-

Sort By

-

Newest

-

Newest

-

Oldest

APRA takes action, CBA falls, GQG set to list The S&P/ASX200 (ASX: XJO) delivered another negative day falling 0.6% as concerns of ‘peak growth’ and stagflation continue to grow. Every sector barring technology and energy were lower, with the latter so far the standout story of the second half of 2021. Whitehaven Coal (ASX: WHC) continues to benefit from booming coal…

RBA halts sell off, record trade surplus, gold rallies The S&P/ASX200 (ASX: XJO) staged a mid-session recovery finishing down just 0.4% after being as far as 1% lower. The selloff was broad-based in terms of sectors with eight of the 11 sectors finishing in the red, but by and large it was focused on the tech sector which fell…

ASX rallies on COVID treatment, travel takes off, real estate boom The S&P/ASX200 (ASX: XJO) followed a strong global lead to finish 1.3% higher as investors digest Merck’s potential COVID-19 treatment. Positive news in the vaccine rollout following Prime Minister Morrison’s border opening last week meant the consumer discretionary sector was among the top performers, up 1.7%. Within the sector it was all…

Volatility returns, market drops 2.1%, banks lead sell off The S&P/ASX200 (ASX: XJO) finished Friday and the week down 2.1%, after recovering most of the week’s losses on Thursday. The selling pressure in the US flowed into the Australian session as investors remain fixated on the emerging threat to energy supplies along with the reduction in policy stimulus. In Australia…

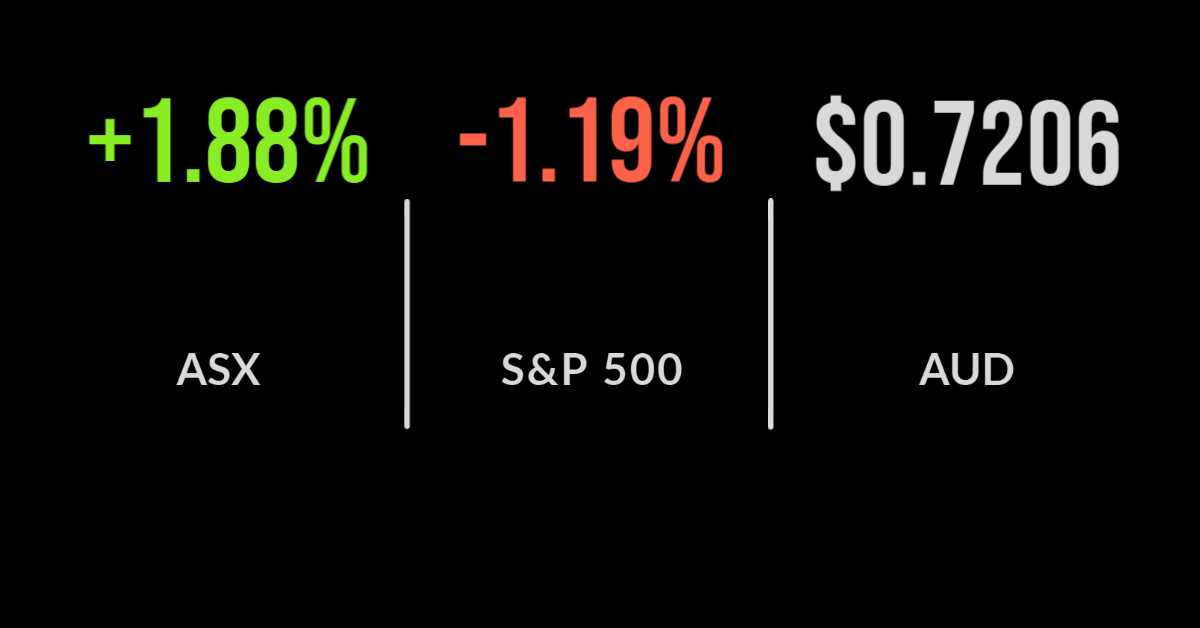

ASX delivers best day in six months, buying the dip, iron ore rallies The S&P/ASX200 (ASX: XJO) finished what has been a difficult month on an extremely strong note, finishing 1.9% higher. This was the largest single day gain since November 2020, right after the vaccine was approved. A number of factors likely coincided today, with 30 September…

