four months, adding 1.5% on Tuesday, all but erasing Monday’s losses. Every sector but healthcare finished higher, with real estate and energy the biggest beneficiaries adding 2.2% respectively. The positive sentiment came from Fed Chair Jerome Powell’s written…

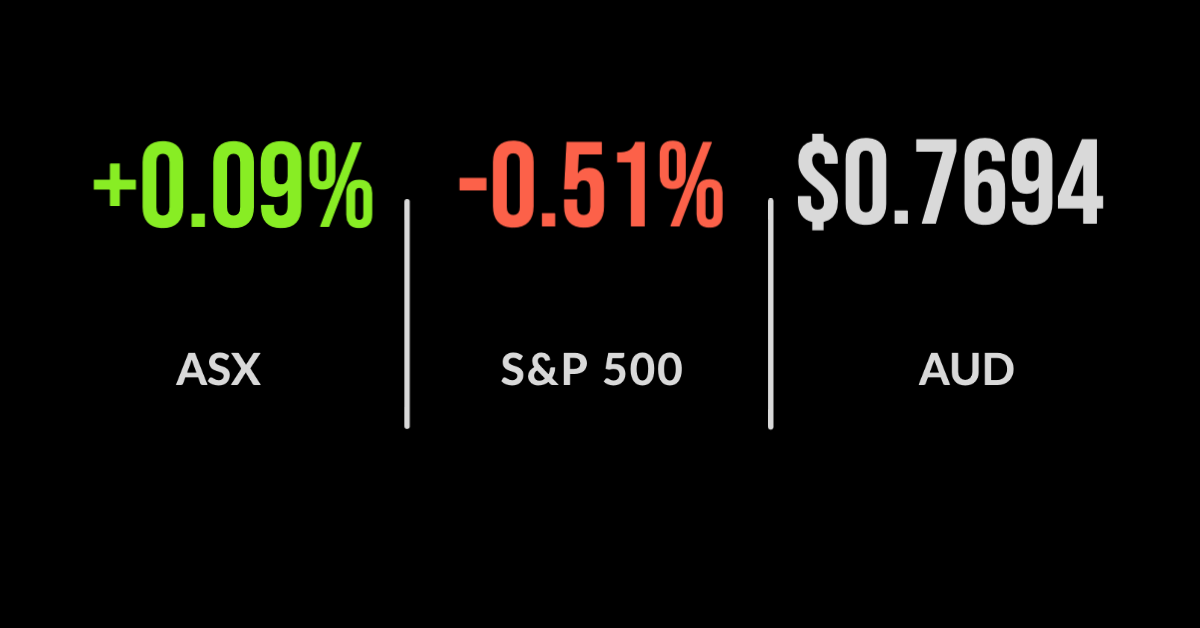

ASX records continue despite mining sell off, energy stronger, lithium deals continue The ASX 200 (ASX: XJO) finished at another record, adding 0.1% on Wednesday despite weakening throughout the day. Most sectors finished higher, led by the energy sector, up 1.5%, with the materials and IT down 1.6% and 0.4%, respectively. It was bad news for those…

ASX hits four day high, gold shining again, growth bubble stalling The ASX200 hit a four-day high, finishing 0.6% to the positive on Tuesday; showing the short-term focus of the market at the moment. The energy and materials sectors were the biggest contributors, jumping by 1.6% each. For energy, it was the case of oil prices hitting…

ASX retakes 7,000, iron ore falls, CBA hits new record, dispersion grows The ASX200 (ASX:XJO) finished the week on a positive note, moving 0.5% higher and retaking the 7,000-point level. Every sector was higher barring materials, with Fortescue (ASX:FMG) and BHP Group (ASX:BHP) falling 2.8% and 1.5% respectively after the iron ore price dropped 9.5% during the day. On the positive side, the…

Another positive week, tech continues disappearing act, Macquarie delivers record profit The ASX200 (ASX:XJO) managed to deliver another positive week, adding 0.3% on Friday and 0.8% for the week. The news of the week was the Chinese Government ceasing high level discussions with Australian officials, but at the same time, their demand sends the iron ore price to a record above…

ASX struggles to another record, Sims upgrades guidance, lithium giants to merge The ASX200 (ASX:XJO) struggled to another record close, finishing just three points higher as a sell off in the energy sector, down -1.4%, offset gains in the mining sector, +0.8%. The news of the day was the planned merger between Australia’s pureplay lithium miners, Orocobre (ASX:ORE) and Galaxy (ASX:GXY),…

OK, so you want to own a big global diversified bulk miner, to take advantage of the impending commodities boom – let’s take a look at the contenders, BHP and Rio Tinto. Here’s the tale of the tape. BHP (BHP, $36.35)Market capitalisation: $183.7 billionOne-year total return: +6.9%Three-year total return: +17.9% a yearFive-year total return: +14.2%…

With dividends at risk in many companies, a surprising sector is emerging as a payout powerhouse – mining. It used to be a truism that the cyclicality of the mining industry worked against dividends, as did the need for large capital spending and reinvestment in mine expansion and exploration. But the strong cashflows of some…