Sell off continues, bond yields spike, Smartgroup under offer The S&P/ASX200 (ASX: XJO) recovered during the session finishing 1.1% lower after falling as much as 1.5%. The weakness came from a negative global lead with long-term bond yields spurring investors to act on comparatively high equity market valuations. In Australia, the 10-year bond yield has jumped from close to 1.0%…

ASX falls 1.5%, Origin’s Octopus win, energy boom The S&P/ASX200 (ASX: XJO) fell another 1.5% on Tuesday as a spike in bond yields in the US and a lack of clarity on the US debt ceiling put markets into a tailspin. Every sector was lower with healthcare the hardest hit, dragging down over 3% on the back of a 3.8% fall…

Financial, travel push market higher, bidding war for Priceline owner The S&P/ASX200 followed a positive global lead to post a strong opening to the week, finishing 0.6% higher. Most sectors improved outside of the ‘defensives’ with healthcare, down 1%, and consumer staples underperforming. Globally, markets were buoyed by a resurgent oil price as weaker supply collides with strong demand across highly…

ASX falters, oil hits multi-year high, Domain’s record, central banks dominate The S&P/ASX200 (ASX: XJO) finished the week on a negative note, falling 0.4% dragged lower by the real estate sector, which fell 2.1%. The materials sector continued its recent weakness, down 1.3% behind another 1.7% fall in BHP (ASX: BHP) despite the iron ore price finally settling. The real estate sector sold off heavily seemingly on the…

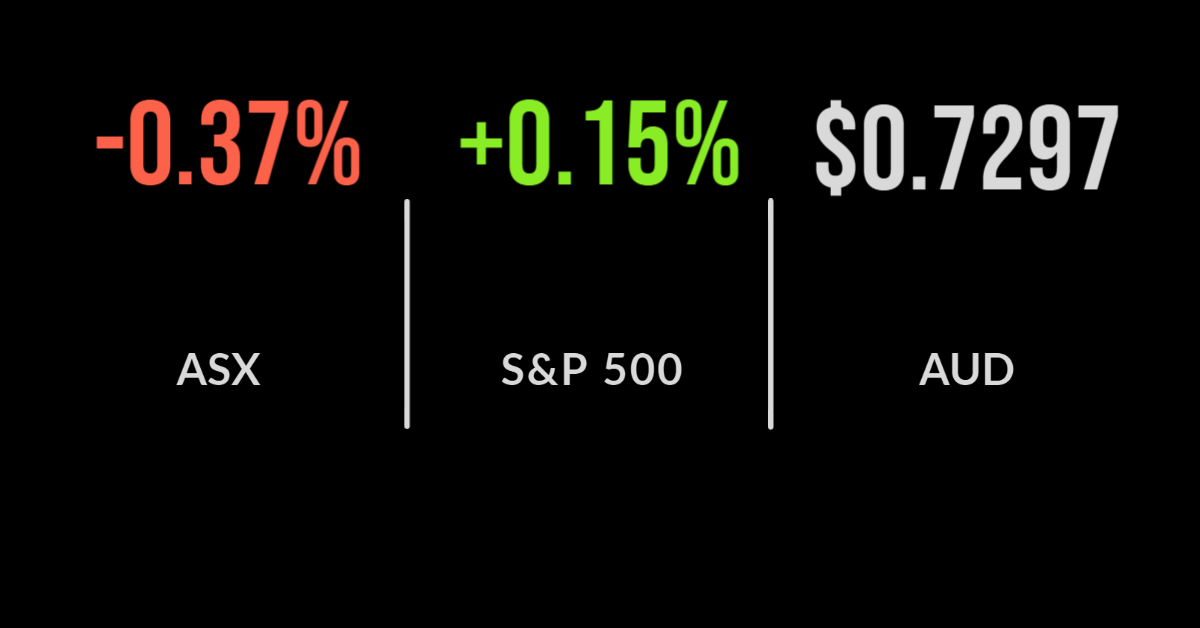

Rally continues despite dividend drag, Premier profit doubles The S&P/ASX200 (ASX: XJO) continued its strong recovery adding another 1% on Thursday after the Federal Reserve committed to continue bond purchases until at least the end of the year. The strength was broad-based with every sector finishing higher, tech, energy and utilities were the highlights with each jumping…